The series had to end at some point! There will therefore be no tenth consecutive week of decline for Bitcoin. This Sunday, Bitcoin just ended a 9-week streak of red candles, which was a sad record for the mother of cryptocurrencies. But then, if the rebound is timid, can it be the start of a recovery? This is what we will try to determine!

Bitcoin ends 9 weeks of decline!

Week after week it was the same story: Bitcoin was posting losses and accumulating a collection of red candles. As evidenced by the following chart, accessible from the Tradingview platform:

This Sunday, the dynamic was thus broken. By a fairly flat green candle which at least had the merit of stopping the bleeding . And for many, that is the main thing. Because over the past 9 weeks, the price of Bitcoin has lost more than 40% of its value. Compared to its all-time high recorded last November and close to $70,000, BTC is posting losses of around 55%.

What impact on the price of Bitcoin?

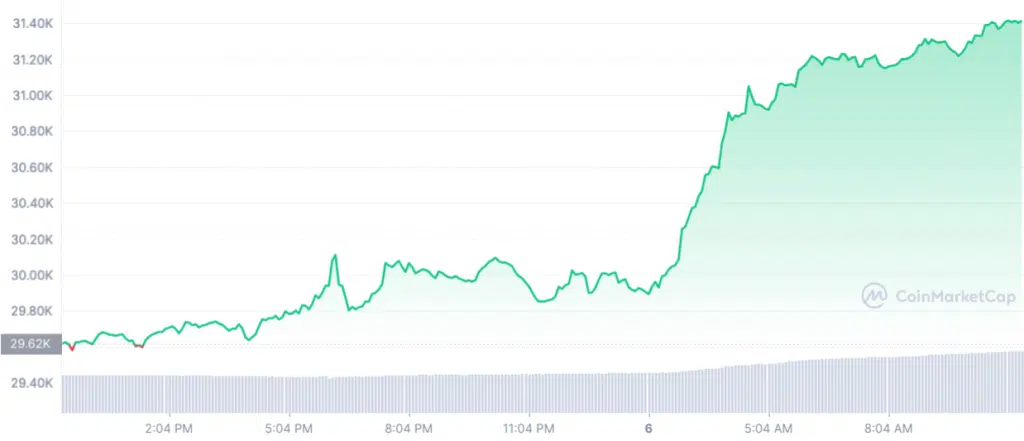

This news carried the price of Bitcoin on the day’s session. As the graph below illustrates:

Shortly after 2 a.m. (French time), the price of Bitcoin rose sharply: + 1,300 dollars in just 3 hours . Nevertheless, this “pump” phase remains to be nuanced. In reality, it would hold more to the start of a new week than to the trend observed the previous week. Indeed, similar pumps have already occurred in the early hours of a new week, as Bitcoin entered a bearish phase.

As of this writing, one Bitcoin is trading for $31,441, up 6.14% over the past 24 hours.

Should we see a trend reversal?

It is obviously too early to be able to say anything. Since mid-May, the Bitcoin price seems to be trending. For some, this could be a sign of an impending bullish reversal while others are anticipating the opposite move. And an inexorable fall towards 20,000 dollars to “clean up the market”.

Anyway, if we refer to the technical analysis, some indicators seem to be encouraging. For example, Bitcoin recently crossed above the 200-day exponential moving average, which may suggest that the low point has been reached.

For its part, market sentiment rose slightly on Monday since it settled at 13/100. A rise to be qualified very widely, because 13 is still largely in the Extreme Fear . If today’s session confirms the rise, it could come back higher tomorrow. In the longer term, opinions on Bitcoin remain rather positive. This level of 31,000 dollars could therefore constitute a very interesting entry point.