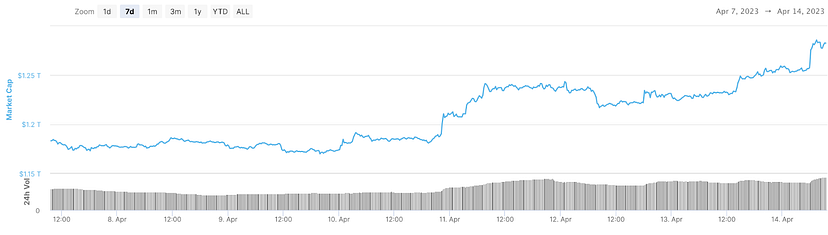

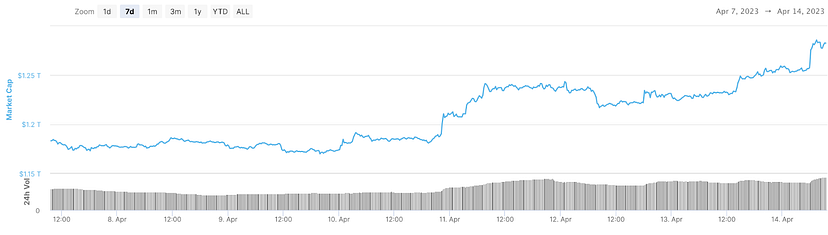

The global crypto market cap has increased by 4.15% to reach $1.28 trillion, while the overall volume of the cryptocurrency market has risen by 18.42% to $54.34 billion in the past 24 hours.

DeFi’s total 24-hour volume is currently at $4.29 billion within the market, representing 7.90% of the overall crypto market volume. Meanwhile, all stablecoin book is currently at $48.34 billion, accounting for 88.97% of the 24-hour volume of the entire crypto market.

At the time of writing, Bitcoin’s price was trading at $30,734.05, and its dominance is currently at 45.83%, a decrease of 0.88% from the previous day. In the last 24 hours, the price of ETH has increased by 10.33% to $2,112.69, while the cost of BNB has gone up by 3.66% to $331.82.

Based on the CoinMarketCap chart, the total market capitalization of cryptocurrencies has shown a fluctuating trend in its movement since the previous week.

The recent surge in Bitcoin’s price has seen it cross the $30,000 threshold, leading many experts to believe that the cryptocurrency market may have bottomed out in November 2022, concluding the so-called “crypto winter” cycle. This has caused growing anticipation for a potential long-term rally, which could result in Bitcoin breaking its previous record and reaching new all-time highs.

Ethereum’s Long-Awaited Network Upgrade has Arrived: What’s Next?

After a long wait, Ethereum’s network upgrade, known as the “Shanghai” or “Shapella” upgrade, has finally been activated, enabling stalkers to withdraw their cryptocurrency. Previously, stickers had to lock up their tokens to earn financial rewards, which reduced their investment’s liquidity. With more than 15% of all Ethereum staked, worth $33.73 billion, investors can now sell off some of their assets, bringing native Ethereum yield to a free market, which experts believe is necessary for genuine growth. Although the unlock may create temporary market volatility due to at least $300 million worth of selling pressure, the upgrade is mainly positive for Ethereum’s future, as it finalizes the switch to a proof-of-stake mechanism, reducing the network’s energy usage by 99.9%. The promotion is considered a bullish event for Ethereum, with experts expecting more institutional investment in Ethereum’s network. Furthermore, the upgrade paves the way for broader institutional participation in ETH staking, which is crucial for the future security and stability of the network.

With $7.3B in Assets Recovered, FTX Contemplates Relaunching the Exchange.

FTX, the cryptocurrency exchange that experienced a massive collapse in November, may consider reopening the business as it navigates bankruptcy, according to attorneys from Sullivan & Cromwell who represent the company. During a court hearing, the attorneys disclosed that one option being discussed is allowing creditors to convert a portion of their holdings into a stake in the reopened exchange. While restarting the business is just one of many options being considered, the announcement caused FTX’s FTT token to more than double in price. However, significant capital would be required, and discussions are ongoing about whether that capital should come from the FTX estate’s capital or third-party capital. Meanwhile, Bitcoin and the broader cryptocurrency market have seen significant growth this year, with Bitcoin’s year-to-date performance standing at over 85%, making alternative investment options like remote mining more profitable. This trend has led many to anticipate a rally that could drive Bitcoin to a new all-time high.

Also Read: