Hello everyone! Today I will tell you in detail about trading strategies in the stock market.

The very fact that investors have been on the stock exchange for a long time indicates that they use one method or another. Without strategies, trading turns into chaos, in which losing money is a matter of time.

The Importance of a Stock Market Trading Strategy

Trading and investing strategies are divided into simple and complex. The most ingenious ones are associated with the use of trading robots, opening 2 brokerage accounts with mutual reinsurance, simultaneously entering a long and short position. In practice, it is easier for novice investors to choose one (preferably simple) method.

When it is mastered and profitable, you can try a trading strategy, gradually developing your skills. For a start, it is better to focus on maintaining the depot, having learned not to lose, choosing for this a trading strategy with minimal risk. Stubborn adherence to a trading strategy will lead to the desired result in the form of financial independence.

How a strategy distinguishes a speculator from an investor

When investing in the stock market, you independently choose a trading strategy, focusing on your own interests, the size of the depot and circumstances. It is customary to distinguish according to the style of work:

- Investors

- Speculators

Investors buy securities for a certain period of time, hoping to take profit from growth. They are distinguished by a long game and even a conscious ignorance of price fluctuations inherent in any market.

For a speculator, the long-term perspective of the price does not matter, he is interested in profit here and now. The retention period for shares after purchase does not exceed a week. The lion’s share of transactions is based on technical analysis.

Classification of speculators

In turn, speculators differ in their trading style, applying certain trading strategies.

- Scalping is an exchange trading strategy based on the difference between the buy and sell price. The scalper buys securities at the bid price and immediately opens a sell position indicating the bid price. A prerequisite for a scalping trading strategy is a calm market. It is important that there are no sharp upward jumps or breakouts

- Swing is a trading strategy that involves holding a position in a time interval for more than one day. Accordingly, the stock is bought at the bottom and sold after the price rises. The most popular swing trading strategy tools are liquid securities that quickly turn into money.

- Intraday. The literal translation of the trading strategy sounds like “intraday” and fully reflects the essence of the trading strategy. A speculator never rolls over a position to the next day. Most often, volatile products with large fluctuations are chosen for trading with this strategy, and the total duration of the transaction is often several minutes. Very often intraday trading on the exchange trades operate with borrowed funds. They are returned to the lender on the same day, allowing no interest to be paid

Investor classification

Like speculators, investors fall into several categories.

- A long-term investor makes investments over several years. This is usually a fundamental analysis when planning takes into account many factors, from the economy to the political environment. Everything goes into the piggy bank, the upcoming elections, the rise or fall of the country’s GDP, access to new markets, oil prices, wars. Technical analysis, if applied, is done on a monthly or weekly time frame

- A medium-term investor invests for a period from several months to a year. Mostly technical analysis is used. This version of the game on the stock exchange offers a cash bonus in the middle or at the end of the year

- A short-term investor opens a position for a period of up to several weeks, focusing on daily and hourly timeframes

Forex and Binary Options Warning

The desire to quickly hit the jackpot and obsessive advertising leads to the Forex market. One of the options for the game are binary options based on the principle of “all or nothing”. Here you need to guess the direction of movement of a particular currency or stock. With the right decision, you get a profit, with the wrong decision, you lose your deposit.

Only the organizers or the most experienced traders with animal instincts can get rich on it. But given the nature of the options, even for them, losing becomes a matter of time. This is followed by a desire to recoup, loans, financial collapse, loss of all property.

Options are attracted by the absence of a broker, margin, commissions, spread (price spread). All of the above is annoying, but it also protects the investor from losing funds due to rash decisions.

Types of trading strategies in the stock market

The total number of trading strategies is incalculable. New schemes are invented every day, and old ones are being improved. Nevertheless, several investment trading strategies have been established for a long time and are used everywhere, having proven their effectiveness on the MICEX and foreign stock exchanges.

Asset Allocation

Distributed portfolio trading strategy, where assets are segmented into categories of timing, risk, potential profit. In particular, this includes securities of Russian and foreign companies, large market players and small firms, government bonds, short-term and long-term instruments.

