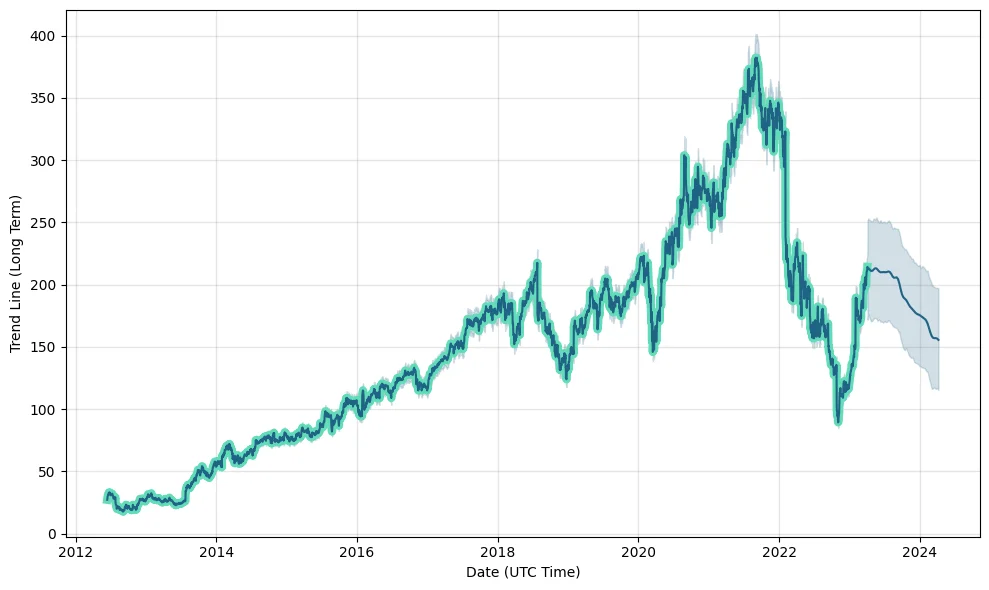

Long-term projections have Meta at $220 by the end of 2023 and $250 by 2024. Meta stock will hit $270 in 2025, $290 in 2027, and $450 in 2030, with further gains expected thereafter.

Meta Platforms Inc. stock is a bad long-term (1-year) investment.

At City Telegraph, we predict future values with technical analysis for a wide selection of stocks like Meta Platforms Inc. If you are looking for stocks with good returns, Meta Platforms Inc. stock can be a bad, high-risk 1-year investment option. Meta Platforms Inc. real-time quote equals 214.720 USD on 2023-04-05, but your current investment may be devalued.

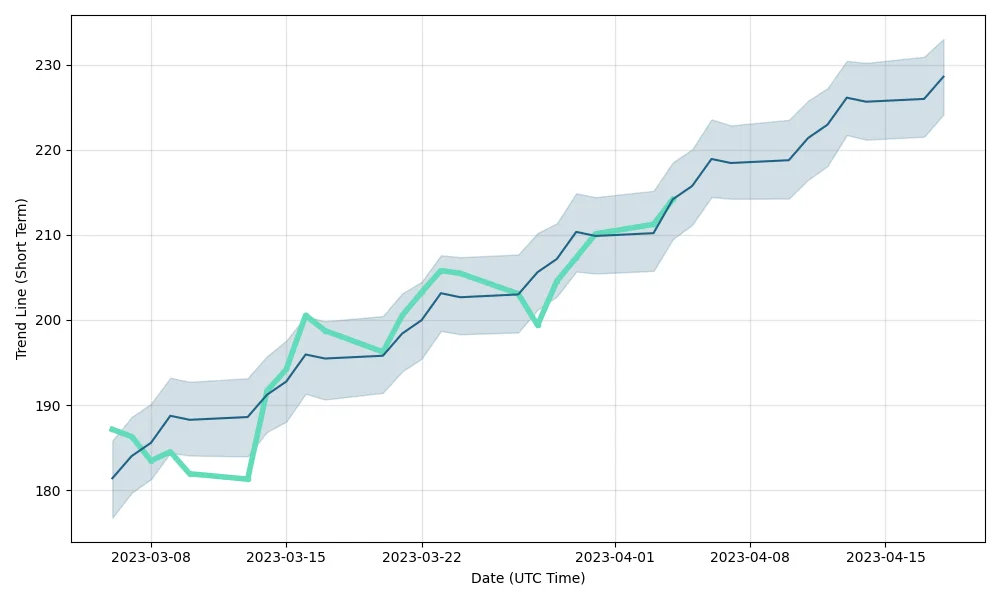

Meta Platforms Stock Chart and Share Price Forecast, Short-Term “META” Stock Prediction for Next Days and Weeks

Meta Platforms Inc. (META) Forecast Chart, Long-Term Predictions for Next Months and Year: 2023, 2024

Technical Analysis of Meta Platforms Inc (Facebook) by City Telegraph using Moving Average (MA) with range 50 and 200.

