There is one investment trick that allows you to increase your income several times – it is to place a deposit at compound interest.

In 1791, Benjamin Franklin bequeathed a compounding bank deposit of $ 5,000 to fund public works to two cities that mattered to him – Philadelphia and Boston. Under the terms of the deposit, money could be withdrawn only 2 times, after 100 and 200 years. A century later, cities withdrew $ 500,000 from the account for public works, and in 1991 the payment was $ 20,000,000 .

One of America’s richest men, Baron Rothschild, has named compound interest the eighth wonder of the world for its ability to make money out of thin air. Warren Buffett said that the secret of his wealth, in addition to living in the United States and good genes, is to use the effect of compound interest.

The magic of compound interest is available to absolutely everyone, not just millionaires. And how to use the compound interest formula and in which investments it works most effectively, you will learn below.

Compound interest is the calculation of the return on an ever-growing capital. Compound interest is interest on a deposit (or otherwise invested), taking into account both your original amount and interest accrued over previous periods. The income received for the period is not deducted from the asset, but is included in the amount of fixed capital and participates in the further calculation of profitability.

If we give a definition in more understandable words, then compound interest is a “snowball” that allows you to increase your capital without additional efforts. Income brings new income, an order of magnitude higher than the previous one.

Compound interest, in simple words, is a way to increase income at times. The world’s financial tycoons have earned their first millions on this very principle.

The essence of the Compound interest is that the first year when you invest money, you receive a certain income, but you do not take it for yourself, but add to the funds already invested. Accordingly, in the second year, although the percentage remained the same, the amount of income is higher, since the base for calculating income has increased. In the third year, the amount of income received is even greater, and so on.

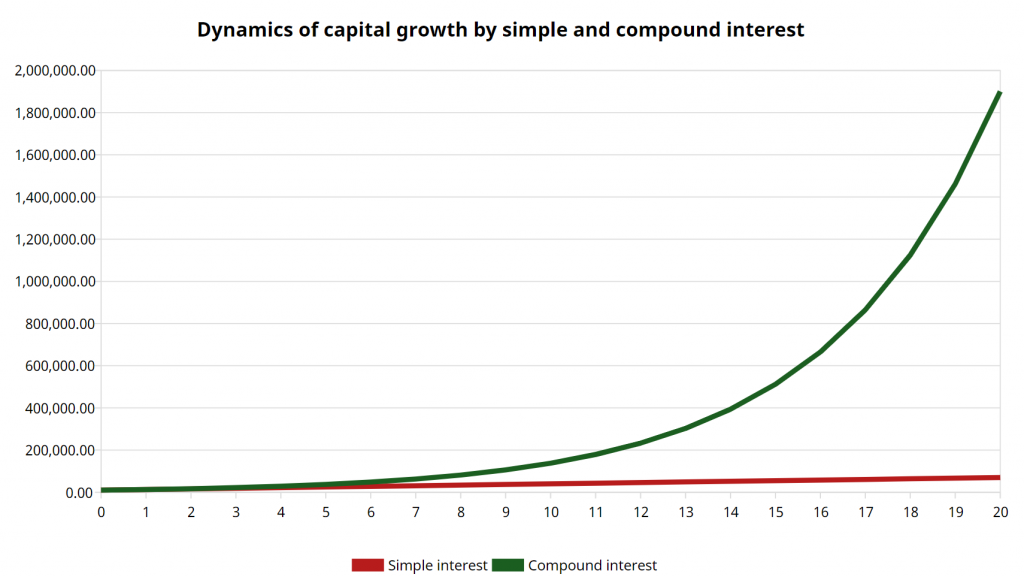

In 24 years at simple interest, your capital will be $ 17,400 , versus $ 242,907 when using compound interest. At the same time, the profitability in the first option remained at the level of $ 600 , while in the second it reached $ 48,581 .

With higher investments or percentage of profitability, these numbers grow exponentially.

Compound interest works and gives an incredible effect precisely on long-term investments. The larger the amount invested and the longer the deposit period, the more income you will receive in the final.

