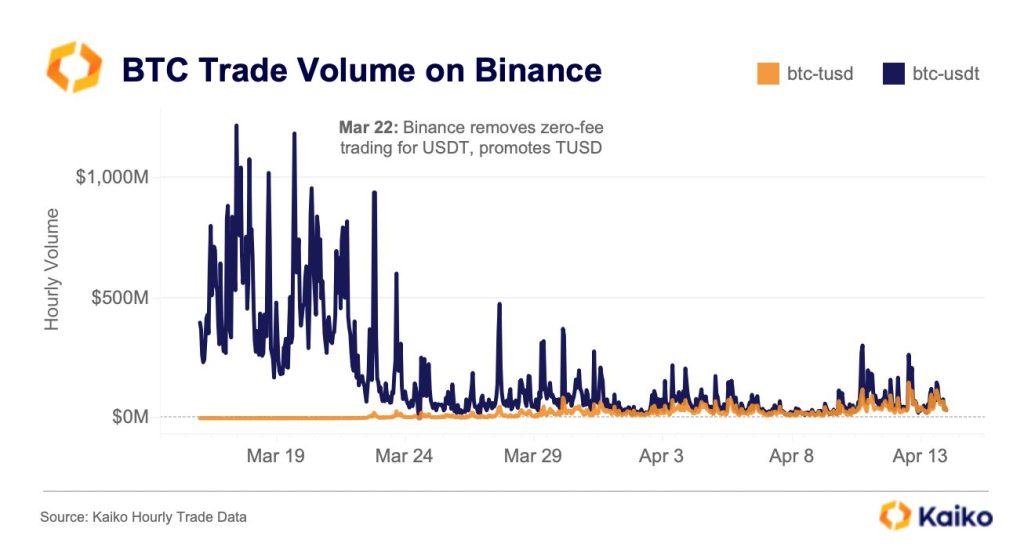

According to Kaiko, TrueUSD’s (TUSD) market share in BTC trading volume on Binance is rapidly increasing and approaching Tether’s USDT due to the exchange’s zero-fee trading discount. However, despite the significant rise to almost 49%, traders still appear hesitant to adopt TUSD, as indicated by larger orders continuing to be placed for the USDT pair. The data further reveals that TUSD’s growth couldn’t offset the rapid decline in the BTC-USDT pair’s trading volume after Tether’s zero fee discount was granted. Kaiko’s head of research, Clara Medalie, commented, “This suggests that traders are still reluctant to use TUSD despite zero fees.”

Binance, the world’s largest cryptocurrency exchange by trading volume, has recently selected TrueUSD (TUSD) as the preferred stablecoin to replace its previously preferred Binance USD (BUSD) stablecoin issued by Paxos Trust. After a six-month pause due to Paxos’ decision to stop publishing BUSD, Binance resumed trading with TUSD and granted a zero-fee trading discount to the BTC-TUSD pair. On March 22, the exchange waived the promotion previously offered for BUSD and USDT.

The stablecoin market, valued at $132 billion, is undergoing significant changes as a result of both regulatory crackdowns and a banking crisis in the United States. In February, the New York Department of Financial Services (NYFDS), the top financial regulator in the state, forced Paxos to stop minting BUSD. BUSD is the third-largest stablecoin with a market capitalization of $16 billion.

Last month, the collapse of Silicon Valley Bank, a reserve partner of the second-largest stablecoin USDC, significantly impacted the market, resulting in more than $10 billion in outflows from USDC. Amid this crisis, Tether’s USDT and TrueUSD (TUSD) have emerged as the clear winners. TUSD has become the fifth-largest stablecoin in the crypto market, with a market capitalization of $2 billion. In comparison, USDT’s circulating supply has increased by $10 billion in recent months and is approaching its all-time high.

Stablecoins are a critical component of the cryptocurrency ecosystem, as they facilitate trading on exchanges and act as a bridge between government-issued fiat money and digital assets. TUSD is a dollar-pegged stablecoin issued by ArchBlock, previously known as TrustToken. Its value is fully backed by fiat assets, as verified by blockchain data provider ChainLink’s proof-of-reserve monitoring tool. In 2020, the intellectual property rights for TUSD were acquired by Techteryx, an Asian conglomerate relatively unknown at the time, according to TrustToken.