If the Ethereum (ETH) blockchain sees its attendance decrease as a result of a general drop in cryptocurrency prices, mining is at record levels. As the Merge approaches, ecosystem players are taking advantage of the last few months where it is possible to accumulate ETH thanks to proof-of-work.

Mining on Ethereum breaks records

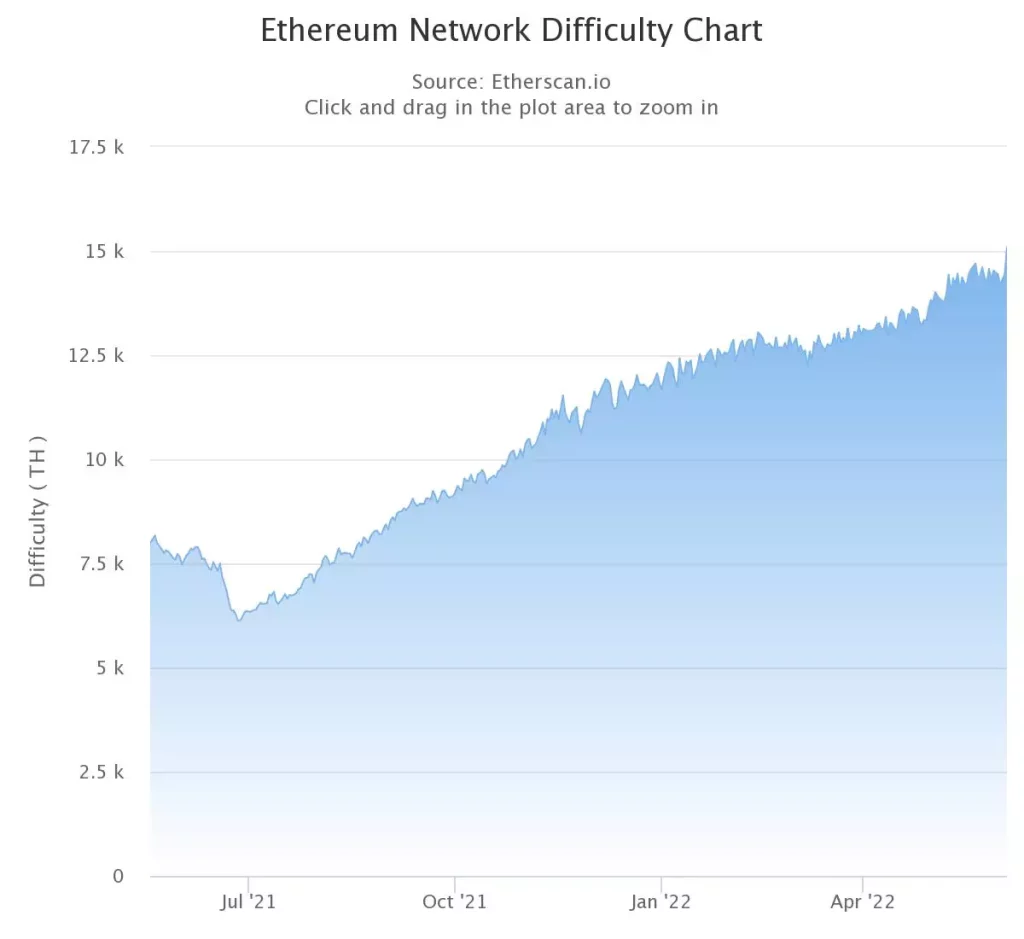

On Saturday June 4, the mining difficulty on the Ethereum blockchain reached an all-time high. According to data from Etherscan, this difficulty rose to 15,089.793 terrahashes (TH).

The higher this value, the harder it becomes to mine a block on the network. Thus, this metric is an increasing function of the computing power deployed by all the miners, in order to guarantee the stability of the blockchain.

As shown in Figure 1, since the Chinese ban last summer, the mining difficulty continues to increase as new miners come to strengthen the network. Moreover, the computing power deployed by the latter also reached a new record this Saturday , according to the CoinWars site.

The hashrate, as it is called, would thus have peaked at 1.318 8 petahashes per second (PH/s) . The conditional is used here, because Etherscan returns a daily average value of 1.08 PH/s and does not offer an intraday chart to compare the data.

