Traders who trade a company’s money on the stock exchange, in the event of a significant error, can cost the company millions and sometimes billions. If a situation arises when one trader loses a significant amount, then this, as a rule, becomes a sensation, it is publicized in all the media. People are always interested in learning such information. Such trading of traders of companies was called “RogueTrading”, which means uncontrolled trading, when the trading style is more like a game than a job. We suggest you take a look at the top 10 most outstanding RogueTrading style traders worth a lot of money.

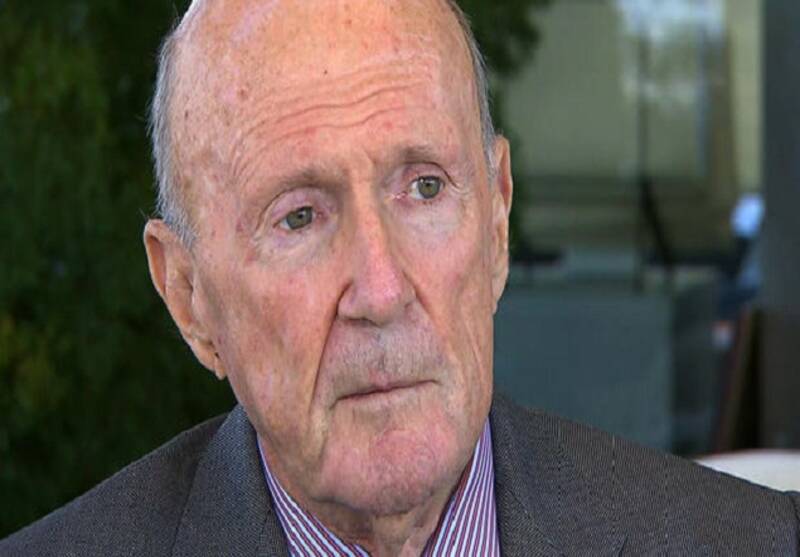

10. Nick Leeson is a trader who cost the company $ 1.3 billion.

Lisson is the most famous RogueTrading style trader. Already at the age of 28, he was a trading star in 1992. Due to his continued trading success, he was promoted to Head of Financial Operations at BaringsBank at the Singapore Stock Exchange.

Lisson’s activities resulted in significant losses for the company. Trading in futures, options on the Nikkei index, which Lisson conducted unauthorized (while filing false reports on the results of work), became the main reason for the bank’s multimillion-dollar losses. The most terrible moment for the bank came when Lisson installed a short straddle on the index. Nikkei ”, which collapsed the next day as a result of Lisson’s actions – it happened unexpectedly for everyone. Losing money, Lisson tried to return it, therefore he constantly increased the risks, losing even larger sums. Such actions could not end happily, the bank was completely ruined already in 1995.

The bank, which had existed for 230 years, was completely bankrupt by a trader, and later “BaringsBank” was sold for just 1 British pound. Lisson was punished for his actions – imprisonment. But already in 1999, Lisson was released due to illness. Lisson is the author of The Aggressive Trader, which became a bestseller, and a film was made on the topic. Today Lisson is the Executive Director of the GalwayUnited Club in Ireland.

9. John Rusnak brought the company a loss of approximately USD 691 million during the Japanese Yen trade.

John Rusnak joined Allfirst Financial in 1993, a division of the Irish bank AlliedIrishBank. He was appointed to the position of a trader in the foreign exchange market. In 1996 Rusnak actively engaged in high-risk trading operations with the Japanese currency. Rusnak played a double game – he had to use fake documents and pseudonyms to hide the financial hole he created while trading in Yen. So, already in 1997 the loss was $ 29 million, in 2001 – $ 300 million.

Rusnak, in addition to hiding the constantly growing loss, also filed false reports, which indicated that the bank had a good profit, which allowed John to also receive a bonus from the bank in the amount of 433 thousand US dollars.

On trading operations when using options, the trader lost about $ 300 thousand, and the cumulative loss by that time was already $ 691 million.

The result of all this was that Rusak was sentenced to imprisonment for a period of 7.5 years, as well as the need to return the amount that the bank lost as a result of his work – 691 million dollars.

The Rusnak scam was marked by the FBI as the largest fraud in banking in recent decades in the United States.

8. Yasuo Hamanaka lost about 2.6 billion USD in the metal market.

“Mister Copper” and “Mister 5% in the Account” are the nicknames for Yasuo Hamanaka, a trader of one of the largest Japanese companies, Sumitomo Corporation, which is focused on copper trading. At some point in his career, Hamanaka says, his total trading volume in precious metals was 5 percent of the world’s total in precious metals.

It is believed that Yasuo Hamanaka was not acting alone, but was a participant in the conspiracy, since the scale of the fraud in the period from 1984 to 1996 is very significant. Already in 1996, the trader was imprisoned for 8 years. Hamanaka falsified trading reports by subscribing to other traders to hide losses. The trader spent seven years in prison instead of eight – he was released for further quiet life.

