While technology giants such as Apple, Microsoft or Amazon are omnipresent in the (financial) media, there are others that are comparatively little reported. And that, although business is also going brilliantly and the corresponding shares have given investors a lot of pleasure over the years.

Strong sales growth

A nice example of this is Adobe (WKN: 871981 / ISIN: US00724F1012). The US group, which is known worldwide for its programs such as the PDF file reader “Adobe Reader”, the media player “Adobe Flash Player”, the photo editing software “Adobe Photoshop” or the typesetting and text Layout program “Adobe InDesign” has been growing rapidly for many years. In the past few years, revenues have increased by an average of 21 percent annually (2019/2020: 12.9 billion US dollars).

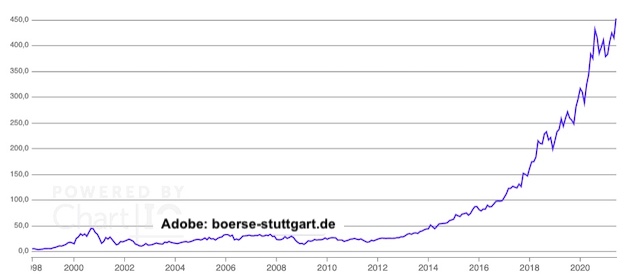

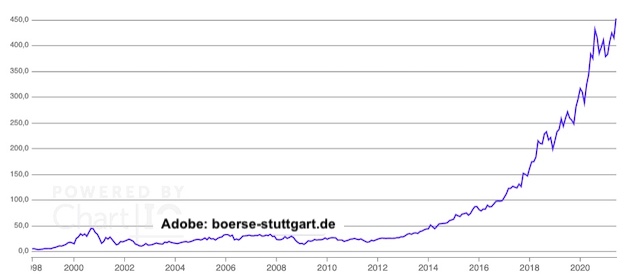

In 2013, Adobe switched to a subscription model. This ensured very steady and strong sales growth in the years that followed. Since then, Adobe shares have only known the way up.

Subscription model is the secret of success

In recent company history, the key to success has proven to be the change in strategy from pure software sales to subscription models. The Californian company switched to a subscription model in 2013.

As a result, Adobe was able to record strong sales growth and gradually increase profitability. Today, recurring sales make up over 90 percent of total revenue, which has greatly improved predictability and predictability at Adobe.

Focus on business figures: the analysts are very optimistic

Investors are currently eagerly awaiting the latest figures for the second fiscal quarter 2020/2021 (as of the end of May 2021), which Adobe will announce on June 17 after the US market closes. According to the analysts’ estimates, the group is likely to have continued on its growth path.

For the second fiscal quarter, industry experts expect annual sales to rise by 19 percent to an average of US $ 3.7 billion. Earnings per share should average $ 2.81, down from $ 2.28 per share in the same period last year.

Share profit: plus 34 percent per year

If Adobe can convince once again with its latest business figures, the share listed in the S&P 500 and the Nasdaq 100 should continue to rise. Over a ten-year perspective, the price increased by an average of 34 percent per year.

New record highs were recently set in mid-June at over 460 euros at times (currently: 453 euros). In terms of chart technology, the railway is thus free of upward price resistance, so that the further milestones are set at the next round marks at 500 and 600 euros.

Also Read:

- Tesla will accept Bitcoin for payment if the cryptocurrency is green

- Bitcoin pumps and MicroStrategy goes on a shopping spree

- Tesla will accept Bitcoin for payment if the cryptocurrency is green

Subscription model ensures high course stability

Although Adobe belongs to the technology sector, the share is characterized by its high price stability. The very steady growth in revenue generated by the subscription model has ensured for years that price drops in the meantime are comparatively moderate and are quickly made up for. Since the switch to the subscription model in 2013, Adobe’s share price has been rising like a string.

Conclusion

The long-term business and stock market performance shows that Adobe is in no way inferior to the big, even better-known tech giants. Because of the very steady development of the share price, the title is also of interest to conservative investors. The Adobe share is therefore a top recommendation from the US technology sector.

Investors who expect the long-term upward trend in Adobe shares to continue, can leverage a long certificate (WKN: MA5VBD / ISIN: DE000MA5VBD0) to benefit from price increases.