However, this does not take away from the fact that the month of May will have been a record for the computing power deployed by miners on Ethereum, and that June seems to confirm the trend.

Network usage follows the decline

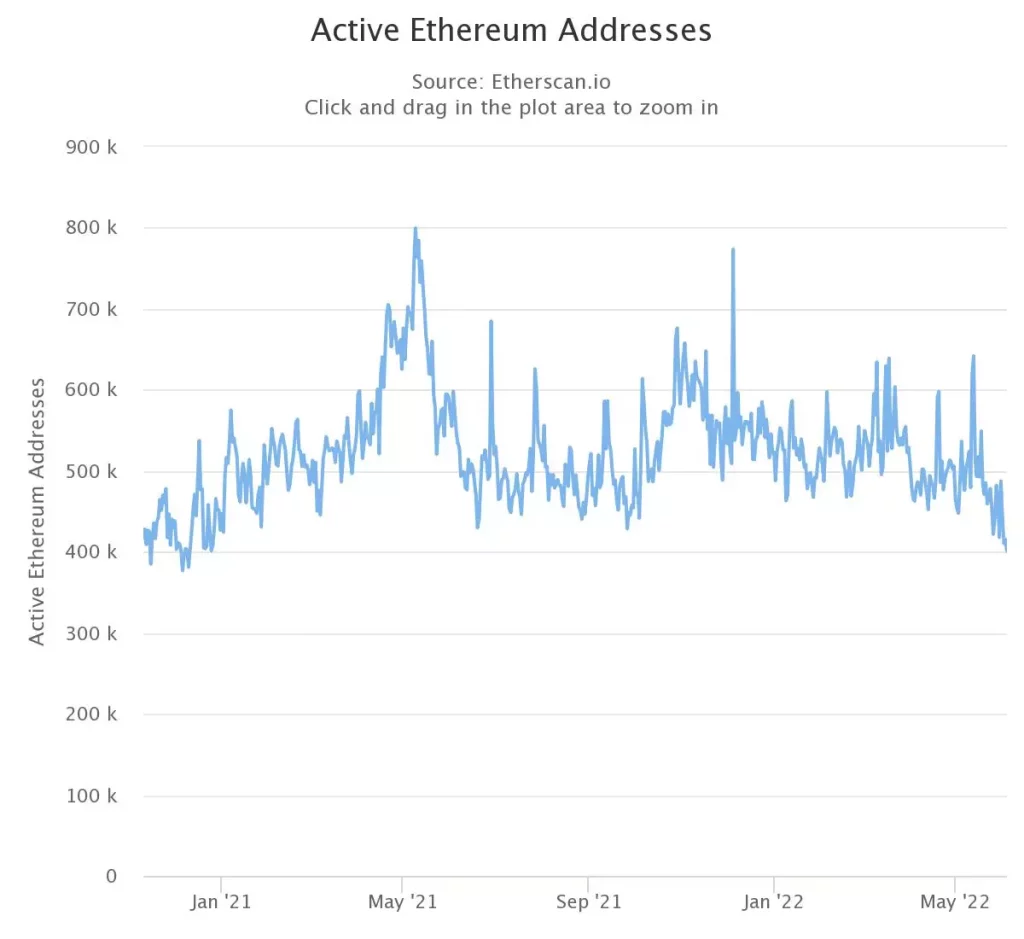

Ironically, while competition between miners has never been so fierce, the network itself saw its traffic fall to annual lows with 401,055 active addresses on the day of June 4. You have to go back to December 10, 2020 , with 381,124 active addresses, to find a lower value.

