Bitcoin is falling and some investors are unsettled. However, data from Glassnode shows that BTC whales are still holding onto their stocks while short-term investors are selling. The market update.

Despite the fact that the third round of US stimulus check payouts started over the weekend, Bitcoin is falling. Many investors had expected that the issue of the stimulus package would lead to a rally in prices. But now the opposite has happened.

On March 15, the sellers in the market gained the upper hand and temporarily pushed the Bitcoin price below the 54,000 US dollar mark.

At the same time, several news had a negative impact on the price – including rumors about a possible ban on cryptocurrencies in India. This ban is intended to criminalize the possession, issuance, mining and trading of Bitcoin and Co. At the time of going to press, the BTC rate is down 6.03 percent for 24 hours at $ 55,377 .

Bitcoin: small investors are back

Data from Glassnode shows that many new participants have poured into the Bitcoin network in the past few weeks. The number of actors in the network has even broken the old all-time high of 2017.

Long-term investors hodln

The massive influx of retail investors isn’t necessarily a positive sign for the market. Compared to institutions, small investors are often more short-term oriented and act more emotionally overall, which can lead to increased volatility in the market.

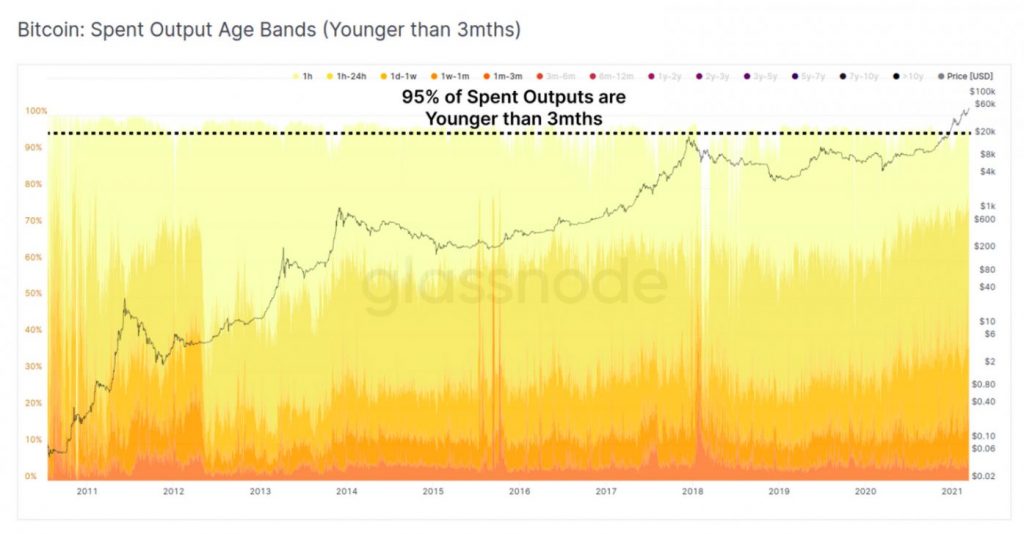

But despite this fact, the majority of long-term investors continue to hold onto their Bitcoin holdings. According to a report by Glassnode , 95 percent of all Bitcoin currently traded have been bought within the last three months – i.e. the stocks of new investors. Only five percent of the coins of long-term investors who are older than 90 days have been moved in the same period. That suggests that the majority of the BTC that have moved are “young BTC” traded by short-term investors.

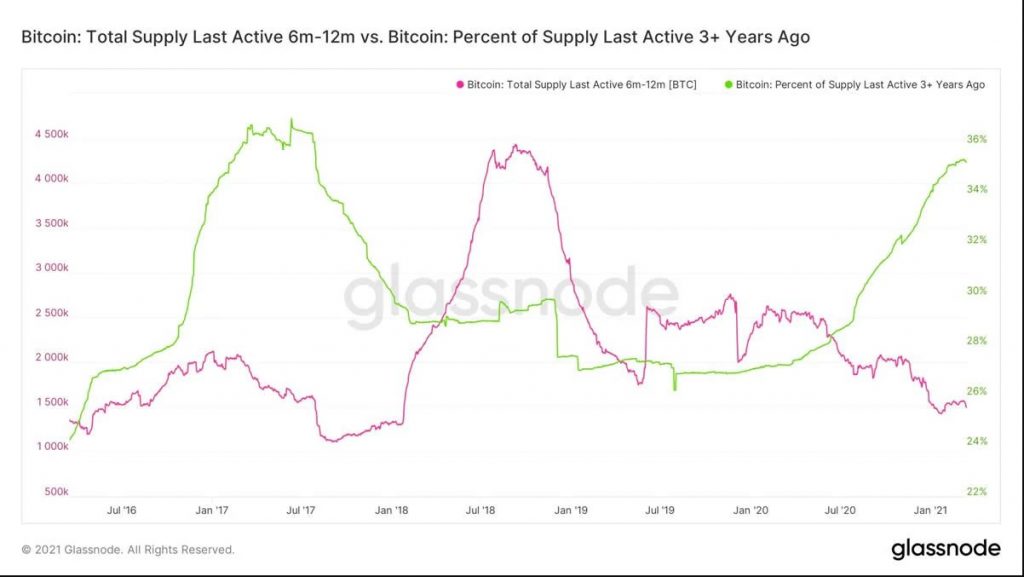

In addition, on-chain data shows that addresses that have been hoarding Bitcoin for at least three years have significantly increased their holdings in the past six to 12 months. At the same time, short-term investors have taken profits since the beginning of 2020.

In addition, Glassnode notes that long-term investors hold even more Bitcoin than usual compared to previous bull markets. This is bullish for Bitcoin in that Glassnode assumes that long-term investors have a greater knowledge of Bitcoin than short-term oriented speculators. Long-term investors have often accumulated BTC in bear markets in the past and sold Bitcoin at the right time in bull markets.