Ethereum’s price has set an important record for the duration of being above a certain level. On January 4, the value of the cryptocurrency for the first time in a long time reached $ 1,042 , while today the coin is estimated at about $ 1,325 . In general, the cryptocurrency has been “closing” for 28 days in a row – that is, ending the day – above the psychological threshold of a thousand dollars, which it had previously managed to overcome several times at the very beginning of 2018. Let’s talk about the situation in more detail and explain its importance.

Let’s start with theory. The cryptocurrency rate is a temporary agreement of all market participants – active traders and just coin holders – about its real value at the moment. At the same time, the rate plays the role of an indicator of attention to the industry, and when it gets higher, the participants begin to be interested in the asset much more.

A similar situation happened with Bitcoin at the end of last year. Industry participants closely followed the behavior of the BTC exchange rate and drew appropriate conclusions. For example, on November 4, 2020, we wrote that the first cryptocurrency held above the $ 10,000 mark for a hundred days. And it did her good – especially considering the current BTC rate indicators.

For clarity, we present a graph of the Bitcoin exchange rate in 2020. It shows the moment when the value of the asset crossed the level of 10 thousand dollars and, as a result, remained there.

Therefore, the importance of such behavior of digital assets is really great. And now representatives of the cryptocurrency community have begun to pay attention to similar actions by ETH.

What’s happening with Ethereum

Recall that in 2018, Ether was above $ 1000 for only 25 days – and not in a row . From January 6 to January 21, the cryptocurrency closed the daily candle above a thousand on the chart. Then on January 24, another jump above the noted threshold took place, and then Ethereum began to rapidly decline in price up to a two-digit figure in value.

The bottom of the asset value was observed during the March market crash. Recall that he was provoked by fears against the background of the spread of the coronavirus. Then the situation improved, and ETH, along with other cryptocurrencies, began to noticeably grow.

However, this year’s rise in altcoin is underpinned by more than speculation and expectations, Decrypt reports . Now an ecosystem of decentralized finance is developing on the basis of Ethereum, which has become one of the main industry trends in 2020. Despite the explosive growth, DeFi still has room to develop , so in 2021 there is every chance of continuing the Ethereum race.