With a competent combination, timely redistribution and addition of new assets, this gives a constant increase in the total value of the portfolio. Using this strategy, the investor refuses to predict anything and buys not individual stocks or bonds, but the entire market using indices.

Dividend strategy

The purchase of securities with high dividends is carried out in order to hold them for a long time and receive these dividends. Today, there are many companies on the stock exchanges that pay dividends from 1 to 4 times a year.

Cost strategy

Undervalued shares are purchased on the stock exchange. The parameter is determined by fundamental analysis. For example, securities are sold at a low cost, but in the long term they have growth drivers, an increase in the company’s profit, debt repayment, and indexation. All this entails market revaluation and growth.

Growth trading strategy

Investments are made in shares of stock market companies with growing profits. Most of it is invested in further development, which increases income and share value. At the same time, the issuer deliberately refuses dividends in favor of reinvesting funds back into the business.

Trading

A trader is characterized by an active position in the stock market. Its positions are short-term or medium-term in nature with the possibility of quick exit, profit-taking and risk control.

The game is often played with borrowed funds. The money with interest is returned to the broker, and the profit remaining after their deduction remains with the investor. Roughly speaking, investors use fundamental analysis and traders use technical analysis.

How to choose a trading strategy

I always say that the choice of a trading strategy is determined depending on the goal and your life circumstances. The volume of the deposit, the timing of the profit, which the investor is guided by, the amount of potential profitability, total employment are taken into account.

A person whose daily income depends on gambling on the stock market resorts to short-term investment and speculation. A trader for whom trading is only one of the sources of income and capital growth uses medium and long-term methods.

Basic stock trading strategies

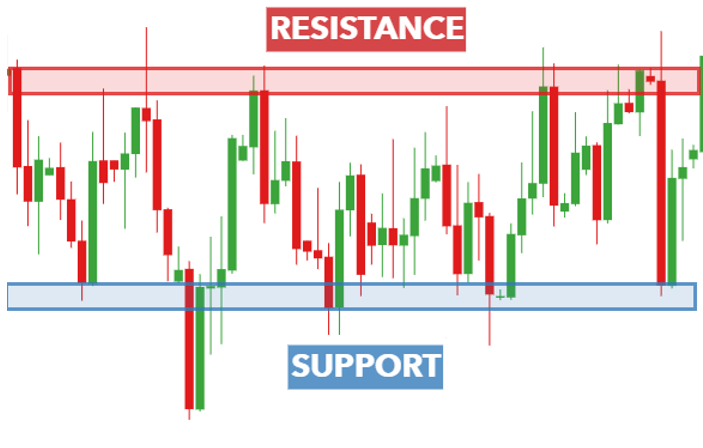

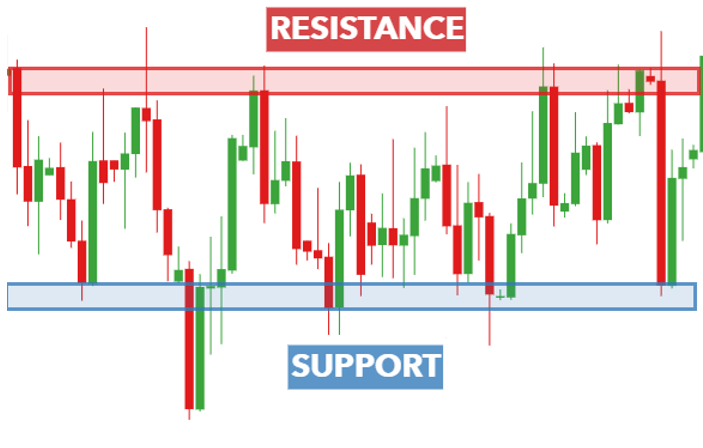

The time interval and price levels are always taken into account. These are important from a technical and psychological point of view, the lines where there is a struggle between traders who play bull and bear.

