Every business, is deeply intertwined with environmental, social, and governance (ESG) concerns. It makes sense, therefore, that a strong ESG proposition can create value—and in this article, we provide a framework for understanding the five key ways it can do so. But first, let’s briefly consider the individual elements of ESG:

- The E in ESG, environmental criteria, includes the energy your company takes in, the waste it discharges, the resources it needs, and the consequences for living beings. Not least, E encompasses carbon emissions and climate change. Every company uses energy and resources; every company affects, and is affected by, the environment.

- S, social criteria, addresses your company’s relationships and the reputation it fosters with people and institutions in the communities where you do business. S includes labor relations and diversity and inclusion. Every company operates within a broader, diverse society.

- G, governance is the internal system of practices, controls, and procedures your company adopts to govern itself, make effective decisions, comply with the law, and meet the needs of external stakeholders. Every company, which is itself a legal creation, requires governance.

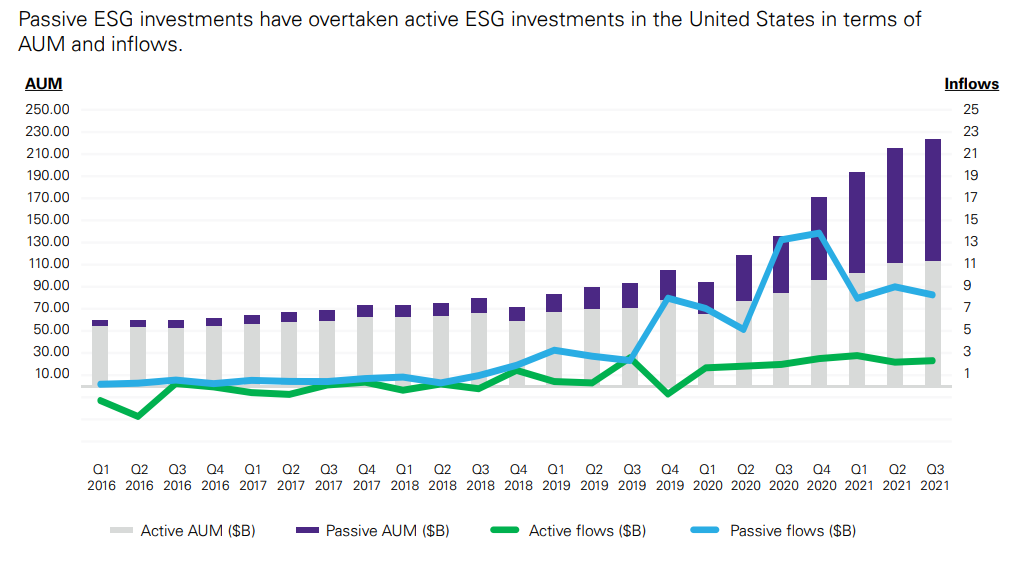

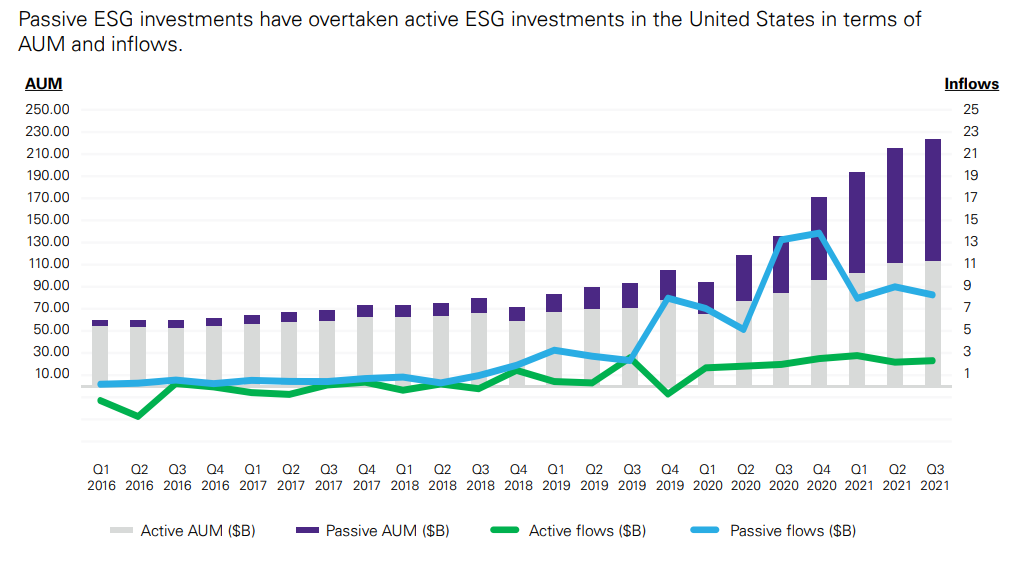

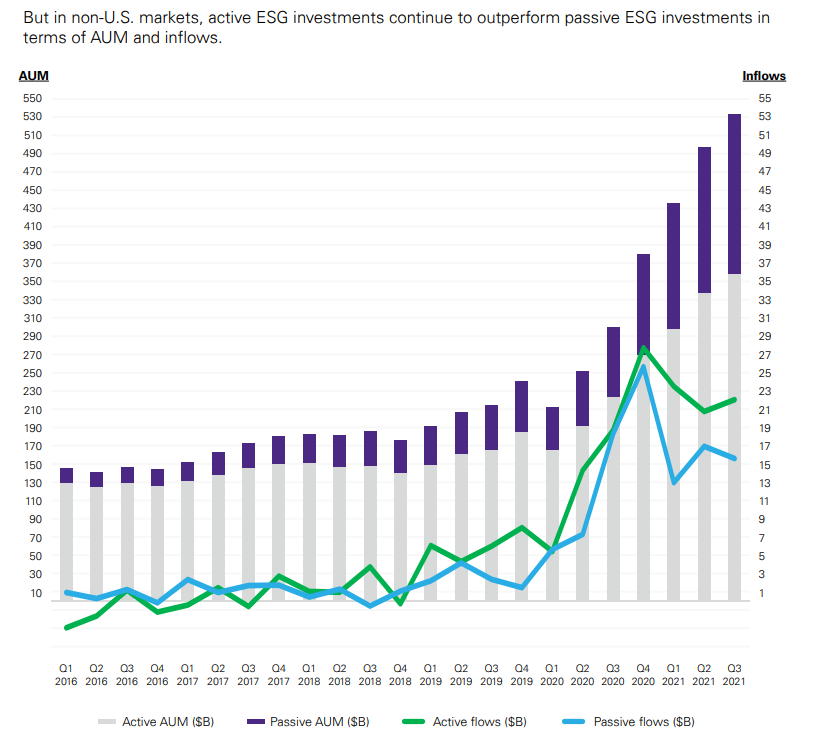

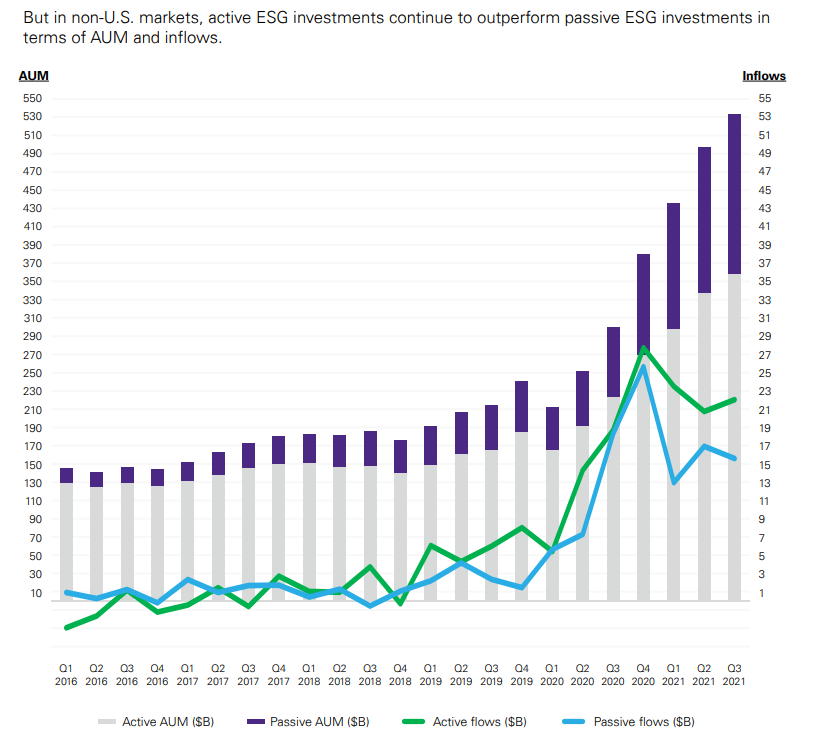

The concept of investing in environmental, social and governance (ESG)-centric products has been introduced previously. Institutional investors have long modeled their investment strategies around socially responsible themes such as clean air and water, diversity, human rights and workplace fair practices. However, sustainable investing in its current form has recently experienced considerable market momentum, driving large inflows into ESG focused products, resulting in an average Compounded Annual Growth Rate (CAGR) of 27 percent in global assets under management (AUM) over the last six years.

