The European Parliament has endorsed fresh regulations designed to impose formal due diligence requirements on cryptocurrency companies, targeting the fight against money laundering.

The approved laws focus on enhancing “due diligence measures and identity verification” for customers, with an extension to entities like crypto asset managers. These entities are mandated to report any suspicious activities to authorities.

The legislation, approved on April 24, will particularly impact crypto-asset service providers (CASPs), encompassing centralized crypto exchanges under the Markets in Crypto-Assets (MiCA) regulation, alongside other entities such as gambling services.

MiCA is a regulatory framework introduced by the European Union to oversee digital assets and their markets. It was enacted in June 2023 and will be fully enforceable by the end of the year.

A new agency, the Authority for Anti-Money Laundering and Countering the Financing of Terrorism (AMLA), has been designated to oversee and supervise the implementation of the new rule.

AMLA’s office will be situated in Frankfurt, Germany. However, the law has not been formally adopted by the Council and has yet to be published in the EU Office Journal.

Patrick Hansen, EU strategy and policy director at Circle, expressed anticipation for the vote’s outcome in a post on X. He mentioned that the package would proceed to be officially adopted by the Council of the EU and come into effect three years later.

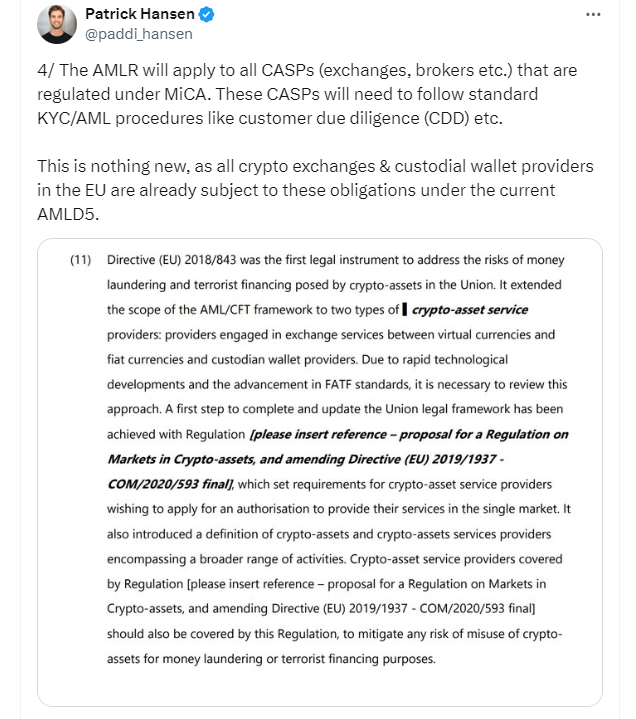

In another post, Hansen mentioned that these CASPs will be required to adhere to standard Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures such as customer due diligence .

He noted that this requirement is not novel, as all crypto exchanges and custodial wallet providers in the EU are already obligated to comply with these regulations under existing legislation.

Hansen described the final version as a “positive result” for the crypto sector. He noted that earlier iterations of the proposed AMLR suggested a much stricter approach, which would have necessitated KYC on the self-custody originator/beneficiary.

However, he credited industry efforts for advocating a risk-based approach with multiple options, ultimately leading to consensus.

Last month, a majority of the European Parliament’s lead committees scrapped the 1,000-euro ($1,080) limit on cryptocurrency payments from self-hosted crypto wallets as part of new AML laws.