Ethereum is on its way to becoming a deflationary asset and could soon become an even scarcer cryptocurrency than Bitcoin – how can that work?

Almost five months ago, on August 5, 2021 , the Ethereum Improvement Proposal (EIP) -1559 went live. Since then, the monetary policy of the second largest cryptocurrency has changed fundamentally. In 2022, ETH could even become a deflationary asset.

EIP-1559 has reformed the fee system of Ethereum and introduced a “basic fee” that changes dynamically depending on the network load. This part of the transaction costs must be paid in Ether for every Ethereum transaction. The entire “basic fee” paid is then permanently removed from the amount of ether in circulation (burned).

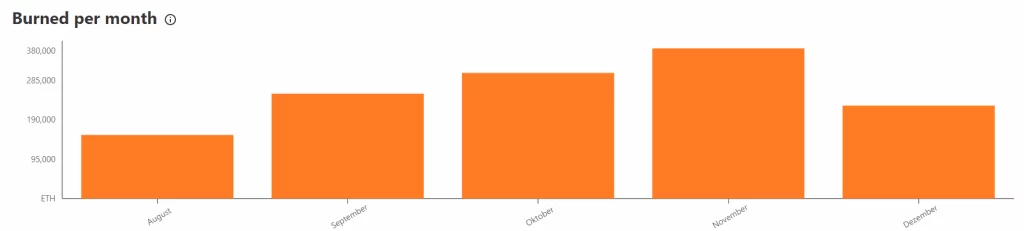

In November 2021, the number of ETH burned reached a new all-time high of 360,000 (almost 1.3 billion US dollars). Compared to the previous month it was an increase of 19 percent.

Although the burn rate fell in December, it is expected to increase in the long term as the adaptation of the ETH network continues.

Which decentralized apps burn the most ETH?

The NFT marketplace Opensea was responsible for most of the ethers born within the last 145 days (~ 135,000 ETH). This is followed by ETH transfers in second place (~ 127,000 ETH) and Uniswap V2 in third place (~ 113 ETH).

According to Ultrasound.Money , Ethereum currently has an annual inflation rate of 1.8 percent. This means that the smart contract platform is only marginally above the Bitcoin inflation rate (1.79 percent) .

If the market demand for Ether continues and the use of decentralized applications on Ethereum increases, that could soon change. Ethereum could experience deflationary development for the first time in its history and undercut Bitcoin’s rate of inflation. It is quite possible that in the year 2022 we will see the first month in which Ethereum has a negative inflation rate (deflation).

Are excessive fees a death sentence for Ethereum?

While high fees are a major obstacle for many small investors, they are not necessarily a death sentence for a blockchain network. Institutional investors in particular are willing to pay the higher ETH fees in exchange for fast transaction processing, the high potential for returns and the elimination of third parties.

In addition, a variety of NFTs on OpenSea consistently sell for tens of thousands to hundreds of thousands of dollars. Anyone who transacts in this asset class simply doesn’t care about the high fees in comparison to the benefits derived from them. The year 2021 has shown that institutional investors are quite ready to pay high fees in exchange for the security of digital assets (NFTs or capital in DeFi) and returns (interest or speculation).

Nevertheless, it is clear that the Ethereum Mainchain with its current fee model is not competitive in all smart contract sectors. In the area of crypto gaming or other microtransaction applications in particular, the ETH mainchain is simply too expensive.

Ultimately, despite the imminent implementation of Ethereum 2.0, Ethereum will have to switch to Layer 2 scaling solutions in order to also reach non-wealthy users.

We can already see how a large number of scaling solutions aim to achieve precisely these niches. In addition to Polygon , Arbitrum, Optimism and the Immutable X scaling solution specially designed for gaming, there is already a flourishing ecosystem of Ethereum Layer 2 platforms that are very likely to experience another wave of adaptation in 2022.