Ether traders have increased their short positions in the last 24 hours, coinciding with Grayscale Investments withdrawing its application for an Ethereum futures exchange-traded fund (ETF).

The price of Ether (ETH) has dipped to around $3,009 and is nearing a crucial support level at $3,010, showing a decline of 1.85% based on CoinMarketCap data.

Interestingly, liquidation maps indicate that traders are more confident about a downward movement in the price in the short term. If the price rises by 3%, approximately $345 million in short positions could face liquidation.

Conversely, a 3% decrease to $2,920 would result in the liquidation of only $237 million in long positions.

Following Grayscale’s decision on May 7 to withdraw its Ether futures ETF application, just ahead of the United States Securities and Exchange Commission’s (SEC) impending decision, traders are closely watching developments in the cryptocurrency market.

There’s ongoing speculation regarding Ether’s classification as a security and the potential approval of spot Ether ETF applications later in May. However, analysts are growing increasingly skeptical about the SEC approving a spot Ether ETF as the May 23 deadline approaches.

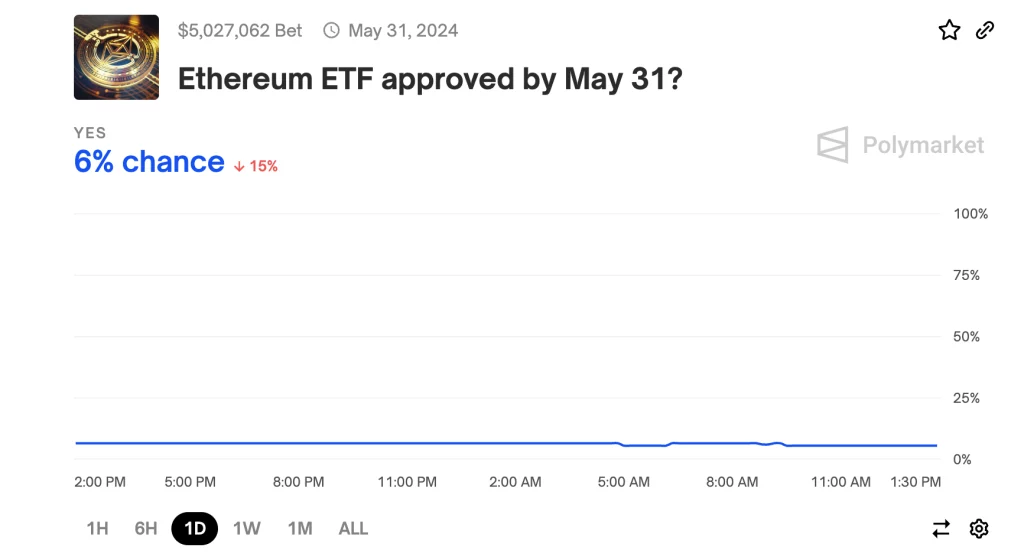

This sentiment is echoed within the crypto community, with 92% of participants on Polymarket, a New York-based crypto predictions platform, believing that spot Ether ETFs will likely be denied.

Polymarket participants are not optimistic about the chances of spot Ethereum ETF approval by the end of May. Source: Polymarkets

There are also broader concerns over Ethereum’s overall usage and lack of speculative interest from short-term holders (STH).

“Usage of Ethereum is currently so low, that their burn mechanism is not keeping up with issuance to validators,” crypto on-chain analyst James Check, aka “Checkmatey,” said in a May 7 post on X.

On May 8, Glassnode highlighted that Ether’s underperformance compared to Bitcoin during this market cycle is attributed to a “measurable lag in speculative interest” from the short-term holder (STH) cohort.

Interestingly, just before this news emerged, some traders expressed optimism about Ether’s potential price breakout by the end of 2024. Ash Crypto, a pseudonymous crypto trader with a significant following of 1.1 million, shared insights with their audience on May 6, pointing out a similar fractal to that of Q4 2020 and suggesting a possible breakout in Q3 of 2024 based on historical patterns.

Similarly, another pseudonymous crypto commentator known as TheCryptoPalace, with 20,400 followers, highlighted Ethereum’s movement within a falling wedge pattern and the testing of a significant support zone. They anticipated potential sideways movement around this support area, indicating a cautious but optimistic outlook for Ether’s price trajectory.