The forex market, with its average daily trading volume exceeding $6.6 trillion, offers a lucrative opportunity for traders. Success in this dynamic environment requires not only a solid understanding of the market but also a well-defined trading strategy. In this comprehensive guide, we’ll explore the basics of creating and managing effective forex trading strategies, delve into different trading styles, and provide insights into the best forex trading strategies for beginners.

Understanding Forex Trading Strategies

What Is a Forex Trading Strategy?

A forex trading strategy is a set of rules that helps traders determine when to buy or sell a currency pair. These strategies can be based on technical analysis, fundamental analysis, or a combination of both. Traders often develop strategies with specific trading signals that guide their decisions.

Basics of a Forex Trading Strategy

Forex trading strategies can be manual or automated. Manual systems involve traders making decisions based on analysis, while automated systems use algorithms for trade execution. Successful strategies involve components such as selecting the market, determining position sizes, establishing entry and exit points, and defining trading tactics.

Creating a Forex Trading Strategy

Effective strategies evolve over time. Traders often start with a simple strategy and refine it as they gain experience. Components of a successful strategy include selecting the market, position sizing, entry and exit points, and trading tactics.

When Is It Time to Change Strategies?

While a strategy may work well initially, market conditions and a trader’s risk tolerance may change. It’s crucial to adapt strategies to evolving market trends and ensure that risk management aligns with the trading style.

Example of a Basic Forex Trading Strategy

One example involves relative interest rate changes between two countries. Traders anticipate currency value changes based on interest rate differentials. For instance, if higher interest rates are expected in the U.S. compared to Australia, a trader might short the AUD/USD pair.

Where Can You Trade Currencies on the Forex Market?

There are numerous online forex brokers, each with its own features. Look for platforms offering low fees, tight spreads, regulatory coverage, and solid reputations. Additionally, charting tools and algorithmic trading capabilities are valuable for advanced traders.

Key Concepts in Forex Trading

What Is a “Pip” in Forex?

A pip, or percentage in point, is the smallest price move in the forex market. It is typically the last decimal point in currency pairs and represents 1/100 of 1% or one basis point.

What Is a Carry Trade in Forex?

A carry trade involves borrowing from a low-interest rate currency to fund the purchase of a currency with a higher interest rate. Traders aim to capture the interest rate difference, making it a profitable strategy depending on market conditions.

What Is Trade Size in Forex?

Forex accounts come in standard, mini, micro, and nano sizes. Standard accounts require orders in multiples of 100,000, mini accounts in multiples of 10,000, and micro accounts in multiples of 1,000. Trade size depends on expertise and capital.

Exploring Forex Trading Strategies

How to Choose the Best Forex Strategy

Choosing the right forex strategy involves trial and error. Traders often spend time testing various strategies on demo accounts to find what suits them. Beginners should start with simple strategies and avoid information overload by incorporating too many technical indicators.

Related: Forex Trading Guide for Beginners: Navigate Markets & Build Success

Commonly Used Forex Trading Strategies for Beginners

1. Price Action Trading

This strategy relies on price movements rather than technical indicators, keeping charts clean and reducing the risk of information overload. Price action trading is popular among day traders seeking short-term profits.

Example: A breakout trading strategy based on identifying key support levels.

2. Range Trading Strategy

Traders using this strategy seek consolidating trading instruments. They identify support and resistance levels, buying at support and selling at resistance.

Example: Identifying consistent support and resistance areas in EUR/SEK.

3. Trend Trading Strategy

Trend trading involves identifying opportunities in the direction of the trend. Popular tools include moving averages, with traders looking for crossovers indicating trend changes.

Example: Using 50-day and 200-day moving averages for trend identification in USD/JPY.

4. Position Trading

Position traders aim to capture profits from long-term trend moves, holding positions for weeks, months, or even years.

Example: Holding a bearish position on the S&P 500 for an extended period.

5. Day Trading Strategy

Day traders focus on specific sessions or times of the day, seeking 2-3 good opportunities daily without the pressure of scalping.

Example: Using M15 to H1 charts for intraday trading.

6. Scalping Strategy

Scalpers aim to profit from small intraday price moves, requiring quick decision-making and intense focus.

Example: Targeting 5 pips per trade with trades lasting seconds to minutes.

7. Swing Trading

Swing traders hold positions for multiple days, utilizing trend following, range trading, or breakout strategies.

Example: Analyzing markets without rush and running positions for days or weeks.

8. Carry Trade Strategy

Traders profit from interest rate differences between two currencies, borrowing from low-interest currencies to fund purchases in higher-interest currencies.

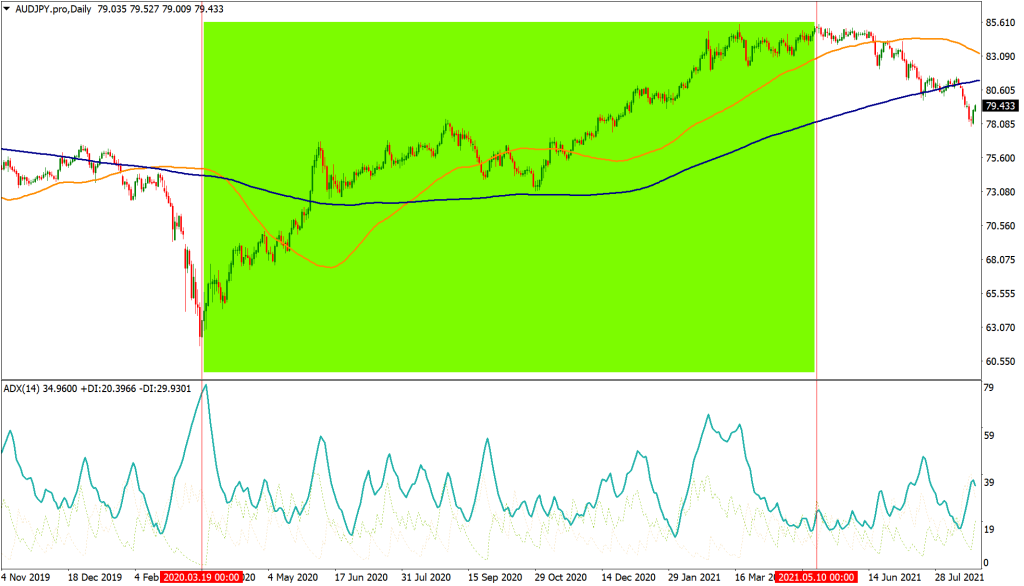

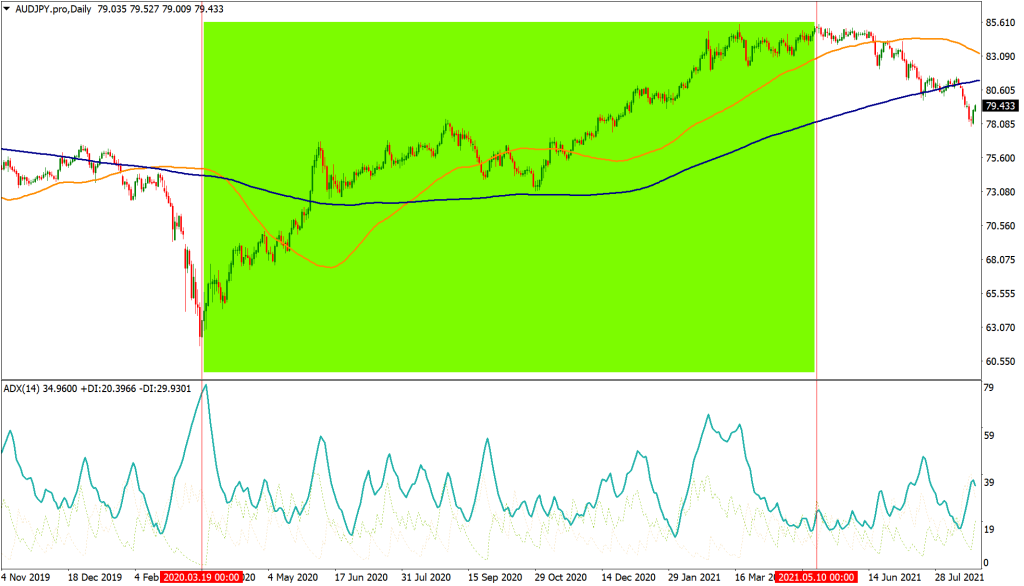

Example: Going long on AUD/JPY due to Australia’s high and Japan’s low historical interest rates.

9. Breakout Strategy

This strategy enters trades when prices break out of their range, seeking to capitalize on strong momentum.

Example: Entering positions as prices break above or below key levels.

10. News Trading

Traders aim to profit from market moves triggered by major news events, requiring careful selection of events and currency pairs.

Example: Anticipating the impact of a hawkish ECB on EUR/JPY.

11. Retracement Trading

Retracement trading capitalizes on short-term price reversals within a major trend, using tools like trendlines or Fibonacci retracements.

Example: Buying at the rising trendline in an uptrending market.

12. Grid Trading

Grid trading involves placing multiple orders above and below a set price, profiting from volatility.

Example: Placing buy and sell orders at regular intervals above and below a price level.

Comparing Forex Strategies

Each trader should identify their unique edge and tailor a strategy to their skills and personality. Testing strategies in a demo environment with virtual funds helps determine what works best. Additionally, considering personal traits through personality tests can provide further insights.

Finding the Right FX Trading Strategy

The process of finding the right trading strategy involves testing various strategies in a demo environment. As traders gain experience, they may evolve and adapt their strategies to suit changing market conditions. Understanding individual skills and preferences is crucial for long-term success.

In conclusion, successful trading in the forex market requires a well-defined strategy, adaptability, and continuous learning. Traders should choose strategies that align with their skills, test them thoroughly, and remain flexible as market conditions evolve. Whether a beginner or an experienced trader, finding the right strategy is an ongoing process that contributes to long-term success in the dynamic world of forex trading.