Many middle-income Americans struggle to pay their Obamacare premiums.

A recent study by the Kaiser Family Foundation (KFF) found that while premiums for ACA market plans have generally remained stable (with a 2018 average for family insurance of $1,191 and a 2019 average of $1,154, according to eHealth), people Middle-income Americans are still struggling to secure their coverage.

According to health.gov, 2019, health insurance is unaffordable if the lowest possible spending plan costs more than 9.89% of your modified adjusted gross household income (MAGI).

There are a number of factors that influence how expensive health insurance can be for individuals and their families. Administrative costs, rising costs for prescription drugs, and lifestyle choices all drive up healthcare costs. While some factors are beyond your control, others are beyond your control. Find out where you can change the cost of your health insurance and your health as a whole.

Administrative costs

Administrative costs increase. This is partly due to new rules introduced by the Affordable Care Act. The US healthcare system has separate funding sources, policies, out-of-pocket costs, and credentials for different private and public insurance providers. Not only that, but consumers also have to wade through complex coverage tiers to choose a provider covering all their healthcare needs.

The rules are so complex that they require multiple people to process, review, and pay insurance claims. Medical billing professionals need to understand deductibles, coverage, and co-payments for multiple insurance companies. Training and remuneration for these professionals result in higher healthcare premiums and costs.

Rise in prescription drug costs

Americans, on average, pay about twice as much for prescription drugs as these and other modern nations. High drug prices are largely responsible for rising healthcare costs in the country. In Europe, governments regulate drug prices based on the benefits they provide to patients. In contrast, American companies often charge more for drugs than they cost to produce. This is mainly due to the high cost of testing and approval required for drugs before they are released to the public.

Lifestyle

Lifestyle choices also play an important role in healthcare costs. Unlike administration fees and prescription drug costs, you have some control over these factors. Unfortunately, many Americans make poor lifestyle choices that affect their health care and insurance costs. This is one of the reasons why health insurance costs can be very high for some people.

Make the right choice for your health. Inherited diseases and bad luck are at the root of some diseases. However, poor diet, lack of exercise, and other factors such as excessive alcohol consumption, tobacco use, and neglect to treat certain medical conditions can lead to serious health problems.

The FPL and the “subsidy cliff.”

Those with incomes between 100% and 400% of the federal poverty line (FPL) may qualify for ACA subsidies to pay for their premiums and, in some cases, out-of-pocket expenses (such as co-payments and deductions). If it’s outside of that, even if it’s only 401% of the FPL, you could fall off the subsidy scale.

2018 poverty guidelines for the contiguous 48 states and the District of Columbia

Those who earn more than 400% of the federal poverty level (FPL) and do not qualify for the bonus tax credit face what is known as the “subsidy cliff,” which refers to a sharp decline in government support. There is no elimination of subsidies for those who reach an FPL of 401% and above.

This means that people earning more than 400% of the FPL pay the full cost of their insurance premiums.

“If you qualify for the Obamacare subsidy, you can be happy with your health insurance premiums – but the truth is, for some families, if you pay just a few hundred dollars more a year, you won’t qualify for the subsidy, and your health insurance costs thousands.” let the dollar ride,” says Scott Flanders, CEO of eHealth. This means those few extra dollars could cost you hundreds or even thousands due to a lack of grants for your ACA health insurance.

Shopping outside of state/federal marketplaces

If you fall off the subsidy scale (or find that the ACA insurance plan is too expensive for some other reason), you will likely benefit from a private marketplace like eHealth. On our online marketplace, we offer ACA plans along with many different alternatives that you may find cheaper. Remember that a more affordable health insurance plan likely means fewer benefits covered. Still, insurance with fewer benefits may be a better option than not being able to afford health insurance. Many middle-income individuals and families look outside the government in exchange for their insurance, whether due to reduced subsidies or something else.

Private exchanges such as eHealth offer a wider choice of health insurance plans than state exchanges. Some people may find they can save money by purchasing an off-market plan through a private exchange.

You only need a zip code to get quotes on various types of plans for eHealth. You will find it easy to compare plan prices with eHealth to find something that fits your healthcare needs and budget.

Opting for short-term health insurance

Another option that people are looking at is short-term health insurance plans. These plans provide coverage for short periods (from a few months to a year, extendable depending on where you live) at a lower cost than most basic medical plans.

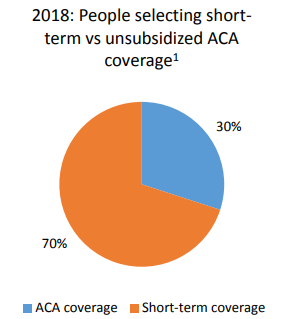

According to eHealth, there has been an increase in the number of people interested in buying short-term health insurance instead of ACA coverage.

Remember that this plan offers less coverage than most major medical plans and may not cover the 10 essential benefits required by law to be covered by an ACA plan. However, if you decide to take out short-term health insurance, you won’t incur a tax loss at the federal level, as individual mandate taxes will no longer apply to start in 2019.

Cost of health insurance: FAQs

Here are some of the most frequently asked questions on why health insurance is so expensive.

How can I lower my health insurance costs?

If you were hurt or injured, take time to determine the severity of the incident. Is a trip to the emergency room justified? What about your prescription medication? Can you switch to generics to save money? Often they have the same active ingredients without the high price tag. You can also be sure to choose a less expensive healthcare provider on the network if possible.

If you need a significant change in the cost of your insurance, it may be worth looking for health insurance that you can afford.

Can you negotiate health insurance costs?

You can’t negotiate your spending, despite common myths. However, you can try lowering your premium. A higher deductible is just one way to lower your monthly premium. Ask your insurance company for other ideas for saving money.

Why is US healthcare so expensive?

High administrative costs, rising costs of prescription drugs, poor lifestyles, and chronic disease in an aging population all contribute to the high cost of health care in the United States.