The positive weekly close on Wall Street in the USA also brings Bitcoin (BTC) and Co. significant price increases. Many alternative cryptocurrencies are increasing in value by double digits.

- Positive economic data from the USA caused prices on the traditional financial markets to rise significantly in the second half of the week.

- The crypto market is currently also benefiting from this bullish trend, which has gained around eight percentage points in the last 48 trading hours.

- The price strength of the key cryptocurrency Bitcoin (BTC) is also pulling many alternative cryptocurrencies north.

- In addition to Ethereum (ETH) with a good seven percent price increase, Polygon (MATIC) with 16 percent and Uniswap (UNI) with 18 percentage points in value growth are particularly convincing.

- The total market capitalization also rose again to the psychological $1 trillion mark.

- Sustained friendly sentiment in the coming trading days could push the value of the entire crypto market up to the key resistance level at $1.16 trillion.

Ethereum: Bulls and Bears again in battle for the key resistance

Ethereum (ETH) price is making another bullish breakout attempt. The recapture of USD 1,267 should result in follow-up buying.

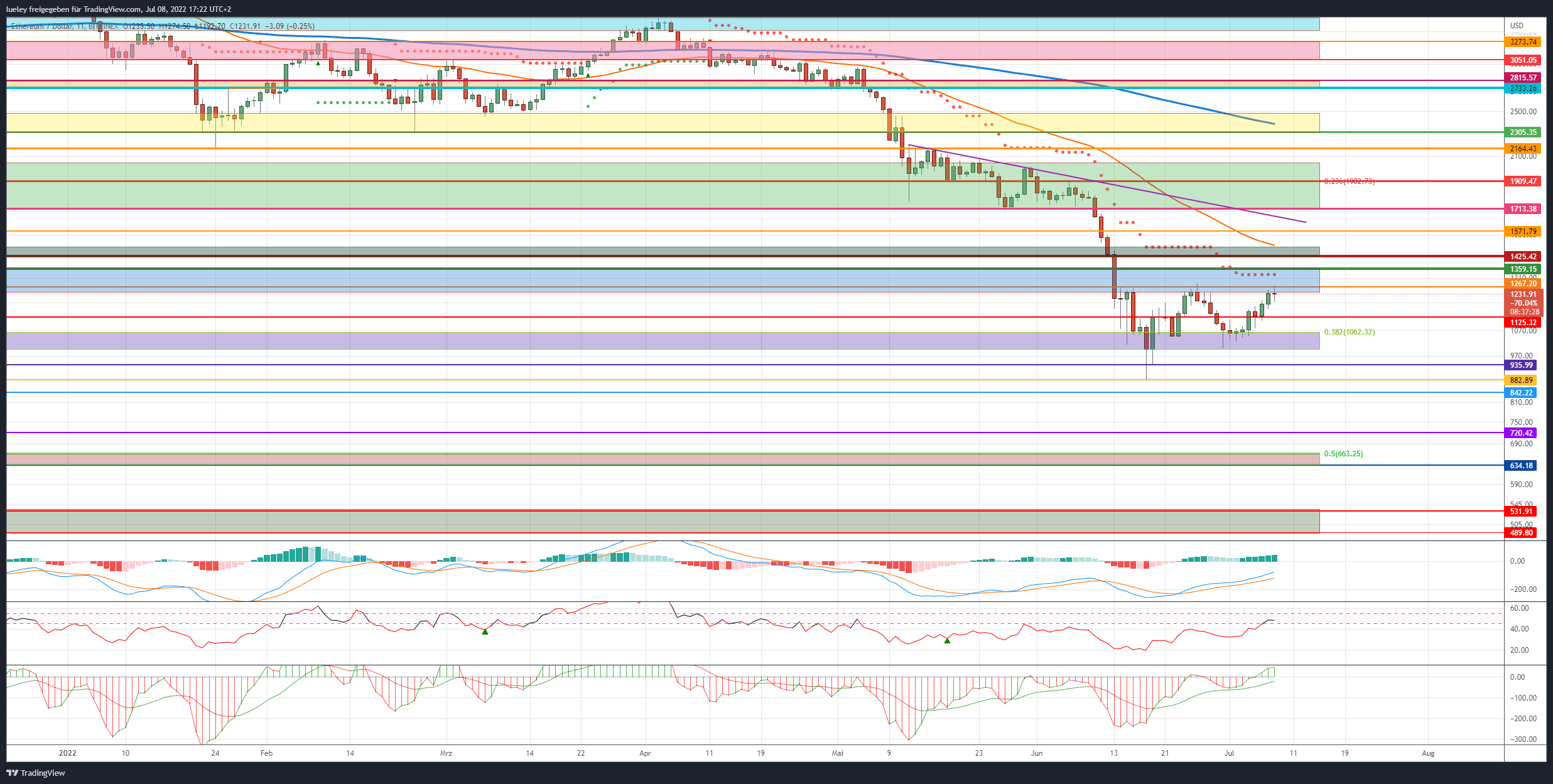

- Rate (ETH): $1,231 (previous week: $1,069)

- Short-term resistances/targets: $1,241/1,267, $1,326/1,359, $1,425/1,480, $1,571, $1,713, $1,829, $1,909, $2,050, $2,164, $2,305, $2,448/2,485, $2,733

- Short-term supports: $1,125, $1,063, $992, $935, $882, $720, $663/634, $531/489

Ethereum Recap

- The ether price continues its price recovery in the current trading week.

