A young biologist comes up with a new technology for cell reproduction, an engineer develops a new engine, and a programmer wants to create a new messenger. What do these young people have in common ? Two things: the presence of new promising ideas and the lack of money to implement them. Where do you get the much-needed finance to bring your ideas to life? An investor is required – a person or company willing to take risks and invest their money in the development and implementation of a new product. Such an investor is ready for the fact that his money will fly down the pipe along with an unsuitable idea, but if the idea goes off, the investment will not just pay off, but will bring huge profits.

The social network TikTok , built on a music platform developed by young Chinese people Alex Zhu and Liu Yang, also developed through venture capital investments. The founders are now millionaires, and TikTok owner Zhangh Yiming is on the Forbes list with a fortune of over 16 billion . dollars.

In terms of potential earnings, direct venture capital investments are unrivaled. Investing in a promising company at the startup stage allows you to reach a profitability of hundreds / thousands of percent in 5-10 years.

In 2019, venture capital exceeded $ 100 billion in the United States alone , so this area is popular despite the increased risk.

Investors willing to risk their money and invest it in new startups are engaged in venture capital investments.

Below is an explanation of what venture funds are, a description of the essence and processes of work.

What are Venture Funds (in simple terms)

Venture funds (from the English venture – risky, adventurous) are investment funds that invest in young companies characterized by high risks (from 50%) and possible high profits.

Venture investments in simple words are investments in promising ideas at the initial stage of their implementation, at the start-up stage.

The investor deliberately takes an increased risk, hoping to compensate for this with income that is several times higher than the return on standard investments in first-tier securities.

The potential of such investments is shown by examples of ” garage ” startups – Google , Microsoft , Amazon , Apple . They became industry leaders and evolved from small but promising companies to industry leaders. Some have trillions of capitalization.

Venture funds in simple words are companies that invest in a real new and promising business.

This trend originated in the United States in the 70s of the last century. At the end of the 70s, about $ 200 million were invested in venture capital funds; since 2020, the volume of investment has grown to $ 100 + billion.

Venture capital is usually formed in special funds at the expense of private investors. Investments can be made not only in monetary form, but also in the form of advertising services, legal assistance, bookkeeping, and consulting.

With regard to terminology, there is no universally accepted definition.

EVCA ( European Private Equity and Venture Capital Association ) calls this direction investments in private enterprises with significant growth potential at the initial stage of their development. Companies with a relatively low degree of novelty also fall into this category. Investments are allowed at the stages of expansion / development, when

In Britain, the BVCA classifies venture capital funds as long-term. Shares of companies in which money is invested are not listed on stock exchanges.

The American NVCA ( National Venture Capital Association ) considers this direction as a subtype of direct investment. The focus is on companies operating in the IT sector and other promising areas in which the likelihood of becoming an industry leader is higher. Shares of companies must not be traded on exchanges. Unlike direct venture capital investments, start-ups are channeled into a startup even before it enters the active sales phase.

The Russian Venture Investment Association (RAVI) uses a different classification:

- VC (Venture Capital, venture capital) is a direct investment that is carried out during the seed and initial stages of the project;

- PE (Private Equity) is direct investment at the subsequent stages of project development. Their size is not limited.

Venture funding for startups has become a natural result of the globalization of the world economy. The main source of venture capital is pension and insurance funds, banks, institutional investors, and individual companies.

The share of ordinary investors with small capital is relatively small.

Venture investors are:

- Individuals;

- Legal entities;

- Commercial banks;

- Venture funds.

The latter is an investment fund whose goal is to find promising startups and work with them.

Investors can get a share of the profit in the form of shares of the company, and not in monetary terms, so they are interested in the development of the company. The profit of a venture investor is the difference between the purchase price of shares and their sale, and the invested capital is called a venture capital.

In simple terms, venture capital investments are investments in a new business with high potential, but also high risks. Typically, companies are startups and companies that develop innovative technologies. Unlike business angels, venture capital funds can allocate money under relatively unfavorable terms, but with large capital and other resources.

Venture Investment Fundamentals

The statistics will not be in favor of the investor . If out of 10 attachments 1 direction works out, this is normal. You need moral readiness for a series of losses of invested funds.

It’s easier to enter a venture deal than to exit . At the time of purchase of shares, they are not traded on the exchange and it is impossible to sell securities at any time. You will either have to wait for the IPO or count on the sale of shares to a large investor. OTC trades are real in theory, but large volumes are difficult to sell.

Most venture capital funds operate at a loss or low return . Wealthfront research shows that the top 20 funds account for about 95% of all profits in this area.

