An interesting puzzle consists of the bankruptcy of Evergrande in China, the energy crisis in Europe and the political problems in the United States, due to which the country is threatened with default. Previously, the problem of the public debt limit was easily solved by Congress, but now Republicans and Democrats cannot come to an agreement.

All of this can be part of the planning of a controlled financial crisis, which will bring down the stock market and other assets, including Bitcoin and cryptocurrency.

Why can such a crisis occur, who and how can it organize it and what will be the consequences?

Fault

In China, interesting developments are continuing with the country’s largest manufacturer, Evergrande Group, and the information coming from it is rather contradictory. On the one hand, they seem to have sold some of the assets to pay off the current debt, and at the same time the Bank of China has poured $ 16 billion in liquidity into the markets to support the whole system. And on the other hand, there is information that the Heavenly Government is already giving instructions to prepare for the failure of Evergrande Group.

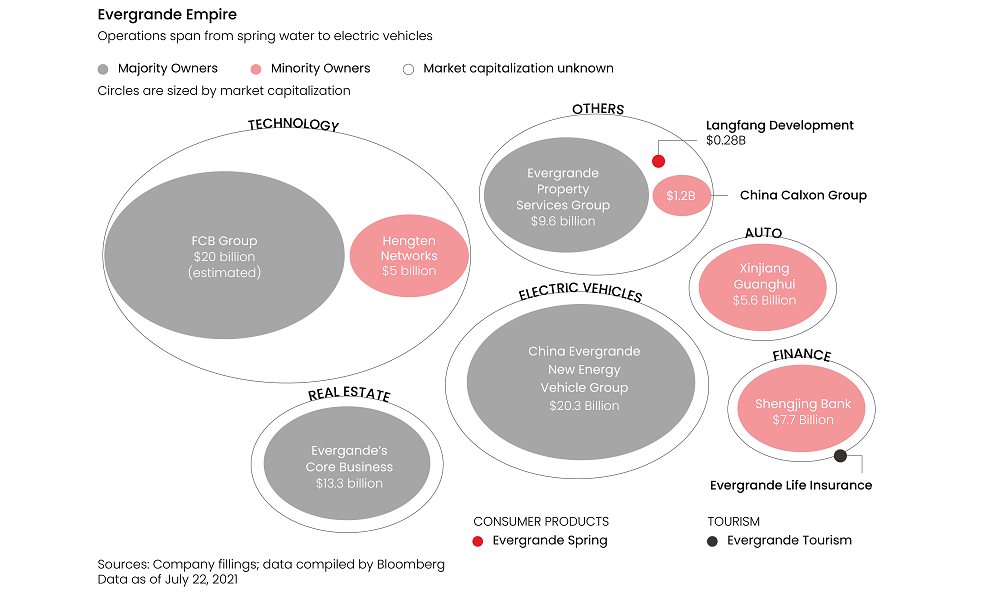

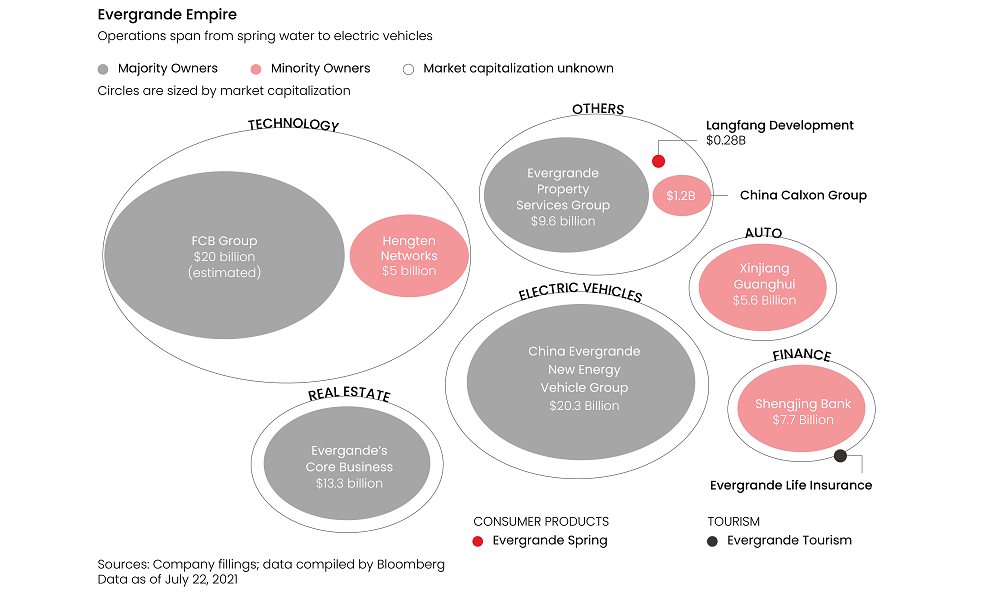

It should be understood that this company is officially considered a developer, but in fact it is a large company with different interests, which is clearly visible in this graph.

