Most likely not.

However, here is the data so you can make your own decision.

As a software developer, I have worked on a few startups and crypto projects. It seemed to me that whenever the business is slower or there are some difficulties, less code is committed. There may be a number of reasons for that, such as fewer developers, weaker motivation, or no urgent bug fixes, etc.

I am absolutely aware that the number of commits by itself is not a perfect metric for the code quality or the speed of development.

However, I was intrigued enough to investigate.

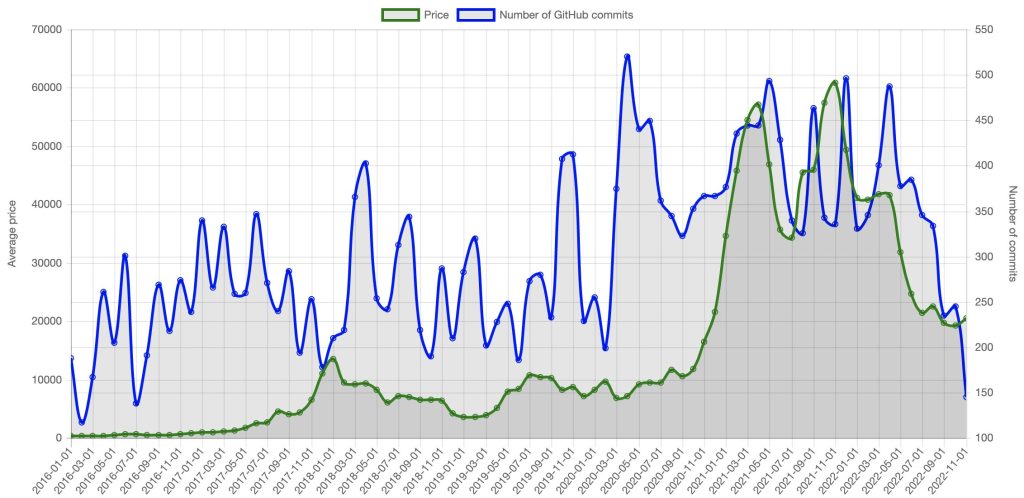

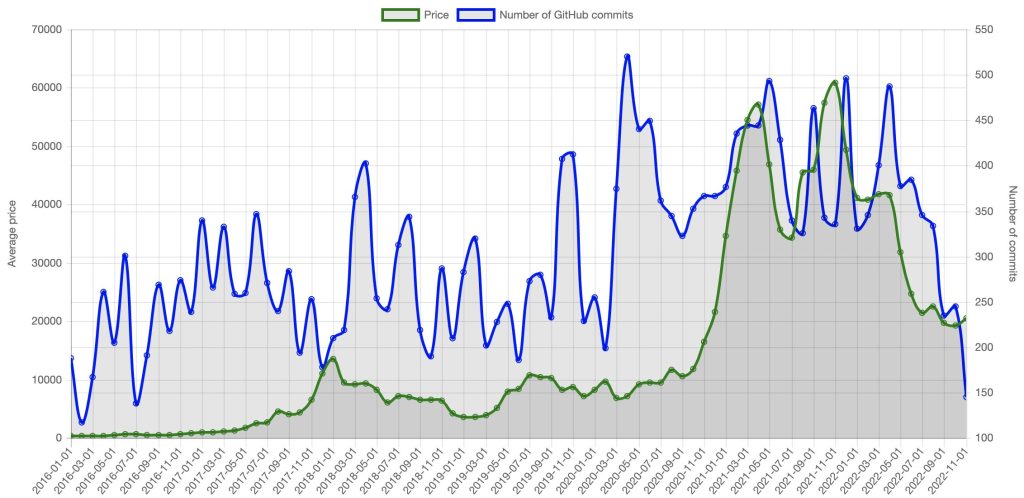

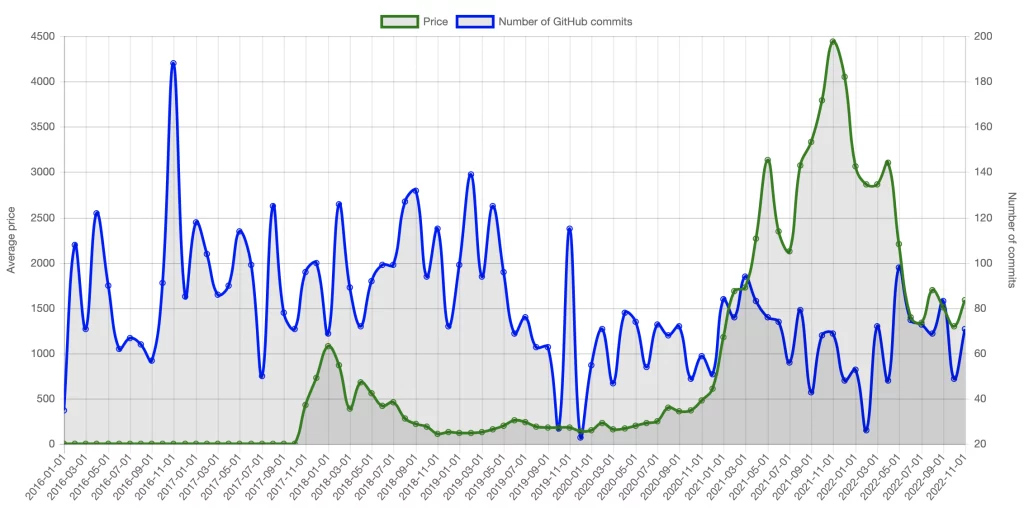

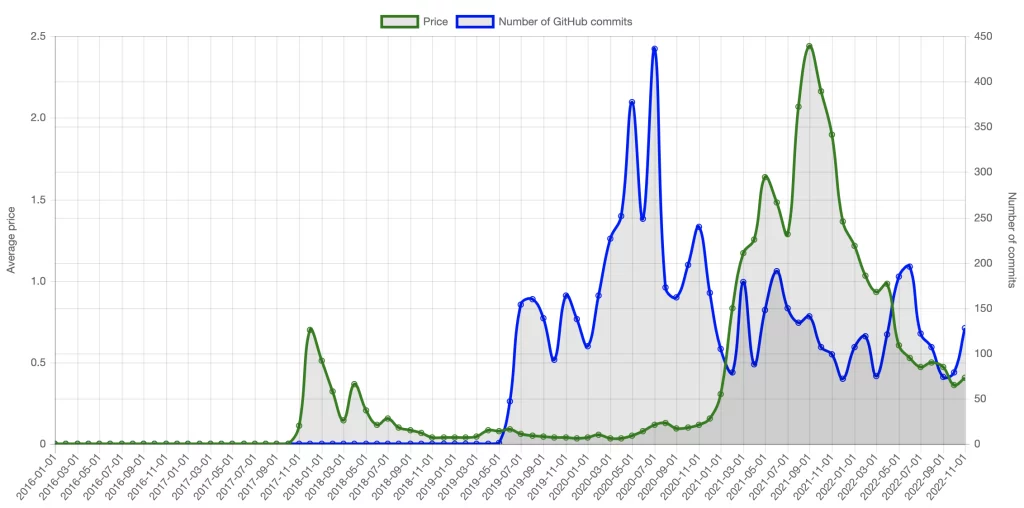

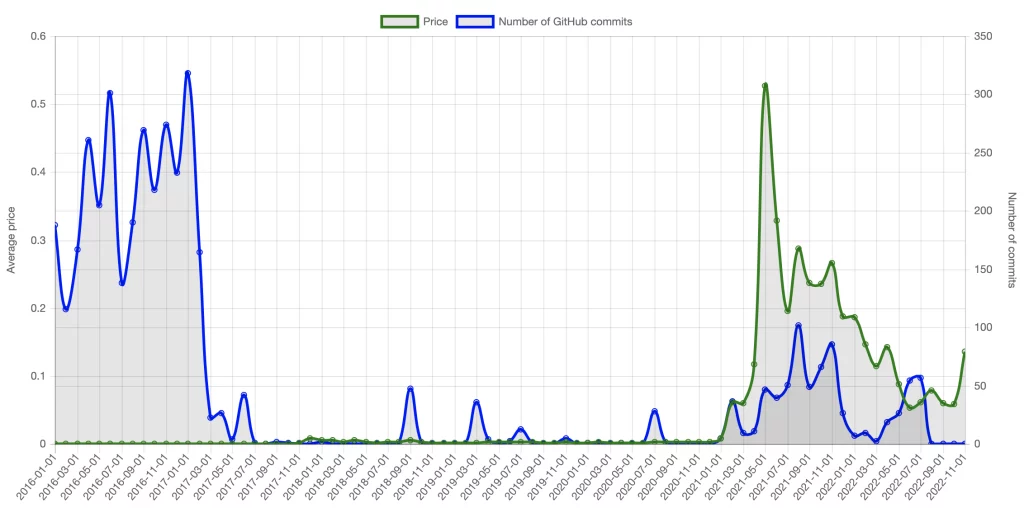

Here are some interesting graphs:

There seems to be no consistent relation between GitHub commits and the price of crypto assets.