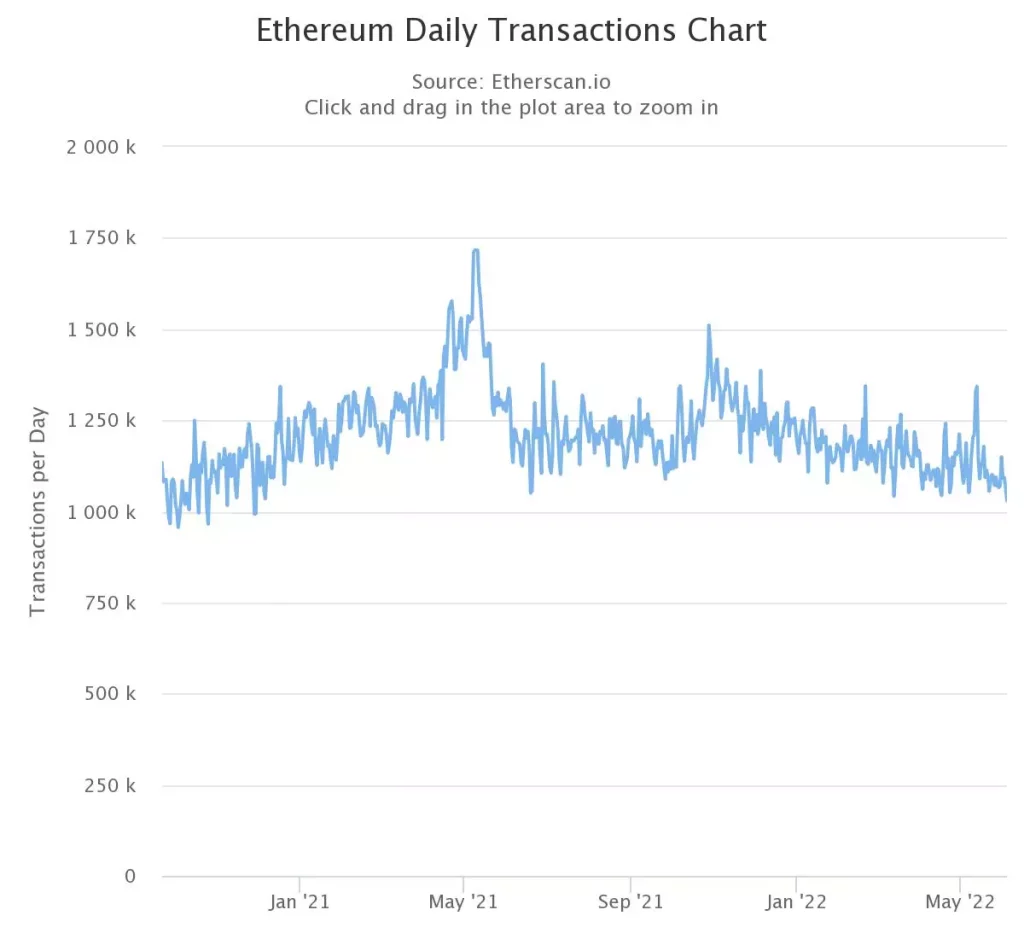

June 4 also sees a yearly low in the number of daily transactions , for a total of 1,029,121. Like the number of active addresses, Figure 4 shows us that we also have to go back to the end of 2020 to find lower values. Namely November 29, 2020 for 993,930 transactions.