Long-term compounding is ideal for creating passive income in retirement, or for setting aside and multiplying funds for children’s education in the long run.

How compound interest works in investments

In order not to write unnecessary sentences, this graph clearly shows how simple and compound interest work. Below we will look at individual examples for different investment options in different markets, but for now let’s talk about calculation methods and you can download a file with ready-made formulas.

How to calculate compound interest

A wonderful property of compound interest is its ability to work in various types of investments: from simple bank deposits to stocks, bonds and investment portfolios.

If you decide to invest your funds for a long time and have already decided on the amount of initial capital, then before choosing where to invest funds at compound interest, calculate the profitability for different options.

Several key factors need to be considered when calculating compound interest:

- % rate;

- Investment amount (start-up capital);

- Period / frequency of charges (daily, quarterly, once a year, etc.);

- Time interval – the period during which money works;

- Capitalization, add. investment or withdrawal of interest.

Firstly, you can independently create a table in Excel with your data, using the following formula for calculating compound interest to calculate interest:

B = A * (1 + P / 100%) n

Where:

- B – the expected amount

- A – the initial investment amount.

- Р – interest rate for a specific investment period.

- n is the number of settlement periods.

Or you can use a special function in Excel – Future Value (FV):

FV (% rate, nper, pmt, [pv], [type])

- FV – financial result;

- Rate;

- nper – the period during which% will be accrued;

- pmt – add. attachments;

- pv is the present value. Removing this indicator means that it is 0.

- type – 0 is indicated if payment is at the end, 1 – at the beginning of the period.

But the easiest way is to download an example already with substituted functions in Excel, which I prepared.

There is another interesting way to quickly estimate the payback period using compound interest, which is used by experienced investors – this is the “Rule of 72”. It shows when the initial capital will double with a known return, for this you need to divide 72 by the percentage of return.

For example : How long will it take to double the contribution of 10,000 rubles. with a percentage of income equal to 6?

72/6 = 12

That is, in 12 years, with a yield of 6%, we will have 20,000 rubles on our account.

But it should be taken into account that this method does not take into account the effects of inflation and taxes, so the value is relative.

Now that we know how to calculate compound interest under different initial conditions, let’s see how it works in different types of investments.

Bank deposits

Throughout the article, there was a comparison with a bank deposit. First, this is a more illustrative example. Secondly, it is more understandable for the common man.

Many work with banks, especially those that place their funds for a short period. But even this period can significantly improve the financial situation of the depositor, if deposits with capitalization are used.

Adding the amount of interest income to the principal amount of the deposit is called capitalization . Depending on the terms of the agreement, capitalization can occur daily, monthly, quarterly or annually.

There is another opportunity to increase the profitability of investments using a bank deposit – to deposit additional funds into the account with a certain frequency.

But, unfortunately, in real conditions, bank deposits are not the best option for increasing funds using compound interest. It is very difficult to find offers for deposits with an interest rate higher than 6%, and given the expected inflation rate in Russia in the region of 3-4%, bank deposits allow you to avoid devaluating your funds to a greater extent, rather than increasing them.

In addition, from January 1, 2021, the law on taxation of income from deposits will come into force, which will also reduce the profitability from using compound interest when investing in bank deposits.

Below we show an example of a more profitable alternative with the same low risk level as banks.

Compound interest in the stock market

Compound interest on the stock market works on an identical principle, but there is still a distinctive feature – this is the absence of the concept of capitalization (as a whole), the capital itself and the percentage of return are floating, there is a fact of capital flow from one securities to another.

But a conservative approach and maximum use of all instruments allows you to create an investment portfolio that brings maximum income. In this process, active trading is not observed, there is constant control over the portfolio.

The owners of large corporations regularly pay dividends to their shareholders. They can be received and spent, or they can be directed to the purchase of other securities, thereby the compound interest formula will begin to work.

Promotions

If bank deposits and bonds have greater investment reliability, but a small percentage of profitability, then stocks bring a much higher income and, accordingly, compound interest will work more efficiently, but this is a more risky investment option.