These are support and resistance zones where most buy or sell orders are opened. Pressure is always exerted on them, on the results of which working trading strategies are based. Now let’s take a closer look at the process.

Rebound from the price level of support and resistance

Having determined the levels:

- Support – support line, lower price limit

- Resistance – resistance line, the upper border of the price

A trader opens positions in the expectation that their value will not break through, bouncing up or down. All this is done on a specific time frame. Each time interval has its own lines. Selling is triggered by the signal of the selected stock market indicator.

Breakout of the price level

On the stock floor, the lines do not change, but the purchase is based on their breakout. At the same time, the price rises or falls in the original corridor. If it was 10-15%, there is a rise or fall in this range. The support level becomes the resistance level and vice versa.

A trading strategy assumes one of two things: buying a little higher or directly on the Resistance line, or buying below the Support level, counting on the return of the original value. The nature of the deals increases the number of pending orders.

Shock day

Sometimes there are happy days when the price of an asset in the stock market rises and the position needs to be held as long as possible, squeezing everything out of it. In this situation, it is difficult to lose, unless you hit the highs in the evening, hoping to continue the banquet tomorrow.

A sign of constant growth is the absence of candlestick shadows, and during corrections, the price either does not touch the support level at all, or it happens very quickly, with a rebound upward. Sometimes one such day of the stock market is able to make an annual revenue, and at the end of it, it remains to get a towel and, wiping away the labor sweat, go to celebrate good luck.