ESG constricted fossil energy in regulated countries, outsourced it to geopolitical rivals with lower environmental standards, and shut down domestic clean nuclear.

Predictably there are energy, fertilizer, and food shortages, countries are ramping up coal, geopolitical rivals got more zealous, and we’re talking about a potential global famine.

Explain: What is ESG all about?

Environmental, social and governance (ESG) is a term used to represent an organization’s corporate financial interests that focus mainly on sustainable and ethical impacts. Capital markets use ESG to evaluate organizations and determine future financial performance. While ethical, sustainable and corporate governance are considered non-financial performance indicators, their role is to ensure accountability and systems to manage a corporation’s impact, such as its carbon footprint.

Also, we can use this term: ESG is a framework that helps stakeholders understand how an organization is managing risks and opportunities related to environmental, social, and governance criteria (sometimes called ESG factors).

Also Read: Talk on ESG for all Sustainable Built Environment at World ESG Summit in Dubai

Purposes of ESG – Keep in Mind:

- ESG is a framework that helps stakeholders understand how an organization manages risks and opportunities around sustainability issues.

- ESG has evolved from other historical movements focusing on health and safety issues, pollution reduction, and corporate philanthropy.

- ESG has changed how capital allocation decisions are made by many of the world’s largest financial services firms and asset managers.

- An emerging class of ESG specialists is stepping into the industry and supporting net zero and carbon neutrality goals.

Pillars of ESG

- Environmental Pillar

- Social Pillar

- Governance Pillar

Environmental Pillar

The environmental Pillar often gets the most attention. Many companies are focused on reducing their carbon footprints, packaging waste, water usage, and other damage to the environment. Besides helping the planet, these practices can have a positive financial impact. For example, reducing the use of packaging materials can reduce spending and improve fuel efficiency.

It’s been regarded for over a decade that sustainability is not only the right thing to do for the planet, but also good for business. In fact, sustainable practices can lead to increased profits, lower costs and reduced risk.

Take for example Google, which has been a leader in sustainable business practices. The company has saved millions of dollars by investing in energy-efficient data centers, using recycled materials to build its offices, and employing green transportation options.

Social Pillar

The social Pillar ties to the concept of social license. A sustainable business should have the support and approval of its employees, stakeholders, and the community it operates in. How such support is secured and maintained varies, but it comes down to treating employees fairly and being a good neighbor and community member, both locally and globally.

On the employee end, businesses can refocus on retention and engagement strategies. These can include more responsive benefits such as better maternity and family benefits, flexible scheduling, and education and development opportunities.

The social Pillar of ESG is wide ranging: it spans everything from diversity and inclusion to human rights, health and safety, security, ethics and Indigenous reconciliation.

But, despite its broad scope, the social Pillar still needs to enjoy equal consideration by all organizations. While some already consider social matters and sustainability factors in their full production lifecycles, others are just beginning their journey.

Governance Pillar

The governance Pillar refers to a company’s governance policies and practices. At the most basic level, this Pillar is all about trust. Can investors trust that a company will make good on its promises? Are the goals of the board and C-Suite in line with those of shareholders, employees, and customers? Are employees confident that their workplace is safe and fair?

A great example of a company with good governance is Patagonia. The clothing company is well-known for its ethical practices, including ensuring that its products are made in factories that treat workers fairly and providing employees with ample opportunities to voice their concerns.

The governance Pillar is important because it sets the tone for how a company will operate. Good governance practices ensure that a company is run ethically and with integrity, which in turn can lead to increased profits, lower risks, and improved relationships with employees, customers, and other stakeholders.

What are the differences between ESG and impact investing?

ESG seeks to mitigate harm by creating exclusionary criteria or seeking to account for negative externalities.

Impact investing, by contrast, seeks to actively achieve positive external outcomes – alongside the traditional objective of ensuring an adequate financial return.

Both endeavors could benefit enormously from objective methodologies and a move away from disparate self reporting frameworks. Both are commonly critiqued for making it too easy to use self reporting to obfuscate true performance (see: greenwashing and impact washing, respectively).

Summarize Note:

ESG Investing: Considering environmental/social/governance corporate risks and opportunities in the investment process.

Impact Investing: where the investor’s marginal dollar investment has a direct and measurable positive environmental/social impact.