- This Friday morning, the ether price jumped again to the important resistance level at USD 1,267, but failed, as it did last time, at this strong resist level.

- The fact that Ethereum was able to continue to defend the purple support zone and is currently trying to form a floor above it is still positive.

- The bulls must now do everything in their power to sustainably break through today’s daily high. The next price target between USD 1,326 and USD 1,359 will only be activated if this relevant price level is dynamically recaptured.

- If these two resistances are pulverized, the ether course could target the gray resistance area between USD 1,425 and USD 1,480 in a timely manner.

- At the time of writing this analysis, today’s daily candle seems threatening after a bearish reversal candle, a so-called “shooting star” is threatening to form.

- The fact that the labor market data from the USA published at 2:30 p.m. (CET) was well above analysts’ expectations is certainly positive from an economic point of view, but the unchanged robust condition of the US economy points to further interest rate hikes in the coming months. As a result, investors’ hopes of getting “cheap” money again faster than expected could be dashed for the time being.

Important course markers for the coming trading days

- If the buyer side again fails to bring Ethereum back above USD 1,267 and Ethereum builds a so-called double top, at least a correction back to the support at USD 1,125 can be expected.

- The relevant support area for Ethereum is unchanged between $1,063 and $992.

- The RSI and MACD indicators are currently showing an inconsistent picture. As in the previous week, the MACD has an active buy signal. The RSI indicator can also continue to recover with a value of 47 and is now back in its neutral zone between 45 and 55. Only a breakout above 55 would also generate a new buying impulse for the RSI.

Bullish Scenario Ethereum Price Forecast

- The bull camp again tried to clear the strong resistance at $1,267 in the last 24 hours of trading. As 14 days ago, however, the ether course seems to have taken over for the time being.

- The buyer camp must now do everything possible to ensure that the ether price does not slip back below USD 1,125 and in turn to raise it above the first relevant resist level at USD 1,267 in a timely manner.

- If a sustained breakout above this resistance is successful, the supertrend, currently at USD 1,326, comes into view as the first target. A spike up to the upper edge of the blue resistance zone should also be planned for.

- If these price marks are overrun and Ethereum can generate further upward momentum, the gray resistance zone awaits as the next price target.

- Another relevant resist zone awaits between USD 1,425 and USD 1,480. However, the EMA50 (orange) is also found on the upper edge.

- If Ethereum does not bounce sharply south here and the crypto market continues to gain momentum, a price increase to the purple downward trend line, currently at USD 1,667, can be expected in the future. In addition, the tear-off edge at USD 1,713 is within reach. Significant profit-taking and renewed sell-off attempts by the bears are to be planned here.

- A further correction movement to the south would be conceivable.

Plan for further price increases in Ethereum

- The next price target in the form of the 23 Fibonacci retracement at USD 1,909 will not be activated until the buyer side can stabilize the ether price sustainably above USD 1,713.

- If this resist is recaptured in the medium term, investors will focus on the next potential recovery targets at USD 2,050 and USD 2,164. However, the Ethereum price should again consolidate more significantly at USD 2,164.

- However, a renewed drop below USD 1,713 must be prevented at all costs. Only then is a sustained upward movement into the yellow resistance zone between USD 2,305 and USD 2,485 possible. As repeatedly mentioned in the previous weeks , this resistance zone acts as a maximum bullish price target for the coming trading months.

- Further price potential up to at least USD 2,733 is only activated when Ethereum dynamically breaks through this resistance area.

Bearish Scenario Ethereum Price Prediction

- For the time being, the bears prevented a sustained breakout above the historical high of June 26 of the previous month in the early hours of the morning.

- Even an increase up to USD 1,480 would still be manageable from the point of view of the seller camp.

- However, in order to generate sustained selling pressure again, the ether course must be sold back below USD 1,125.

- Only then is further consolidation up to at least USD 1,062 available. If Ethereum falls back below this support from the 38 Fibonacci retracement and horizontal support at the daily closing price, the chance of a sell-off to the low of June 30 at USD 997 increases.

- Should Ethereum then break below the purple support zone again, the support levels at USD 935 and USD 882 will come into focus again.

The old breakout level as a target in view

- If the ether price cannot stabilize here this time and generates a new annual low, the downward movement extends to around USD 720.

- If the crypto market continues to be bearish, a fall back into the zone between USD 663 and USD 634 should not come as a surprise. In addition to the higher-level 50 Fibonacci retracment, the breakout level from December 2020 also runs here.

- Plans are definitely to be made with increased resistance on the part of the buyers.

- However, if Ethereum does not manage to use this area to bottom out, a sell-off to the higher target area between USD 531 and USD 489 is not excluded.

Disclaimer: The price estimates presented on this page do not represent buy or sell recommendations. They are merely an assessment by the analyst.