That is, in addition to construction, they are engaged in the production of cars, electronic vehicles, they have a bank, an online marketplace, a travel business and that’s not all. At the same time, there is information that despite promises Evergrande has failed to meet its current debt obligations and has now taken a 30 day deferral period. During this time, they will either find money or file for bankruptcy. And the Chinese government is going to make it an example for other companies, how not to get into debt. (Check: Nayib Bukele proudly talks about the Chivo project)

It is clear that the Chinese authorities are not interested in the crisis and if they allow the collapse of Evergrande, they will try to minimize its impact on other companies. It is not certain that this works.

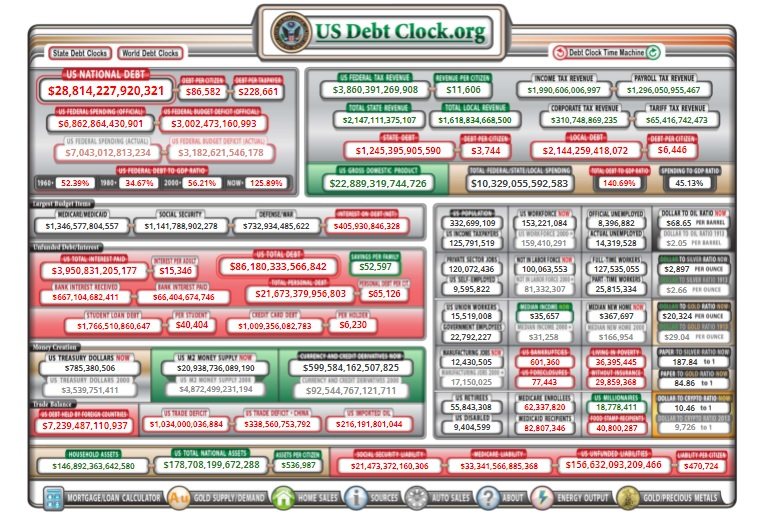

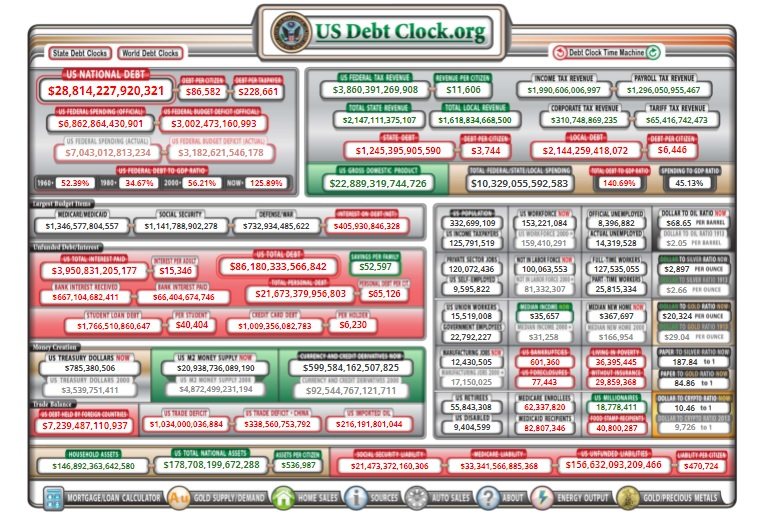

In the middle of the summer we were first talking about the default of the United States, whose public debt is approaching $ 29 billion.

So, the current Minister of Finance Janet Yellen called on Congress to raise the ceiling on public debt, so as not to end up in a situation of default in August. Nothing happened, but the US Department of Finance found the money again and brought the issue to the attention of Congress in early September. He indicated that the Treasury’s balance sheets were at a pre-pandemic level and that this money was enough for about a month, that is, in October the United States could not pay the debts.

But what’s the deal if they can just print more dollars? In fact, the problem exists, because the dollars are printed by the FED and the Treasury borrows them. And since the United States has almost reached the maximum level of public debt, it can no longer borrow money. The situation is absurd, but this is the way this system works, and if Congress does not allow the limit to be raised, then in the middle of the month America will have to declare itself in default. (More: The Cardano-Chainlink partnership: what does it mean for alts?)

FED has already warned that such a situation would deal a blow to all financial markets:

“If you really cross that line and get to the point where the government doesn’t pay its obligations, I think it’s going to create a very negative dynamic, not just in the United States, but around the world.”

For now, the lower house of Congress has already voted in favor of increasing the public debt ceiling and now the problems only arise in the Senate, where Republicans are blocking passage of the law. Interestingly, before such problems in the United States were solved without problems, constantly increasing the limit, but now politicians can go to principle, and the situation may get out of hand.

Politics

The current public debt problems in the United States are caused only by the lack of a political solution, because if Congress gives the green light, the Fed will immediately print the right amount of dollars and there will be no default. But the Republican Party is categorically opposed because it does not want Democrats to continue spending money in an uncontrollable manner, thus turning America into some kind of communist system. One of the main issues they don’t like is Biden’s $ 3.5 trillion social plan. (Also Read: Cosmos (ATOM) vs Solana (SOL): which has more potential?)