How compound interest works in shares – they received income (dividends) and purchased more shares on them, and so on. If in bonds we rely mainly on coupon income, then on shares you can still earn money on rising prices. This means that it is more expedient to buy for dividends not only the original shares, but also those that show steady growth.

Many experienced investors prefer to invest their initial capital in shares of stable companies with moderate profitability, and reinvest in more risky stocks with high returns, this will help to strike a balance between preserving capital assets and earning income.

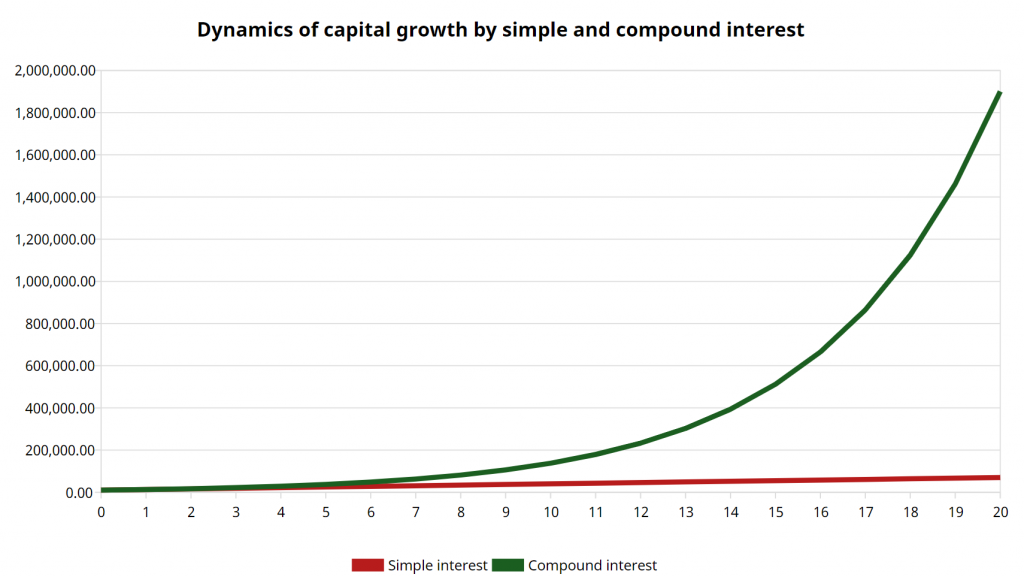

This graph shows the compound interest curve. As in the examples above, the longer the period, the faster and more noticeably capital and profit grows.

There is another way to increase profits – compound interest with replenishment of initial capital. From the example above, where we invested $ 3000 at an average stock market return of 20% per year, we will add a condition under which we will additionally replenish our account by $ 100 every month:

| Year | Total amount |

|---|---|

| one | 3600 |

| 2 | 5520 |

| 3 | 7824 |

| four | 10589 |

| five | 13907 |

| 6 | 17888 |

| 7 | 22665 |

| 8 | 28399 |

| 9 | 35278 |

| ten | 43534 |

| eleven | 53441 |

| 12 | 65329 |

| thirteen | 79595 |

| 14 | 96713 |

| 15 | 117256 |

| 16 | 141907 |

| 17 | 171489 |

| eighteen | 206987 |

| 19 | 249584 |

| 20 | 300701 |

| 21 | 362041 |

| 22 | 435649 |

| 23 | 523979 |

| 24 | 629975 |

| 25 | 757170 |

For all the time, $ 33,600 was invested , and as a result, capital was formed for $ 757,170 with an annual return of $ 151,434 .

This example shows how compound interest works in stocks over the long term.

There are two main ways to get a return on your investment. First, the rise in prices for purchased shares, which in the future can be sold and receive an order of magnitude more funds (taking into account the initial investment). Secondly, dividends (this is a part of the net profit that the owners of firms / companies distribute among their investors). They are paid annually.

It is also better to buy shares of dividend aristocrats , who pay dividends consistently and constantly increase them.

Compared to a bank deposit, calculating the exact amount of compound interest is much more difficult.