Venture funds focus mainly on institutional investors, but this does not mean that the path is closed for ordinary investors. Anyone can invest in startups; this does not require millions of dollars and specialized education.

Ideas that are being implemented in new directions have the greatest potential. When working with startups, it is advisable to take into account the dominant technological order. For example, there are already leaders in IT, and it is almost impossible to take their place. At the same time, with the transition to the 6th technological paradigm, the sector of nano- and biotechnology acquires great importance.

In these areas, the chances of success are higher, a conditional ” garage ” startup in 5-10 years can turn into an analogue of the same Apple, but in the field of bio- or nanotechnology. Investments, for example, in a newly opened cafe do not belong to venture capital, it is an ordinary business project, the probability of its sharp growth and becoming an industry leader is practically zero.

The venture capital market is dynamic. A change of priorities is a normal phenomenon, in fact, the world has already entered the 6th technological order, so the role of bio- and nanotechnology will increase in the future.

- Venture capital is a long-term investment with an investment period of 3 years or more, usually 5-7 years. Sometimes the development stage of an innovative project can take several years;

- The payback period is long, from 5 years and more;

- The amount of investments is significant, usually the entry threshold starts from 20-50 thousand dollars and can reach several million;

- Prediction of the project result tends to zero .

An investor who wants to invest in only one startup is called a venture capitalist. He needs to exercise full control over the activities of the company, so the investor can insist on his appointment as CEO or joining the board of directors.

How much can you earn from venture capital funds?

The above is the example of Peter Thiel, who increased his initial investment 2000 times in 8 years.

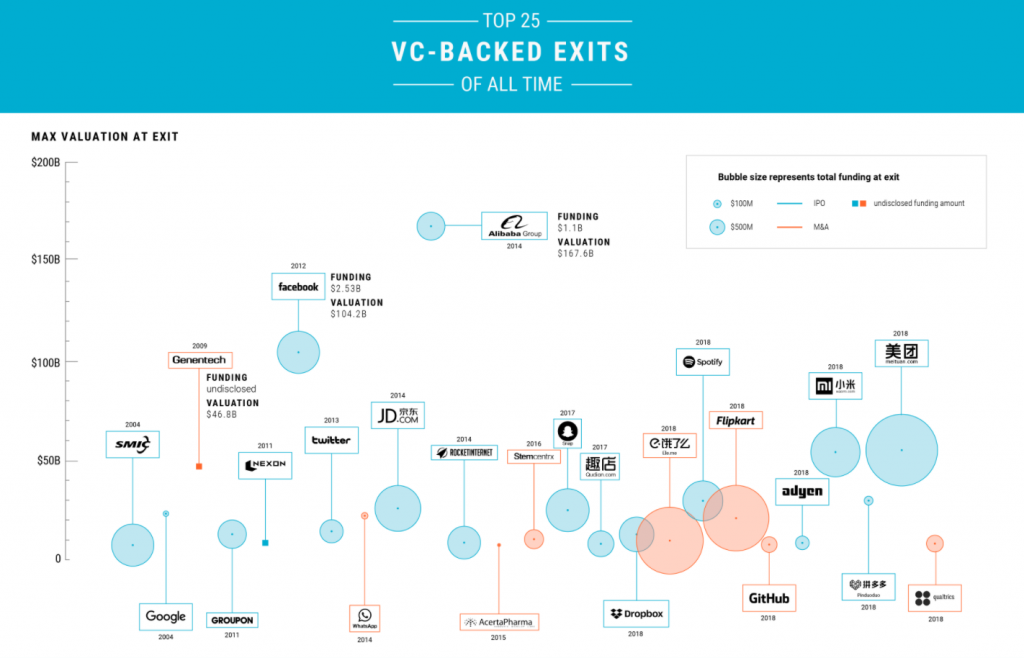

The figures for the income brought by successful projects to their investors are impressive.

On the example of the social network Twitter, it can be seen that the initial investment amounted to $ 5 million, and the profit reached $ 15 billion.

- WhatsApp . Sequoia was the sole investor, with a total of $ 60 million invested in the first rounds, giving Sequoia an 18% stake in the business. WhatsApp was later acquired by Facebook for $ 22 billion. Sequoia received $ 3.96 billion and increased it 66 times.

- Groupon . One of the illustrative examples of exponential growth in invested capital. At the start of the project, Eric Lefkofsky invested a million in it, after the IPO his share was estimated at $ 3.6 billion. In the rounds before the IPO, he sold his shares for $ 386 million, while spending only $ 546 on their purchase. Eric Lefkowski literally turned hundreds of dollars into hundreds of millions and later billions of dollars.