An interesting fact: During Donald Trump’s presidency, the Republican Party raised the public debt ceiling three times and saw no problem. But now they want revenge for the defeat in the last election and earn more points with voters ahead of the congressional byelection next fall. Therefore, the Republicans have taken a firm stand: they would not be against saving the country from default, but the Democrats should not scatter the money.

And the most interesting thing is that, in fact, Democrats and Biden are profiting from the crisis here and now. Because it is obvious that the stock market is incredibly overheated and there is no guarantee that it will not collapse until the next election, creating a crisis that we have not seen in the 21st century. Especially in a context where the Chinese economy is seriously threatened and where the energy crisis is intensifying in Europe, all these factors combined can lead to very big problems.

What can Biden and the Democrats do in such a case to have good positions in the next election? The answer is very simple, they must create a regulated crisis now to blame the Republicans for it and present themselves as the rescuers of the situation. Of course, this is only a theory, but it is quite possible to organize a controlled crisis here and now.

Crisis

A perfect example of the controlled crisis we received last year, when, despite the fact that countries were quarantined and many industries were left without clients, the financial market still showed an incredible pace. recovery.

The secret of such a miracle lies in the incredible impression of money in the United States, Europe and even China. As a result, we have rising inflation around the world, supply chains are still not restored, and shipping prices are breaking records, which in turn is boosting commodity prices. There has already been a price spike on lumber, aluminum, copper and other materials, now gas and coal prices have skyrocketed, although the latter has other good reasons. Obviously, countries can’t just print money anymore, so Europe has already started cutting asset buybacks from the market, and the FED promises to start doing that from November 3, which is sure to hit the markets.

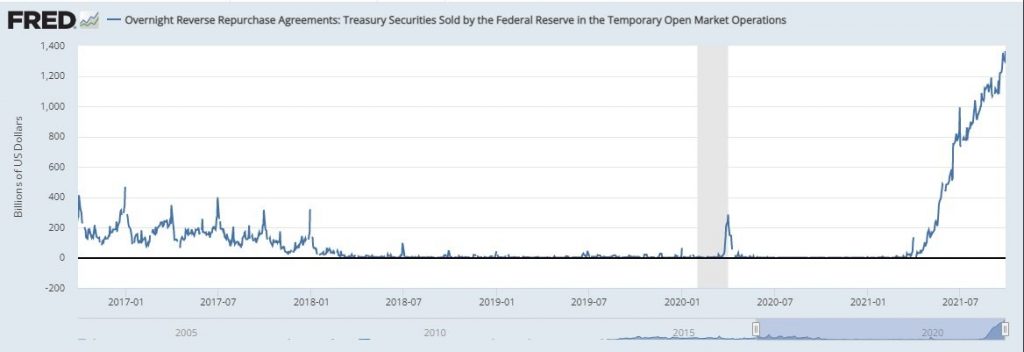

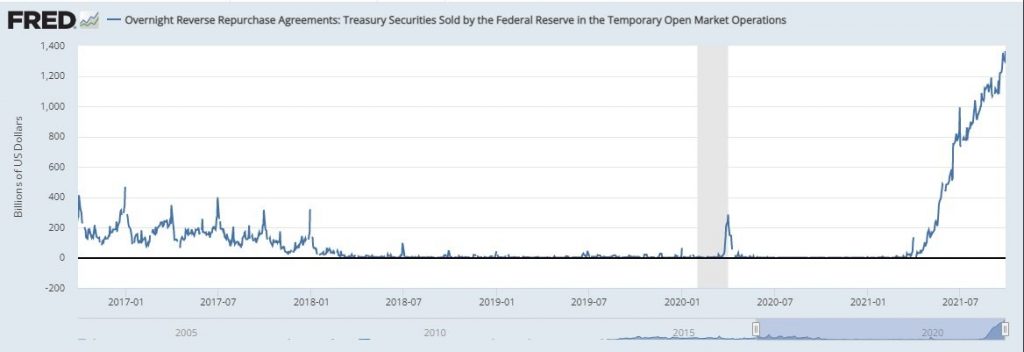

Add to this the political problems in the United States, which can turn into a temporary government blockage and the threat of default, and we have the perfect mix for a stock market meltdown. And then we can see the following picture: The Democrats use their technical majority to the detriment of the decisive vote of the vice president, bypass the procedure and vote independently to increase the limit on the public debt. After that, the banks, which are currently actively accumulating money on the balance sheet, buy back the market fund from the FED.

It is worth noting that they have already raised around $ 1.4 trillion and this process started in April of this year.

I remind you that this is only a theory, but if it becomes a reality, then with the price of Bitcoin, incredible changes will also occur.

In March 2020, as in other crises, the fall in the US stock market means an even greater pullback in all financial markets, including gold and Bitcoin.

Thus, in 2020 a controlled crisis of such a model will take place. Bitcoin was adjusted by 60% and stopped at the 200 weekly moving average:

If we assume that Bitcoin will make a similar decline, then -60% of the current price just falls on the 200 week slide:

It’s a level of around $ 16,000, but it’s much more important that every time Bitcoin hits that line it drops to its current bottom. So we can expect a restart of the growth cycle, which will start with a rally to the current high of $ 64,000 and then go even higher.