At some point this Bitcoin correction will also be over. Some indicators are already turning bullish again. The market update.

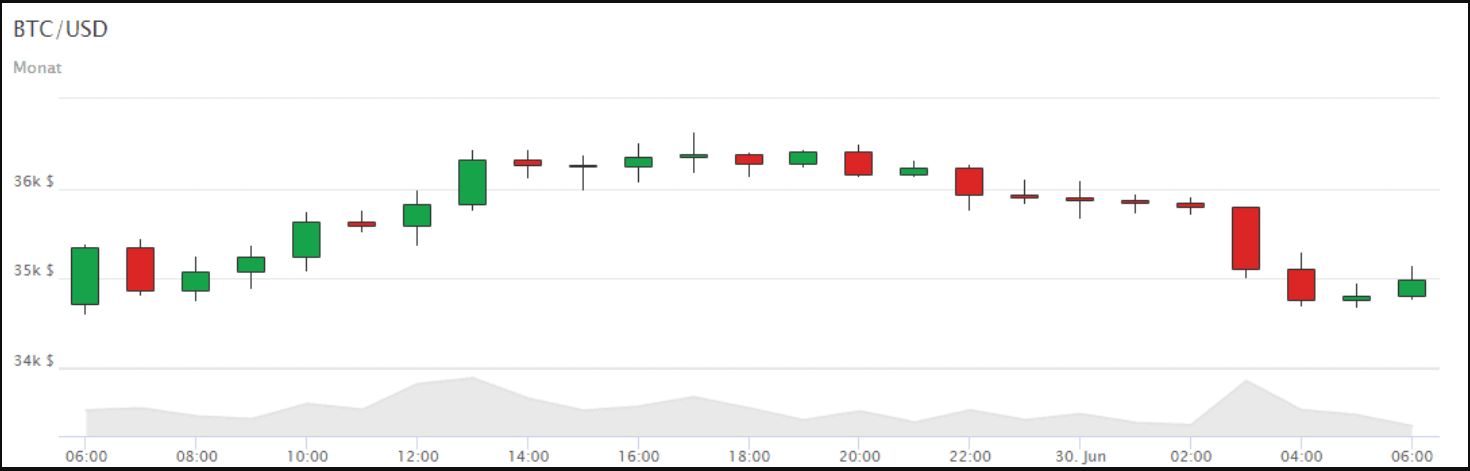

After all: Bitcoin is giving signs of life. After the cryptocurrency started a kind of mini rally on Tuesday, June 29th, BTC is still slightly in the green today. Bitcoin is correcting slightly from its preliminary high of 36,600 US dollars (USD) today, but is still around one percent up on the day-to-day perspective.

At this point it is difficult to say whether this is the long-awaited trend reversal. The “dip”, which has been going on for three months, can hardly be compared with corrections from past bull markets. It is accordingly difficult to make sense of the market sentiment. If there is no small miracle on June 30th today, BTC will close in the red for the third month in a row. That would be a novelty for a bull market.

Bitcoin hash rate in descent – so what?

The reason for the persistent dry spell despite bullish news ( El Salvador is only the tip of the iceberg ) could – once again – be China. The fact that the Middle Kingdom has almost completely put an end to Bitcoin mining is generally known in crypto circles. It is clear that a loss of 50 percent of the hash rate does not leave the network without a trace.

The network is still secure enough. But news of this caliber would have the potential to send BTC into a multi-year bear market. For a stress test of this magnitude, the correction turned out to be surprisingly light.

And there are signs of improvement: some on-chain indicators are already sending buy signals. First of all, there is the Puell Multiple, an indicator that in the past was able to predict cheap entry prices with astonishing accuracy. The Puell Multiple is calculated by dividing the dollar value of the Bitcoin issued daily by the 356 day moving average of the daily dollar value. Instead of from the point of view of traders or exchanges, the Puell Multiple evaluates the market situation based on mining.

Values between 0.3 and 0.5 have repeatedly indicated imminent upward trends in the past. If the Puell Multiple rises above 1, BTC is overvalued and miners tend to sell the coins. That’s the theory.

Currently, you can already guess, the Puell Multiple is quite low at 0.45.

It is of course questionable whether this leads to an immediate implication for an immediate bull phase. The Puell Multiple can oscillate in the green for a while until the courses follow. Sooner rather than later, however, this correction should also be over.

Bitcoin Price Prediction – Failure to Revisit $35,500 Levels Would Bring Support Levels into Play

It’s been a bearish morning for Bitcoin and the broader market. A Bitcoin move back through to $36,000 levels would bring $40,000 levels back into view.

After a mixed day for the crypto majors on Tuesday, it’s been a bearish morning for Bitcoin and the broader crypto market.

At the time of writing, Bitcoin, BTC to USD, was down by 2.51% to $35,019.0. A mixed start to the day saw Bitcoin rise to an early morning high $36,099.0 before hitting reverse.

The Rest of the Pack

It’s been a bearish morning for the broader crypto market.

Through the morning, Ripple’s XRP was down by 4.62% to lead the way down.

Bitcoin Cash SV (-3.57%), Chainlink (-3.82%), and Crypto.com Coin (-3.48%) also saw heavy losses.

Binance Coin (-2.92%), Cardano’s ADA (-2.83%), Ethereum (-1.37%), and Litecoin (-2.50%), and Polkadot (-1.44%) saw relatively modest losses, however.

Through the early hours, the crypto total market rose to an early morning high $1,447bn before falling to a low $1,387bn. At the time of writing, the total market cap stood at $1,398bn.

Bitcoin’s dominance rose to an early high 46.95% before falling to a low 46.50%. At the time of writing, Bitcoin’s dominance stood at 46.54%.