- Inc Snap . The history of this company is an example of the excellent work of a venture fund. Benchmark Capital Partners specialists invested about $ 8 million, later this amount increased to $ 2 + billion.

Do not think that all these initial investments were made by hand, they were made through funds to preserve all the legal aspects, as well as to take advantage of more convenient tax policy terms when making a profit.

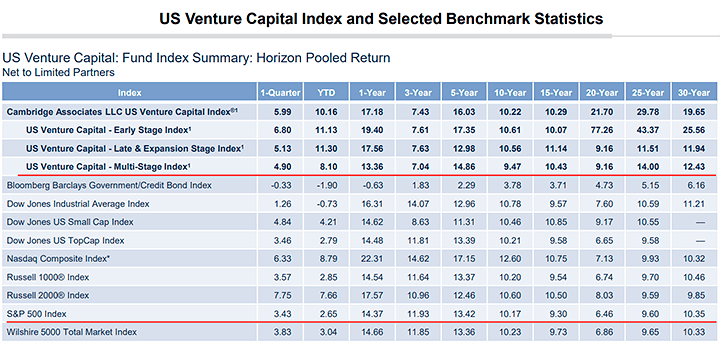

There are dozens of such examples, but on average, the profitability of venture capital funds surpasses the classical stock market in terms of profitability. At a distance of 25-30 years, yields outperform the S&P 500 by 2-3%, this gap persists over time.

When investing in portfolio, it is worth focusing on this yield. Out of a dozen projects, 1-2 will be successful, but a loss will be recorded for the rest, because of this, the final profitability will be lower.

According to CrunchBase , an online database that keeps track of investors in IT startups , on average, each promising startup can attract about $ 25 million, and after its shares go public, the company’s capitalization reaches $ 180-200 million. The profit is calculated in hundreds and thousands of percent.

Investment methods

The simplest way will be to independently search for promising startups in the industry that is of interest to the investor – from writing a new music album to creating a nanorobot.

Experienced investors prefer to invest through venture capital funds. The disadvantage will be a high entry threshold – from $ 20,000 per check.

There are fundamentally different ways to invest in promising ideas:

- Direct access to the author of the idea / management of the young company, not only financing the project, but also directly participating in the development. In this scenario, the investor becomes a business angel, has personal experience in the field in which the startup that interests him is working. This path is inaccessible to most ordinary investors – they need a large start-up capital, we are talking about millions of dollars.

- Venture investment funds . The method is more convenient compared to the previous one, the investor only needs to invest money in the fund, his employees will do the rest. The disadvantage of this direction is a high entrance threshold, sometimes there are other filters, up to a personal interview with a person who wants to participate in it. Fund employees take a commission for the selection of projects, portfolio management.

- Investor clubs . As in the case of foundations, the task of selecting promising startups falls on the shoulders of the club; all that is required from its members is to deposit money. The entry threshold can be reduced compared to funds.

- Crowdinvesting services . Through such platforms, you can invest small capital in a lot of projects. The minimum contribution can start from $ 50- $ 100 depending on the platform. After the successful implementation of the project, investors receive either a refund with the corresponding percentage of income, a share of the startup’s income, and a direct share in the company after its reorganization into a JSC.

Investments in venture projects can be implemented in any of the following ways. The choice depends on the start-up capital and experience in this area.

If an investor plans to concentrate on several projects working in an industry familiar to him and has a multimillion-dollar capital, it is more profitable to become a business angel. An ordinary investor chooses crowdinvesting services or venture funds.

Differences between Venture Investments and Traditional Investments

Investments with increased risk differ from traditional ones not only in the accepted risk. A number of fundamental differences stand out:

- Availability of information . For companies of the 1st and 2nd echelons, a lot of statistics are calculated, quarterly reports are published, information and analytical services provide not only current production indicators, but also forecast them in the future. The business has already taken place, there is a basis for analyzing and predicting future results. Startups are much more difficult to analyze, there is only an idea and initial steps in an attempt to implement it. It is not known how things will develop in the future; there is no data on such companies in the information and analytical services.

- Reliability and predictability of results . Venture capital investments are unstable, investing, for example, in blue-chip stocks, the probability of losing money is relatively small. A startup does not provide such reliability, even a promising idea may remain at the initial stage of implementation. Statistics show that about 20% of startups close in a year, 50% in 5 years, and 70% in 10 years. It is difficult to predict which of the projects will be successful. A good example is Sprig , a startup envisioned super-fast food delivery, but despite raised $ 57 million in funding, it never grew into a stable business.