The investment scheme using compound interest is quite simple: buying shares of a chosen company – receiving dividends – buying new shares (these can be securities of this company or another, everyone makes a decision independently). New shares also bring in their income, which are also sent to work. The process can be endless or continue as long as the level of annual income will fully satisfy the investor.

By themselves, dividends can be a good source of additional interest. Suppose you bought 100 thousand rubles of shares in a company that pays 5% dividends annually. After 10 years, the amount of investment will increase by 63 thousand, in 20 years – 165 thousand and 332 thousand in three decades, not to mention the possible growth in the value of the shares themselves.

Bonds

This is a good alternative to bank deposits, since the level of risk here is comparable to that of a bank when we talk about government securities.

Bonds are also similar to a bank deposit with a fixed amount of annual income, it is charged daily, and coupon payments can be paid once a quarter, six months or a year. If we use the received income to buy new bonds – we reinvest the income , then the compound interest mechanism is involved.

A larger number of bonds will give a higher coupon yield, every year the cumulative effect will only grow and by the time the bonds mature, you can become the owner of a solid capital.

The main rule when investing in bonds and then reinvesting income is to give them time to work. Take an example from Warren Buffett – he never bought securities for less than 10 years.

Despite the similarity, bonds have the main advantage over bank deposits – they have a higher yield. It is better to give preference to reliable federal loan bonds or securities of large companies. The yield on government bonds is about 5.15 – 6.70%, and the yield on corporate bonds can go up to 13%.

Let’s calculate the dividend yield on bonds, subject to reinvestment of income in the same shares. For the purity of the experiment, we will consider the cost of bonds at a single price.

We take federal loan bonds OFZ-PD 26233 with maturity in 15 years. Coupon income is paid twice a year in the total amount of 60.82 rubles. The cost of one bond is 991.40 rubles. Initial investments – 20 bonds in the amount of 19,828 rubles.

Let us even take only 6 years : If we simply took coupon payments for 6 years and did not invest them in the purchase of new bonds, our income would be 7298.4 rubles (20 bonds * 60.82 rubles * 6 years). And with reinvestment, the income for 6 years already amounts to 11,002.65 rubles. The maturity of bonds is 15 years – over time, compounding will be even more significant.

You can independently calculate the effective yield of the bond to maturity (YTM) – it just takes into account the reinvestment of coupons at the same yield throughout the entire time to maturity.

Useful Tips

Money in a safe or under a pillow will never make a person more successful and richer. Money should work – this opinion is shared by all the world’s financiers, investors, bankers and businessmen. It’s time to think about this question. A few tips to help you decide.

- It is necessary to analyze all the options and choose the most suitable one: buying stocks, bonds, opening a bank deposit, etc.

- Check the financial condition of the company, the shares of which are planned to be acquired, what% are paid, the regularity, the growth of their value for a certain period. If it is a bank, then it is worth checking whether it is a member of the guarantee fund, what amount is subject to return, if force majeure occurs, the presence / absence of deposits with capitalization.

- Consider different investment opportunities, be it PAMM accounts, securities, aggressive or conservative ways.

- Use compound interest. The examples above clearly show the difference in income.

The main thing about compound interest

The choice of an investment instrument will depend on the initial investment amount and the investor’s objectives. With a small start-up capital and a desire to minimize risks with a low profitability, you should choose a bank deposit or purchase of bonds.

If you are not afraid to take risks and want the maximum return on compound interest, then you should try your hand at the stock market.

If funds are sufficient, a reasonable approach would be to invest in various instruments: deposits and bonds will reduce the risk of losing funds, and stocks will give high returns.

Don’t forget about diversification – work with investment portfolios and choose ETF funds that reinvest your dividends themselves.

Albert Einstein said:

“Compound interest is the eighth wonder of the world, those who understand it earn, those who do not pay for it.”

Compound interest is a kind of “magic wand” that allows even modest savings to multiply. The only condition is time. It is impossible to become a millionaire in a month or a year. The minimum period when you can see the result of compound interest is about 10 years. Benefit from the experience of professionals.