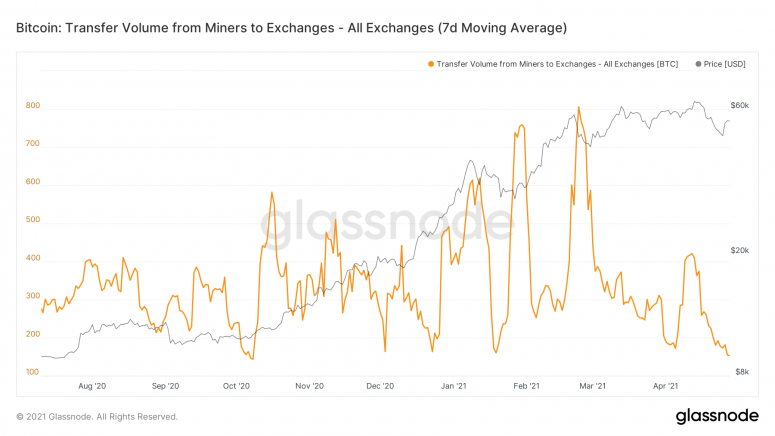

Bitcoin miners continue to cut BTC transfers to cryptocurrency exchanges. This speaks of the optimistic price expectations of miners regarding the possible continuation of the “bullish” rally in Bitcoin.

According to Glassnode, the 7-day moving average of the daily volume of coins transferred by miners to cryptocurrency exchanges fell to 152.77 BTC on Wednesday, April 28. This was the lowest since October 8, 2020. The rate is down 80% since it peaked at 805 BTC on February 23rd. (Also Read: Binance Coin (BNB) Price Prediction and Bank of France tested national digital currency)

A decrease in coins transferred by miners to exchanges is considered a sign of bullish sentiment – miners withdraw as little BTC as possible to trading platforms, as they expect to sell them later at a higher price. Miners are permanent sellers in the market, liquidating at least some of their assets on a daily basis to finance operating expenses.

Seven-day moving average of daily BTC volume transferred by miners to exchanges. Source: Glassnode

Seven-day moving average of daily BTC volume transferred by miners to exchanges. Source: Glassnode

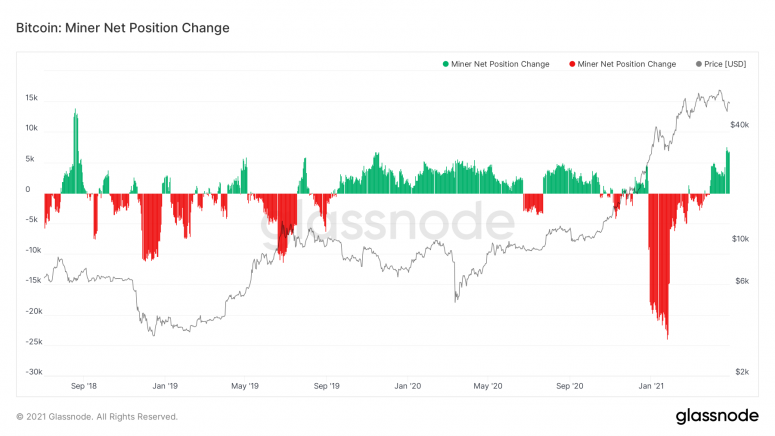

Miners increased the volume of BTC transfers to exchanges in January and February to lock in profits. The Glassnode metric, which measures the 30-day change in coin stocks held at miners’ addresses, also suggests that miners have returned to hoarding mode this month.

The indicator broke above zero at the end of March, signaling that miners were once again adhering to the HODL strategy, and has now climbed to its highest level since September 2018. According to Glassnode, the balance of coins on miners’ addresses has also increased by more than 8,000 BTC to 1,809,992 BTC over the past two months.

However, reducing the amount transferred to the Stock Exchange of coins does not necessarily mean imminent price increase, as these coins make up a small part of the total market as written in Twitter CEO Glassnode Rafael Schultze-Kraft (Rafael Schultze-Kraft). As of April 28, miners’ transfers to exchanges accounted for less than 1% of the total 32,912 BTC inflow to trading platforms.

Note that last summer the situation was reversed on the market – miners brought more BTC to exchanges than they mined.