- The method of making a deal . Securities of startups are not traded on the stock exchange; you have to resort to the services of venture funds or interact with the project management yourself.

- Participation in the life of the company . An ordinary investor in, for example, Intel does not influence the IT giant’s policy in any way, although formally it is its shareholder. In the case of a start-up, an investor can determine the policy of the project and help it develop.

- Venture investors tend to be more cooperative .

- Shorter investment cycles . Most startups are forced to conduct investment rounds in order to attract additional funds for development. They do not yet have financial stability and stock of their own funds. At the initial stage of development, work can be carried out at a loss.

- Great flexibility . For startups, a change in strategy is the norm; for large companies, frequent changes in priorities are a sign of instability.

Of the above, the key ones are income potential and risks.

Also read: Forex Trading Guide 2021: JMA System trading

Advantages and Disadvantages of Venture Funds

The strengths of this area include :

- Potentially several times higher profitability compared to classic short-distance investment.

- For owners of capital from several million dollars – an opportunity not only to invest, but also to take part in the management of a startup.

- Moral satisfaction. Successful venture capital investments give a sense of being at the forefront of progress, which is important to some.

There were also some drawbacks :

- The risk of losing the invested funds is high. If when investing, for example, in blue chips, the probability of losing 90-100% of investments is practically zero, then in startups this is a real scenario. In a 10-year time period, about 70% of projects leave the race.

- High entrance threshold.

- The complexity of analyzing startups. These are young projects, information and analytical services do not provide detailed information on them, there is also little reporting.

- Possible changes in legislation.

All of these disadvantages cannot be called cosmetic, but the potentially unlimited profit covers them with a large margin. This is what investors are willing to risk large sums of money for.

There are pros and cons for a startup as well .

Among the pluses :

- The ability to attract the necessary funds if you cannot get a loan;

- You do not need to provide collateral or draw up many documents;

- You do not need to pay interest for using the money;

- If necessary, you can attract additional investments;

- You will not have to return the money spent in the event of a project failure.

The cons are :

- Difficulty finding depositors;

- The need to admit the investor to control the company;

- You will need to give the investor part of the company;

- The risk of losing funding if the investor decides to abandon the project for any reason.

There are more advantages for a new startup, because otherwise the project is unlikely to be implemented.

Interesting Facts

According to the well-known Russian venture capitalist Igor Ryabenky ,

“The plus of sole investing is that whatever you earn is yours. However, like everything that you lose. “

This is true, as 92% of startups that are launched stop operating within the first three years of their life. Half of those who stayed will not last five years. Two out of three online startups are not scaling themselves.

Despite this, in the USA the volume of the venture capital market is about $ 30 billion per year.

Chinese startup Alibaba is the most successful in the world so far. Its founder is Chinese teacher Jack Ma , who created a $ 60,000 company that his friends invested in. In 2019, the company’s profit amounted to almost $ 20 billion .

Below are interesting facts that an investor rarely thinks about when thinking about investing in startups:

- More than half of venture capital investments end in failure.

- Multinational corporations are destroying the venture capital sector. The reason lies in the staff; it is easy for large companies to lure talented and creative people. Not everyone is willing to take the risk of investing all of themselves in a startup with a vague prospect of future success.

- The exit is thought out immediately after entering. This is how funds operate, if this rule is not followed, then the investment fund will be left with a line of startups and without money, it will be forced to urgently sell them at a discount.

- The ideal startup scenario is a takeover by another major player. At this point, venture capital funds come out.

- A KellogInsight study found that a 40-year-old startup author is twice as likely to succeed as a 25-year-old.

- One of the main reasons for project failure is lack of demand and poor management.

Conclusion

If we consider the question of what venture funds mean from the point of view of an investor, then this is a chance to get thousands of percent of profit with the risk of losing 100% of the invested amount. The ratio of potential income and loss still exceeds 1 to 1, which makes venture capital investment attractive. For startup authors, this is a chance to get money for the implementation of their idea.

One of the main constraining factors for the rapid development of this area is the complexity of investment in comparison with classical investments in stocks of the 1st and 2nd echelons.

If the shares of companies can be bought on the stock exchange, then the question of how to become a venture investor is resolved through the appropriate funds on an individual basis. The option with crowdinvesting platforms partially solves this problem, but the problem of choosing startups does not go away.

Venture investing will never be as widespread as the classic purchase of securities. But this does not mean that it will disappear, there will always be those willing to risk a million in an attempt to earn billions.