7. LuChi-Bin cost the company $ 1 billion.

Lu Chi-Bin was the leading metals trader at the Korea State Bureau of Reserves. He is known for taking a significant position in copper prices on the London Metal Exchange (LME), he made the decision to buy 200 thousand tons of copper (this volume was so significant that it is comparable to that of China’s copper). This caused a violent reaction in the market – copper quotes rose very quickly. After this deal, LuChi-Bin left London, he did not fulfill the obligation of the contract.

The Korean authorities began to reduce quotations, reassuring investors that the situation is stabilizing, that copper reserves are much larger than previous estimates and that calm will soon return to the market. The government indicated that Chi-Bin acted on his own, therefore he is obliged to bear responsibility for the consequences.

Experts put forward the opinion that the trader was fulfilling someone’s task, since those who sold it during the transaction earn the highest profit on the rise in metal prices. The amount of damage caused has not yet been precisely determined, the location of LuChi-Bina has not been determined.

6. Brian Hunter – Trade losses were about $ 6.5 billion.

A trader from Canada – Brian Hunter – the manager of the AmaranthAdvisors fund, performed transactions to increase the quotations of natural gas. When Hurricane Katrina and Hurricane Rita hit the US in 2005, gas futures tripled, making Hunter the 29th most profitable trader in March 2006. But after the hurricane was over, gas prices fell. Brian Hunter’s loss exceeded USD 6 billion.

5. Jerome Kerville – losses in the course of trading in futures on the Euro about 7 billion dollars.

The account of SociétéGénérale, a major financial institution in Europe, recorded a loss of $ 7 billion. The charges fell on Jerome Kervil, who held the position of a trader at the SociétéGénérale bank, already on January 26, he was detained by the financial police in Paris. The volume of its trading operations was approximately 50 billion euros, which was many times higher than the capital of the bank itself. Taking into account this significant amount, the members of the court concluded that not only Jerome Kerville was involved in this scam, but also the persons managing the bank. Two criminal cases were initiated – one against Jerome Kervil, the other against an anonymous person.

4. John Meriwether – $ 6 billion in trade loss.

John Meriwether, an experienced trader, opened Long-Term Capital Management in 1994 with a combined capital of about $ 100 billion. Meriwether connected a large number of investor clients, he promised minimum risks and maximum profit.

One fatal mistake sealed the fate of the hedge fund – in 1998, this mistake happened – the fund made a big bet on the Russian market and its stabilization, but the fund went bankrupt as a result of the fact that the Russian Federation abandoned its financial obligations. The US government lent the fund USD 3.6 billion to avoid the crisis, but this further exacerbated the situation and increased the loss to 4 billion. The company was liquidated already in 2000.

3. Julian Robertson – $ 17 Billion Stock Market Losses

Julian Robertson used to be famous for his talent as an investor. In 1980, he created the Tiger Management fund, and during the hedge fund period 1980-1996, 8 billion were made from 8 million. But 1998 was a fatal year for the fund. Robetson made two big mistakes – working against the Yen and miscalculating technology stocks.

Robetson, being an investor, invested large sums in purchases of the most promising, as they believed, shares of technology companies, which, as it turned out, were not promising. As a result of these mistakes, the fund suffered significant losses – assets decreased to a small amount for the fund, 6 billion dollars, and in 2000 the fund was closed, the capital returned to investors.

2. Peter Young – lost about $ 400 million in financial fraud

Peter Young served as a manager at MorganGrenfellAssetManagement, which was later acquired by DeutscheBank. Young was fired when violations were discovered in the management of the assets of EuropeanGrowthTrust, which he managed. Peter Young illegally created several companies in order to implement various options for trading stocks to his advantage. Under his management, the fund suffered losses in the amount of 220 million British pounds, trader Young fled from the government. Within 2 years he was noticed in London, dressed in women’s clothing.

He was charged with fraudulent transactions. But Young’s mental state did not allow the punishment to be realized. After he was detained dressed in women’s clothing, he demanded to be called Elizabeth, psychiatrists diagnosed him accordingly.

1. The Hunt Brothers – the amount of losses during the silver trade does not apply

William Herbert Hunt and Nelson Bunker Hunt completed a purchase of over one hundred million ounces of silver in 1980, which resulted in them pushing silver prices down to $ 50 an ounce. The decline started in 1980 (in January), and later – on March 27, 1980 (this day was called “Silver Thursday”) – the quotes fell even more significantly.

After such a significant drop, the Hunt brothers completed the sale of 59 million ounces (which they bought for 1.75 billion) for 1.2 billion, after which a loss of $ 550 million was recorded. They continued to work in the same direction until complete bankruptcy in 1988. Nelson Haight was also sentenced to return $ 10 million for attempting to exercise control over precious metals.

Also Read: