European and Global Markets Outlook by Kevin Buckland

On Tuesday, the dollar, once considered unbeatable, continued to struggle following recent macroeconomic data suggesting that the U.S. exceptionalism story might be losing its shine. The dollar index dropped to a fresh two-month low during Asian trading, marking a decline of over 1% since Wednesday. This fall was driven by a series of disappointing U.S. economic reports, including a factory slowdown and an unexpected contraction in construction work.

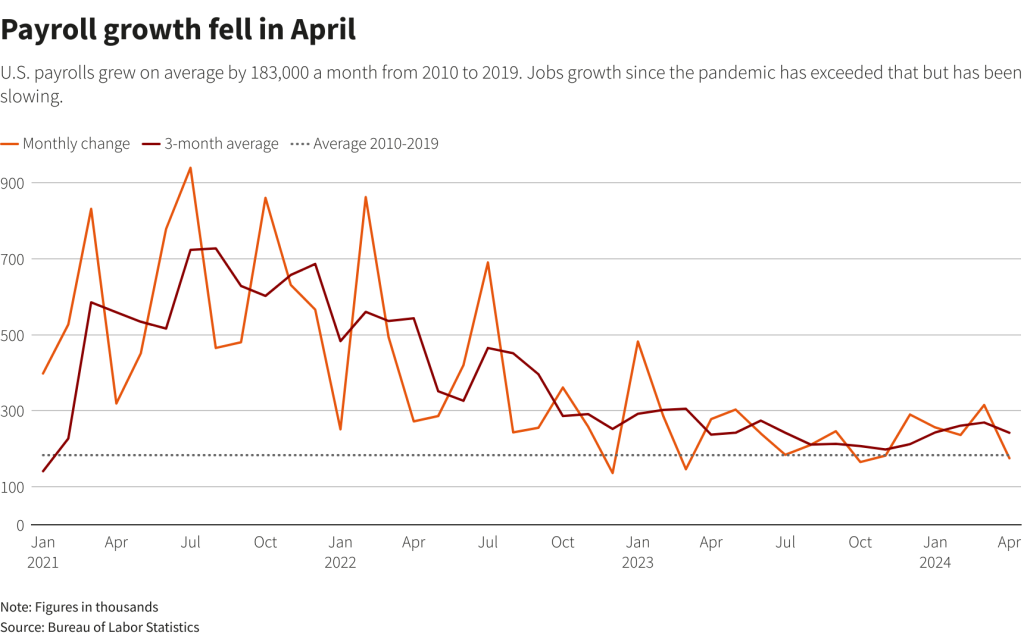

The big test comes on Friday with monthly payrolls figures, but a jobs market reading later today could also deal the dollar a blow in the form of the JOLTS report – a favourite of former Fed Chair Janet Yellen – which is forecast to show job openings sinking to deeper three-year lows.

The big test comes on Friday with monthly payrolls figures, but a jobs market reading later today could also deal the dollar a blow in the form of the JOLTS report – a favourite of former Fed Chair Janet Yellen – which is forecast to show job openings sinking to deeper three-year lows.

Equity markets aren’t sure how to take the news, which on the one hand brings forward potential Federal Reserve rate cuts, but on the other sends a worrying signal about corporate profits.

Not so the bond market, where yields are firmly lower.

From a coin toss a week ago, odds are now 60:40 for a September rate cut, according to the CME Group’s FedWatch Tool.

The next Fed meeting runs from Tuesday to Wednesday of next week, and while it might not bring a policy change, updated economic and rates projections will give fresh fodder for punters.

Of course, the ECB meeting is only two days away, and markets are braced for a hawkish cut. Inflation is flaring up again, making for a murky view of potential policy easing later in the year.

German unemployment is the only euro-zone data of particular note today.

Switzerland, meanwhile, publishes CPI. Inflation is ticking up there too, but economists and traders currently still lean slightly toward a rate cut this month, after the SNB became the first major central bank to kick off an easing cycle earlier this year.

Key developments that could influence markets on Tuesday:

-Germany unemployment (May)

-Switzerland CPI (May)

-US JOLTS job openings (Apr)