The crypto space could tap into the trillions managed by the financial advisory industry once legal uncertainties are resolved by U.S. regulators, according to Bitwise’s investment head.

Regulatory ambiguity has been the primary reason financial advisors have hesitated to increase their exposure to crypto over the past five years, noted Matt Hougan, Bitwise’s chief investment officer, in a post dated June 4.

Hougan believes that the U.S. is on the path to achieving regulatory clarity, which could potentially unlock the $20 trillion financial advisory market.

“Imagine, then, how much of that $20 trillion will go into crypto when the biggest barrier gets lifted.”

“If you think BlackRock’s move into the crypto space positively impacted the market, imagine if all of Wall Street accepted crypto as a normal part of the market,” he added.

Hougan said a “shift” started last month when Democrats “crossed the aisle” to repeal Staff Accounting Bulletin 121 and again when the House passed the Financial Innovation and Technology for the 21st Century Act (FIT21), which many in the crypto industry marked up as a win.

The Securities and Exchange Commission also approved spot Ether $3,797 exchange-traded funds (ETFs) on May 23 after months of analysts speculating that it would knock them back.

Hougan noted President Joe Biden’s veto of the SAB 121 repeal which he claimed showed “crypto still has a long way to go.”

“But even this is a minor setback. We’ve been sailing upwind for a decade in crypto,” he added.

Market not ready for what’s next

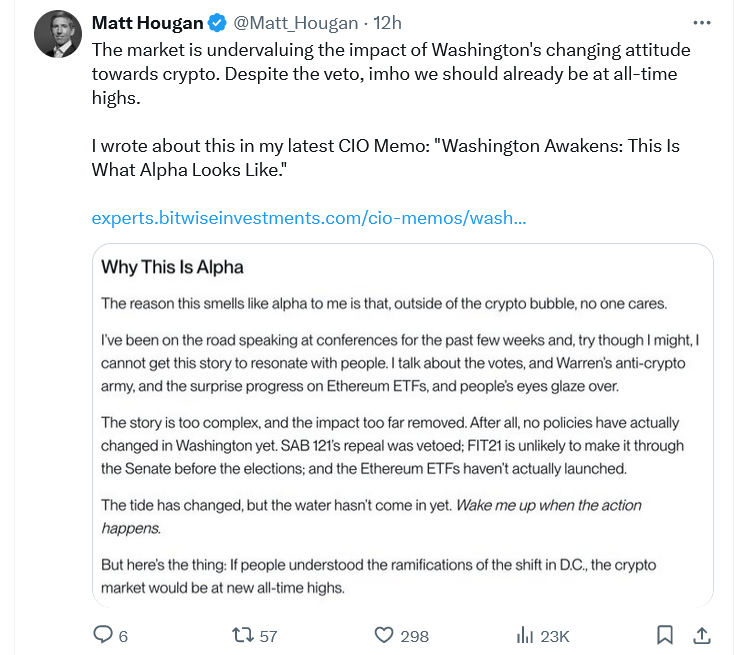

Hougan believes there’s a lot of “alpha” to capture in the crypto market, which he said is largely untouched by those “outside of the crypto bubble.”

He continues to see “people’s eyes glaze over” when he speaks about crypto-related political developments at conferences.

“If people understood the ramifications of the shift in [Washington D.C.], the crypto market would be at new all-time highs,” Hougan argued.

With SAB 121’s repeal vetoed, FIT21 unlikely to make it through the Senate before the November elections and the approved spot Ether ETFs still to launch, Hougan conceded that “no policies have actually changed in Washington yet.”

“The tide has changed, but the water hasn’t come in yet. Wake me up when the action happens.”