As per the above chart, it can be clearly seen that on 25 Jan 2023, the MA (50) crossed over MA (200). This means the market has been bullish since the beginning of 2023. This is a Gloden cross, and since then date, i.e., 5 April 2023, the Meta (Facebook) Stock Price has increased by 69.79%. The price at the golden cross, i.e., on the date 25 Jan 2023, was 126$ (approx) (As per Nasdaq), and now at the time of writing, the Meta (Facebook) Stock price is trading at 214$ (approx).

As the RSI (Relative Strength Index) the RSI is a little over 70 (default range), which means the Meta Stock might experience a price drop or correction in the coming days. Overall the market is not bad for Facebook stock in 2023-2024

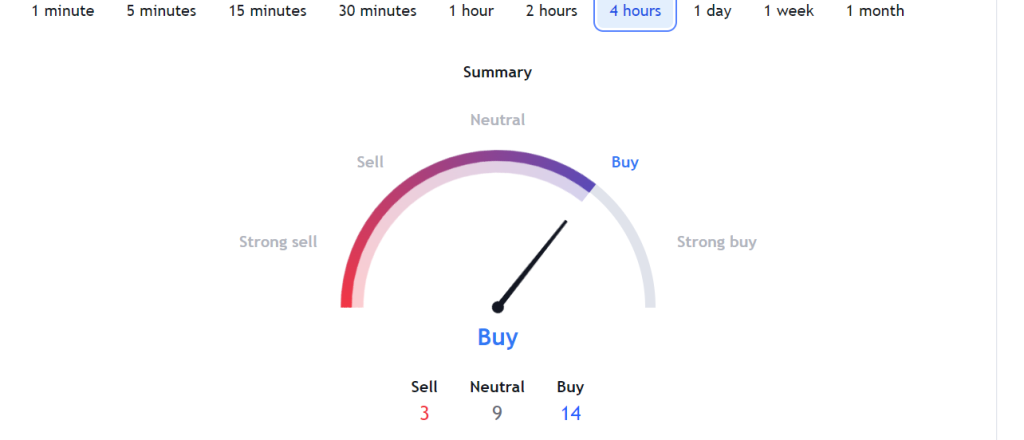

Meta Platforms Inc. (Facebook) stock Price Forecast by TradingView.com

technical Indicators

TradingView.com provides a range of technical indicators and charting tools that can be used to analyze stock price trends and forecast future movements. Common indicators include moving averages, Bollinger Bands, and Relative Strength Index (RSI).

It’s important to note that while technical analysis can be helpful in predicting short-term stock price movements, it may not be as effective in forecasting long-term trends. Additionally, stock prices can be influenced by various factors, including market trends, company performance, and global economic conditions, among others.

Historical data:

Market Cap (Previous Close): 549.48 B

Price in USD (Previous Close): 214.720

Share Volume (Previous Close): 27.45 M

Price in USD (Last): 214.720

52 Week Change: -8.580

90-Day Moving Average: 173.071

Beta: 1.1799

52week High: 236.86

52week Low: 88.09

50-Day Moving Average: 179.5232

200-Day Moving Average: 150.6043

Shares Short: 28684969

Shares Short Prior Month: 27448198

Short Ratio: 0.99

Short Percent: 0.0129

Forecast data:

52 Week High: 213.992

52 Week Low: 155.222

45-Day Moving Average: 212.253

90-Day Moving Average: 211.343

Pivot, Resistance Levels, and Support Levels

For Stop Loss and Trading Targets

Calculation For Trading:

Resistance Level (R3): 217.910

Resistance Level (R2): 216.600

Resistance Level (R1): 215.660

Pivot Point: 214.350

Support Level (S1): 213.410

Support Level (S2): 212.100

Support Level (S3): 211.160

FREQUENTLY ASKED QUESTIONS (FAQs)

Facebook (Meta) is a large and established company with a significant market share in the social media industry. Its value is likely to be influenced by the industry’s performance and broader economic conditions. Over the past few years, Facebook (Meta) has continued to grow its user base, expand into new markets, and diversify its revenue streams through strategic acquisitions and technological innovations. The company is expected to continue investing in new technologies and products, potentially driving growth and increasing its overall value over the next five years. However, various factors can influence stock prices, and any predictions should be made with caution and based on thorough research and analysis. It is recommended to consult with a financial advisor before making any investment decisions.

How much will META be worth in 2025

According to a current stock forecast for Meta, it’s predicted that the value of Meta shares will experience a 2.35% increase and reach $219.58 per share by April 10, 2023. Technical indicators suggest that the current sentiment is Bullish, while the Fear & Greed Index displays a reading of 39 (Fear). Over the past 30 days, the stock has had 20/30 (67%) green days and experienced 7.33% price volatility. Based on this forecast, it may be an excellent time to consider buying Meta stock since it trades 2.30% below the predicted value.

Meta (formerly Facebook) is a dominant player in the social media industry, with a diversified revenue stream and a history of growth and innovation. However, various factors can influence stock prices, including market trends, company performance, and global economic conditions. Therefore, conducting thorough research and analysis is essential before making investment decisions. Investing in stocks for the long term can be beneficial, but having a diversified portfolio and considering individual investment goals and risk tolerance is necessary. Seeking professional advice is always recommended.

According to forecasts, Meta stock is expected to perform well in 2024, with a projected yearly high of $384.046. This peak is anticipated to be the highest point for the store during that year.