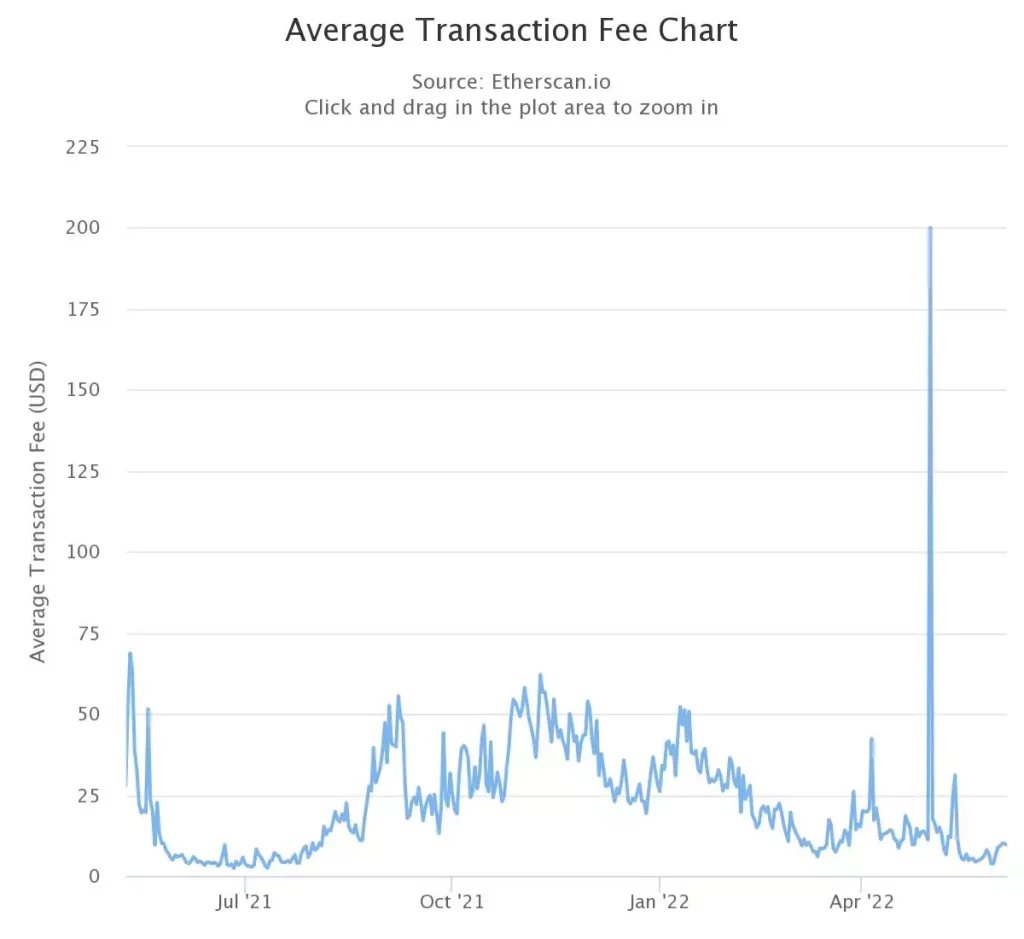

This downward trend in demand for the Ethereum blockchain benefits these users . Indeed, the price of transactions has been particularly low in recent months , compared to what could be seen at the heart of the bull run.

On May 28, the average price of a transaction was $3.73, its lowest since July 11, 2021, which recorded $2.43.

The statistical aberration visible in Figure 5, bringing a daily average to $200.06 on May 1, corresponds to the sale of land in Otherside , Yuga Labs’ metaverse.

The upcoming arrival of the Merge

The decrease in network traffic is not exclusive to Ethereum . Rather, it follows a general trend, due to the fall in prices themselves, scaring away investors.

Like other cryptocurrencies, ETH is currently working a hinge zone , which was also defended at this time last year. This area is around $1,800.

A popular idea in the ecosystem describes that the price of ETH could rise again when Ethereum moves to a proof-of-stake (PoS) consensus: the Merge.

This idea is defended by an upcoming drastic drop in the rewards awarded to each block generation. Coupled with the burn mechanism, implemented last August with the integration of EIP-1559 , this historic change would be the equivalent of three halvings on the Bitcoin (BTC) network in terms of reducing inflation.

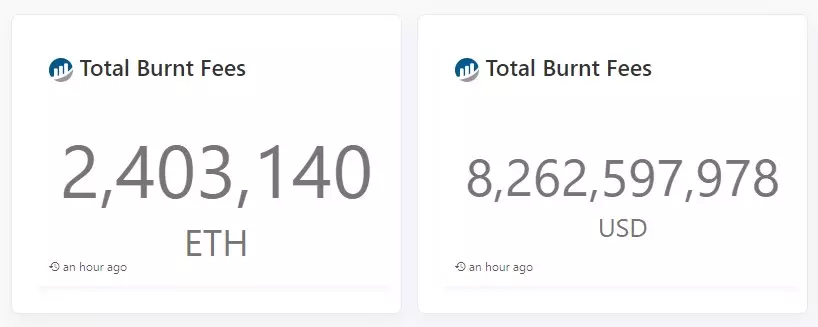

While 2.4 million ETH have already been burned , the scarcity of the asset will tend to decrease further, provided the consensus shift goes well.

We can then understand Ethereum’s recent mining records. Miners are indeed taking advantage of the last months when it is still possible to accumulate ETH through proof-of-work (PoW), before this activity stops .

However, there is no guarantee that the Merge will drive up prices. First, it will depend on the overall health of the ecosystem , but also keep in mind that 10% of all ETH in the network will return to circulation.

The staking contract for Ethereum, 2.0 set up on November 3, 2020, indeed has nearly 12.8 million ETH . These will be released sometime after the final settings , once the switch to proof-of-stake has taken place. Investors could therefore choose to take profits , thus driving the price down.