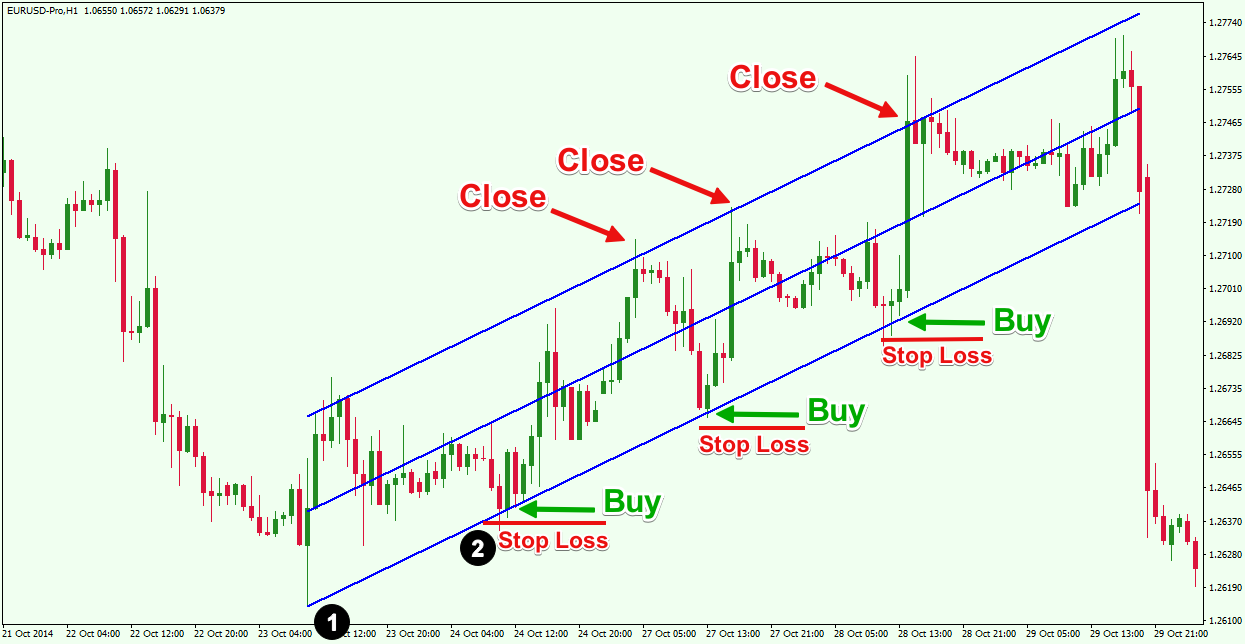

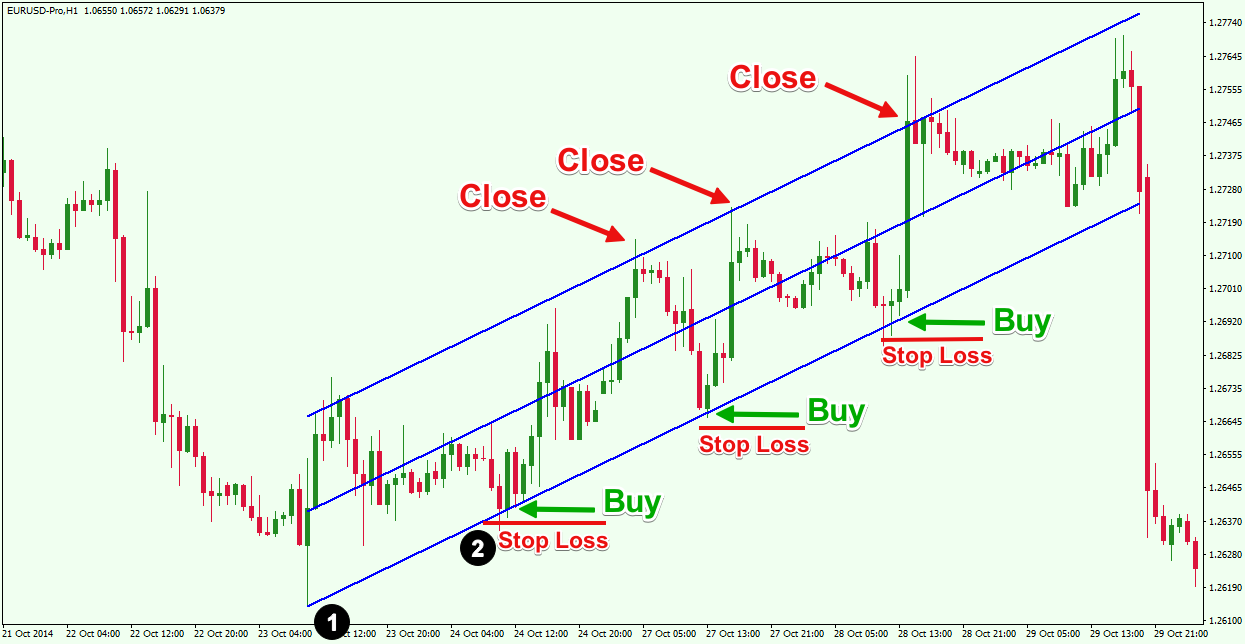

Channel trading strategy

A universal method, when the price on a time chart moves in a certain corridor, without breaking out of its borders. At the lower mark the asset is bought, at the upper mark it is sold. For safety reasons, it makes sense to put a stop loss (stock markets provide such an opportunity), and in case of a breakout of the upper level, do not rush to sell.

Where and from whom to learn trading

The main practice in investing and trading in the stock market. Knowledge that is not backed up by action is worthless. A savvy theorist who has read a sea of literature will not be able to compete with a stock trader who has worked for at least a month.

So that the initial period of your trading does not end with a sad fiasco, I suggest several stock brokers to choose from for training:

| Name | Reliability | Distance learning |

| Opening | High. The acquired skills are honed on a demo account. Most stock instruments are free | Present |

| VTB 24 | High. Several courses on the stock market, depending on the degree of preparation. | Video format. In large cities, face-to-face seminars on stock market trading are held |

| ALOR | High. During trading, the investor receives remote support from the broker | Present |

Conclusion on trading strategies

Having chosen a trading strategy, the investor abandons hasty decisions in favor of a well-balanced line of behavior in the stock market. For beginners, following a trading strategy guarantees stable development. This is much more effective than trading on your intuition or reinventing the wheel.