The United States dollar is eying its “best 5-day run” since February 2023, while Bitcoin BTC $64,098 has dropped over that time as interest rates are expected to remain high and the cryptocurrency sees volatility leading up to its April 20 halving.

The dollar’s strengthening is likely driven by expectations of sustained higher interest rates, according to trading resource The Kobeissi Letter.

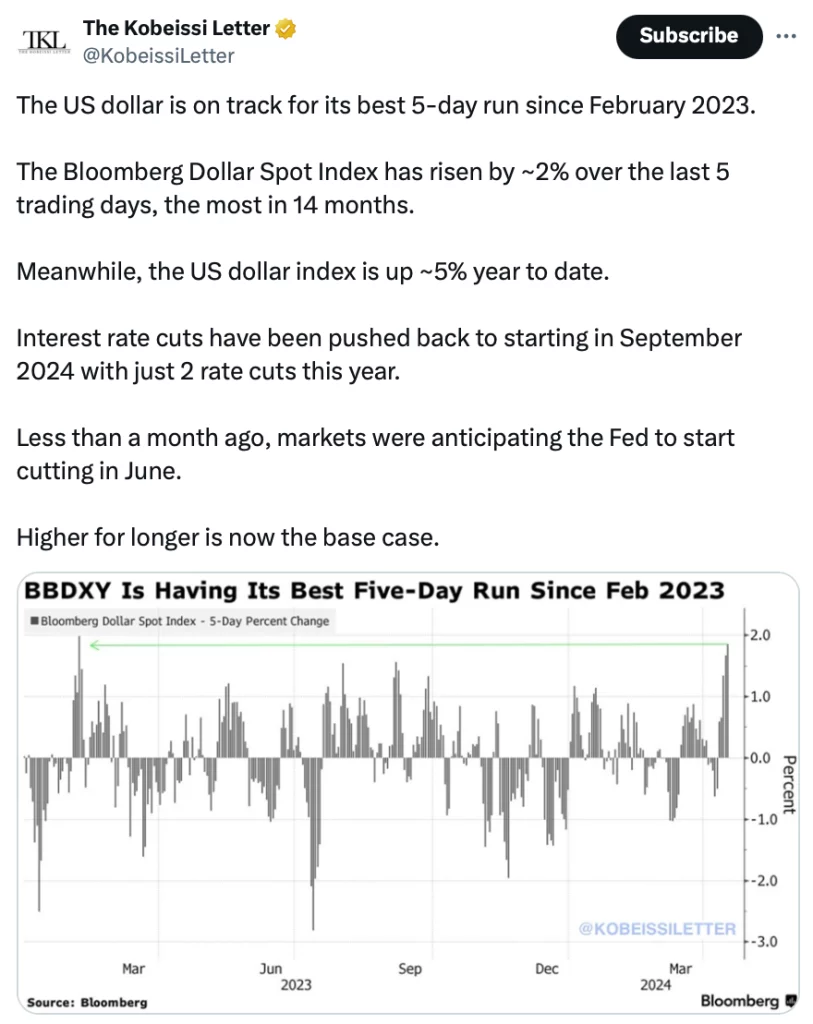

“Less than a month ago, markets were anticipating the Fed to start cutting in June. Higher for longer is now the base case,” The Kobeissi Letter wrote in an April 17 X post.

Higher interest rates typically encourage foreign investors to take advantage of greater returns on bonds and term deposits, increasing the demand for the dollar.

The Bloomberg Dollar Spot Index (BBDXY) — which tracks the performance of a basket of 10 leading global currencies versus the U.S. dollar — has climbed by approximately 2% over the last 5 trading days, its largest increase in 14 months.

According to the BBDXY, the U.S. dollar index score stands at 106.34, an increase from 105.28 five days prior, which indicates that it has strengthened against the other nine currencies included in the index, including the euro, pound and Japanese yen.

Meanwhile, Bitcoin has seen a 9% price decrease over the past five days to $63,936, per CoinMarketCap data.

While not always correlated, Bitcoin and the dollar have shown an inverse relationship over the years.

Reuters reported on April 16 that Federal Reserve Chair Jerome Powell said the country’s inflation rate — currently 3.5% — is not moving toward the central bank’s 2% goal, meaning it’s “likely to take longer than expected to achieve that confidence.”

Meanwhile, trader Justin Spittler warned in an April 16 X post that each time the U.S. dollar has reached “overbought levels,” it has been swiftly followed by a significant correction.

Bitcoin, which is seen as a more volatile asset, usually sees spikes in demand when the dollar weakens.

However, another factor comes into play with the Bitcoin halving scheduled just three days away, slated for April 20 — a process that reduces the amount of BTC that can be mined per block by 50%.

Although this is halving, crypto investors are showing greater confidence in riskier crypto assets compared to the 2020 halving event, according to Bitcoin’s dominance chart.

Three days before the 2020 halving, Bitcoin dominance — a ratio of Bitcoin’s market cap compared to the cumulative market cap of all other cryptocurrencies — stood 15% higher than its current level.

The U.S. dollar was 6% weaker at the time compared to its current strength.

Bitcoin’s dominance is currently 52%, according to CoinStats.

Meanwhile, the five-day rise in the U.S. dollar has also seen the crypto market sentiment tracking Crypto Fear and Greed Index drop by 11 points since April 10.