Mortgage Calculator

Results:

Monthly Payment: $0.00

Total Cost: $0.00

What is Mortgages

A mortgage is a type of loan specifically used to finance the purchase of real estate, such as a home or a piece of land. It is a legal agreement between a borrower and a lender, typically a bank or a mortgage lender. The borrower, often referred to as the mortgagor receives a loan to buy the property, and in return, they agree to repay the loan amount plus interest over a specified period, usually spanning several years.

The key components of a mortgage include:

- Principal: The amount of money borrowed to purchase the property.

- Interest: The cost of borrowing the money, expressed as a percentage of the loan amount. Interest is the profit for the lender.

- Term: The length of time over which the borrower agrees to repay the loan. Common mortgage terms are 15, 20, or 30 years.

- Monthly Payments: The borrower typically makes regular monthly payments, including principal and interest, until the loan is fully repaid.

- Collateral: The property being financed serves as collateral for the loan. If the borrower fails to make payments as agreed, the lender may have the right to seize the property through a legal process known as foreclosure.

Mortgages allow individuals to own real estate without paying the full purchase price upfront. The terms and conditions of mortgages can vary, and there are different types of mortgages, such as fixed-rate mortgages (with a constant interest rate throughout the loan term) and adjustable-rate mortgages (with interest rates that may change over time).

It’s important for borrowers to carefully review and understand the terms of a mortgage before entering into an agreement, as it represents a significant financial commitment.

How to calculate your mortgage payments

Mortgage Calculator simplifies the intricate calculus involved in mortgage payments, transforming a complex math problem into a quick and straightforward process.

To get started, input the home price (if you’re purchasing) or the current value of your home (if you’re refinancing) in the designated “Home price” space.

Navigate to the “Down payment” section and specify the down payment amount (for buyers) or the equity amount (for refinancers). The down payment represents the upfront cash paid for a home, while home equity is the home’s value minus outstanding debts. Input either a dollar figure or the percentage relative to the purchase price.

Proceed to the “Length of loan” section and select the loan term—typically 30 years, but alternatives like 20, 15, or 10 years are available. The calculator automatically adjusts the repayment schedule based on your choice.

In the “Interest rate” box, enter your expected rate, which varies based on whether you’re buying or refinancing. While the calculator defaults to the current average rate, you can modify the percentage.

As you input these details, the calculator generates a new figure for principal and interest on the right. Additionally, Bankrate’s calculator provides estimates for property taxes, homeowners insurance, and homeowners association fees. Feel free to adjust or disregard these amounts while shopping for a loan, as they may be included in your escrow payment but do not impact your principal and interest calculations as you explore financing options.

Mortgage payment formula

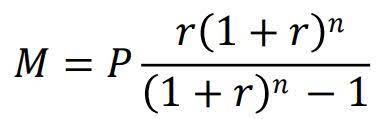

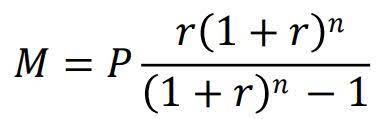

Want to figure out how much your monthly mortgage payment will be? For the mathematically inclined, here’s a formula to help you calculate mortgage payments manually:

The equation for mortgage payments

How a mortgage calculator can help

Determining your monthly house payment is a critical step when setting your housing budget, as it often constitutes your largest recurring expense. Whether you’re in the market for a purchase loan or considering a refinance, Bankrate’s Mortgage Calculator offers a convenient way to estimate your mortgage payment. You can explore different scenarios by adjusting the details in the calculator, aiding you in making informed decisions on:

- The optimal loan length for your situation. If your budget is fixed, a 30-year fixed-rate mortgage may be the suitable choice, providing lower monthly payments at the expense of more interest over the loan’s duration. On the other hand, if your budget allows, a 15-year fixed-rate mortgage can reduce total interest paid, albeit with higher monthly payments.

- Whether an Adjustable Rate Mortgage (ARM) is a viable option. As interest rates fluctuate, an ARM with its initially lower rates may seem appealing. For instance, a 5/6 ARM, featuring a fixed rate for the first five years before adjusting every six months, might be suitable for short-term residency. However, it’s crucial to carefully assess how much your monthly mortgage payment could change once the introductory rate expires.

- If you’re exceeding your affordable spending limit. The Mortgage Calculator provides an overview of your expected monthly payments, encompassing taxes and insurance, helping you gauge whether your financial commitments align with your budget.

- The appropriate down payment amount. While the standard down payment is often considered to be 20 percent, it’s not mandatory. Many borrowers opt for as little as a 3 percent down payment, and the calculator can assist you in evaluating various down payment scenarios.

FAQs

The equation for these loans can be expressed as follows: Loan Payment = Amount/Discount Factor. To initiate the calculation, it’s essential to determine the discount factor using the subsequent formulas: Number of periodic payments (n) = payments per year multiplied by the number of years. Periodic Interest Rate (i) = annual rate divided by the number of payments per year.

A mortgage is a type of secured loan where the home being financed serves as collateral. In this arrangement, the lender holds a lien on your home until the mortgage is fully repaid. Following the closing process, you will be required to make monthly payments encompassing principal, interest, taxes, and insurance. In the event of a default on the mortgage, the lender retains the authority to initiate foreclosure proceedings on the property.

There are various types of mortgages, including conventional loans and jumbo mortgages from private lenders, with stricter qualifications for jumbo loans. Federal government-insured options like FHA, USDA, VA, and 203(k) loans are also available, designed for low- to mid-income and first-time buyers.

Mortgages can be obtained from traditional banks, credit unions, and online lenders. To apply, assess and enhance your credit score for a better interest rate. Calculate your affordable home price, considering the down payment you can manage.