To test whether there is any relation, I have backtested a number of trading strategies.

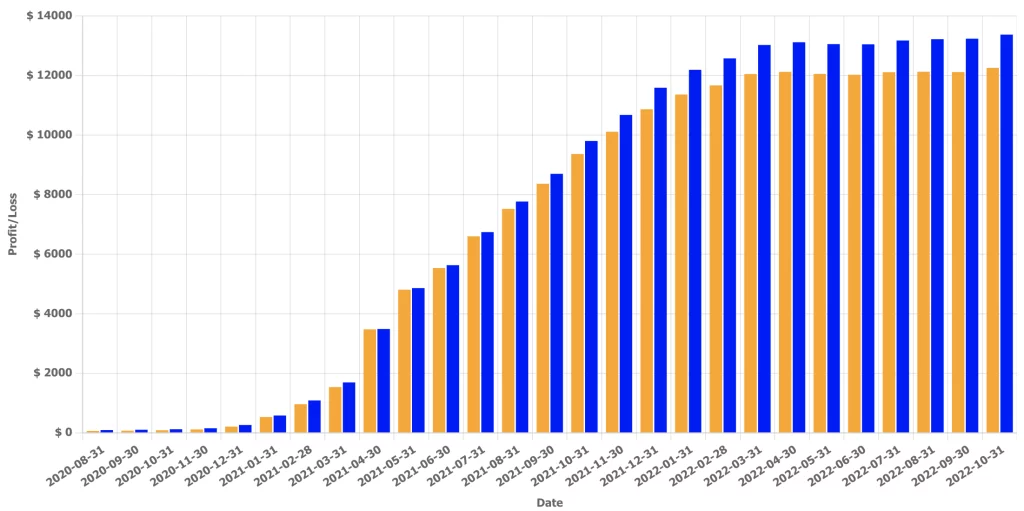

The graph shows the average profits at different points in time if $100 was invested every month when the number of commits to a coin’s GitHub repository was greater (blue) or lower (orange) in the last month compared to the preceding month.

Data was calculated for the crypto assets with the largest market cap and active public repository: BTC, ETH, ADA, DOGE, and MATIC.

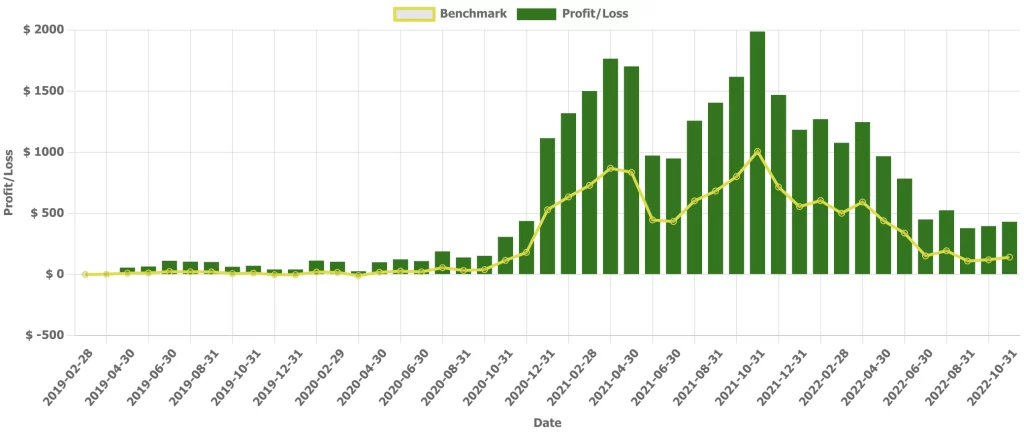

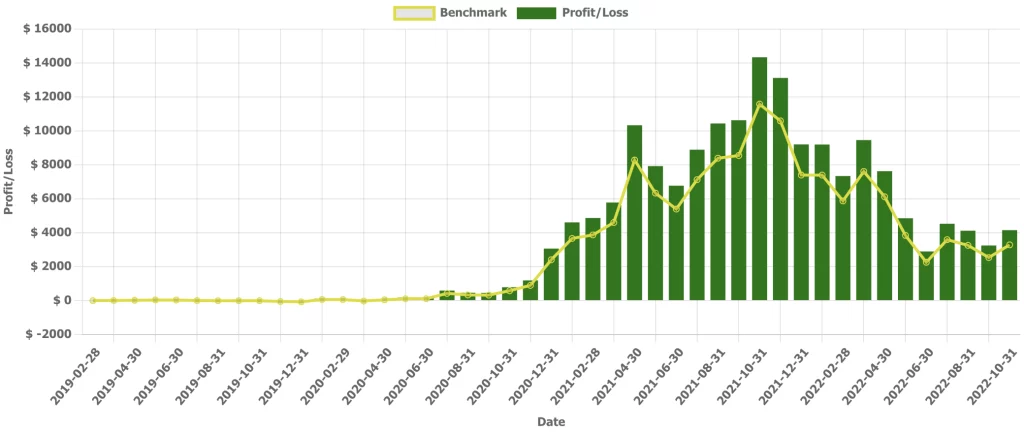

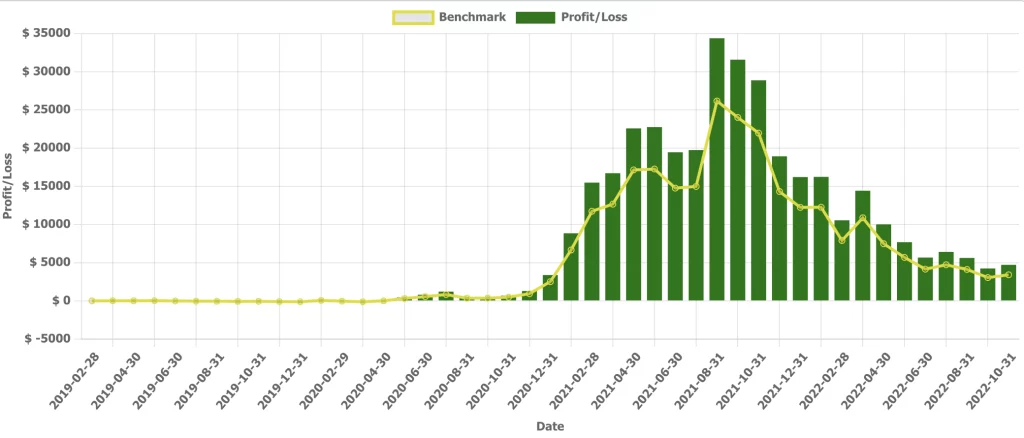

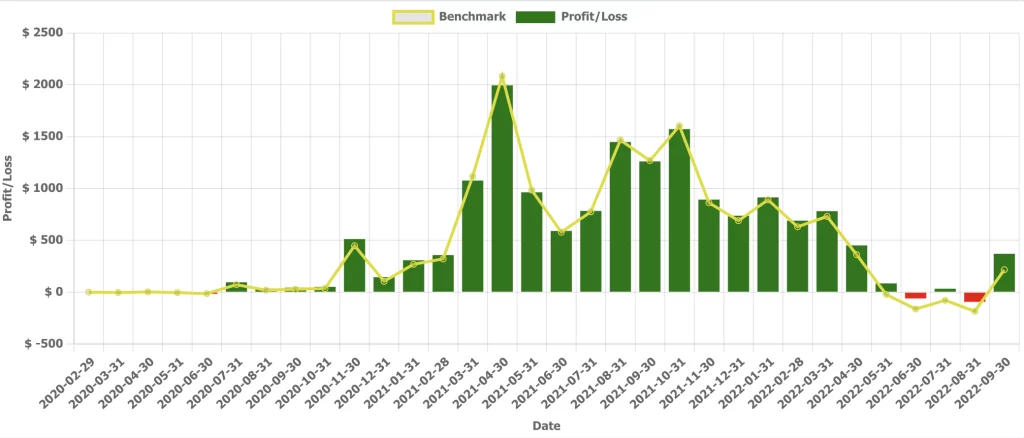

Here are some of the best-performing strategies:

Every month, if the number of commits on GitHub is down for Bitcoin (BTC) by 30% compared to the average from the previous month, then buy $100 of Bitcoin (BTC).

Every month, if the number of commits on GitHub is up for Ethereum (ETH) by 30% compared to the average from the previous month, then buy $100 of Ethereum (ETH).

Every month, if the number of commits on GitHub is up for Cardano (ADA) by 30% compared to the average from the previous month, then buy $100 of Cardano (ADA).

Every month, if views on Wikipedia are down for Ripple (XRP) by 20% compared to the average from the previous month, then buy $100 of Ripple (XRP).

The profits in the above strategies might be explained by the fact that some of those strategies bought crypto currencies early, while the benchmark buys an equal amount every month.

These findings seem to be consistent with this article: https://research.thetie.io/does-github-activity-affect-crypto-prices/.