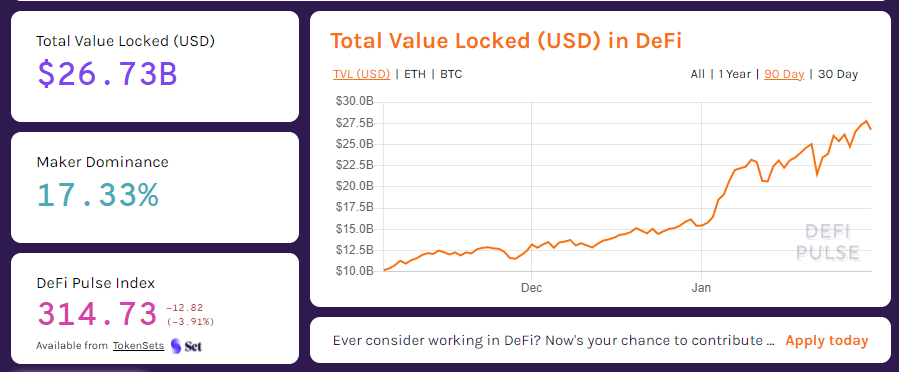

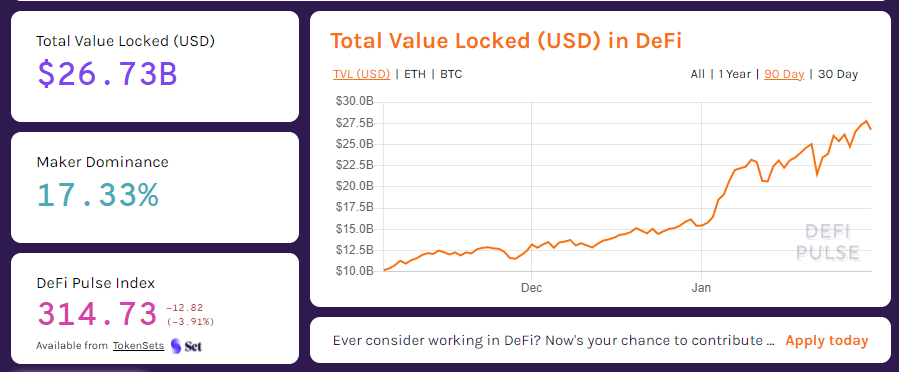

The difference between Ethereum of 2018 and 2021 is also visible in terms of cryptocurrency. Last time, the trading volume in pairs with ETH barely reached the $ 4 billion mark, and most recently this figure exceeded the $ 20 billion level. Also, do not forget about the amount of funds blocked in DeFi- protocols. In 2018, it reached the $ 77 million line, but today the same figure is $ 26.73 billion. That is, we have an increase of 354 times over three years.

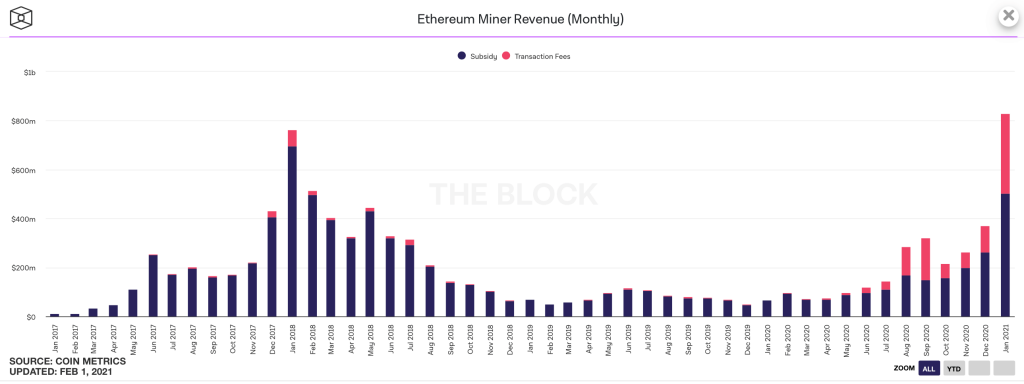

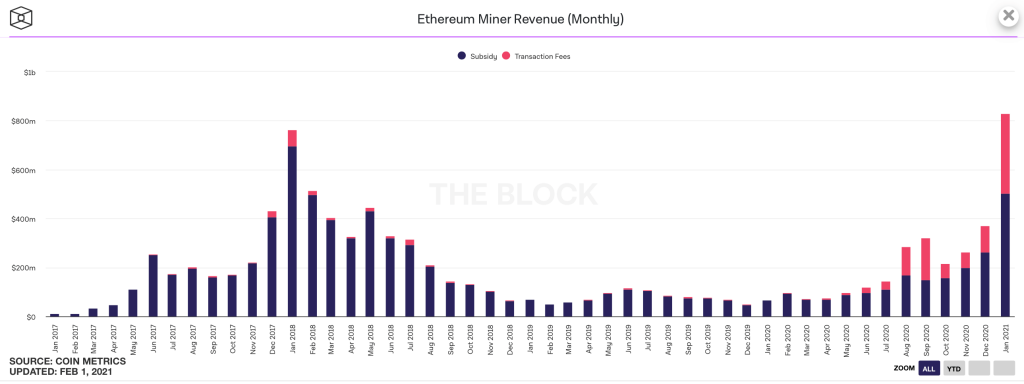

We checked the actual data: against the backdrop of the growth of Ethereum, the cryptocurrency is of great interest for ETH miners . In particular, January 2021 became the most profitable month for cryptocurrency mining and brought miners the equivalent of $ 829 million. The previous record was held since January 2018 and amounted to 762 million.

In other words, the new Ether record is just the beginning – at least such a scenario is hinted at by what is happening in the cryptocurrency network. We believe it would be fair to continue the ETH race. Especially considering the fact that Bitcoin managed to beat its historical maximum from 2017 more than twice.