In Switzerland, shares in a start-up were tokenized. Credit Suisse and the blockchain-focused company Taurus will also be there.

In a press release, the Swiss- based company Taurus SA made public that shares of the company Alaïa SA were successfully tokenized on the Ethereum blockchain. Taurus SA focuses on digital assets and Alaïa on offering unique sports experiences. The tokenized shares were then deposited with Credit Suisse. The tokenization was carried out in accordance with the laws applicable in Switzerland and the standards of the “Capital Markets and Technology Association” (CMTA).

For this project, Credit Suisse used the services of Taurus. Together it became possible to map the Alaia shares in the booking system and to enable “end-to-end management”. In the press release, Taurus SA refers to its own products that made tokenization possible in the first place. For example Taurus-Capital or Taurus-Protect.

A co-founder of Taurus, Lamine Brahimi, was delighted with the collaboration with Credit Suisse.

We are committed to supporting entrepreneurs and financial institutions in making private wealth digital. And thus enable Corporate Finance 2.0. The collaboration with Credit Suisse’s institutional client team was excellent and I’m looking forward to the next steps in this project. The project is a world premiere and will pave the way for many other projects.

Lamine Brahimi, co-founder of Taurus SA

More opinions on partnership in Switzerland

Adam Bonvin, the founder of Alaïa, also said:

(…) We are particularly enthusiastic about our collaboration with Taurus and Credit Suisse. This enables us to be a pioneer again, this time in the area of digital finance.

Adam Bonvin, founder of Alaïa

Daniel Hunziker, Head Institutional Clients at Credit Suisse, was also delighted with the collaboration. Because he speaks in an interview with finews.ch about the demand of institutional clients for blockchain applications. So he says:

In general, we can say that various customers from different business areas have already asked us about DLT applications. Now we have the opportunity to advise our customers in this regard and to address the possible implementation of their needs.

Daniel Hunziker, Head Institutional Clients at Credit Suisse

Ethereum grabs 25% gain in a week and pushes on towards $4,000.

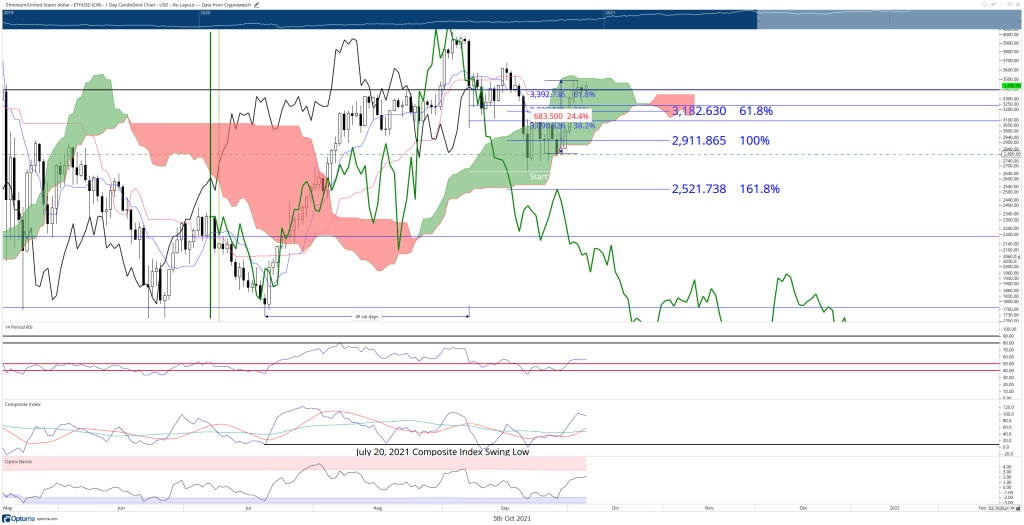

Ethereum price attempts a breakout higher; bulls target $3,600 close to confirm a new bullish expansion

Ethereum price, unlike Bitcoin, remains inside the Cloud has stubbornly been rejected higher from the top of the Cloud (Senkou Span A) at $3,500. For a bullish breakout to be true, the close and the Chikou Span must be above the Cloud, with the Chikou Span also above the candlesticks. This can only occur with a close at or above $3,600. Until then, downside pressure remains a very likely scenario. The same hidden bearish divergence scenario on Bitcoin’s chart exists for Ethereum as well. To negate that bearish divergence and eliminate any downside pressure threat, a close above $4,000 is necessary.

ETH/USD Daily Ichimoku Chart

Ethereum price dropping below $3,000 would be a signal that further downside movement is likely.