Dutch Bros Inc. is a popular drive-thru coffee chain that has experienced significant growth in recent years, with plans for continued expansion. As a result, many investors are interested in the company’s stock and its potential for future growth. In this report, we will provide a forecast and prediction of Dutch Bros’ stock price from 2023 to 2025. We will examine various factors that could impact the stock’s performance, including the company’s financial performance, market trends, and external factors such as economic conditions and industry competition. Our analysis will provide insights into the potential risks and opportunities associated with investing in Dutch Bros, and help investors make informed decisions about whether to buy, hold, or sell the stock.

Dutch Bros Stock Price Prediction For 2023-2025

Based on Dutch Bros’ recent expansion and growth, Citytelegraph anticipates the stock price to be within the range of $30 to $60 in 2023. By 2024, we expect the stock price to rise to around $65 per share, with projections indicating a potential increase to $82 per share in 2025.

The company’s continued expansion and the growing demand for specialty coffee are expected to contribute to this upward trend. It’s important to note, however, that these projections are estimates and are subject to change based on various factors that may impact the market.

Dutch Bros stock is a Good long-term (1-year) investment.

Using technical analysis, we at City Telegraph offer future value predictions for a range of stocks, including Dutch Bros. For investors seeking high-risk, potentially high-return options, Dutch Bros. stock may be a good choice for a 1-year investment. As of April 6th, 2023, Dutch Bros.’s real-time quote is 31.89 USD, but it’s important to note that your current investment may be subject to devaluation.

Technical Analysis of Dutch Bros by City Telegraph using Moving Average (MA) with range 50 and 200.

Based on the above chart, it is evident that the MA (50) surpassed MA (200) on Monday, March 20th, 2023, indicating a bullish market trend since the beginning of the year. This is referred to as a Death Cross, and since that date, which was 16 days ago on April 6th, 2023, the Dutch Bros Stock Price has increased by approximately 5%. The stock price at the time of the Death Cross was around 29.48$ (as per Nasdaq), and as of now, it is trading at approximately 31.89$.

However, the RSI (Relative Strength Index) currently indicates a value slightly below 70, which is the default range. This suggests that there may be a potential price drop or correction in the near future. Overall, the market looks good for Dutch Bros stock in 2023-2024.

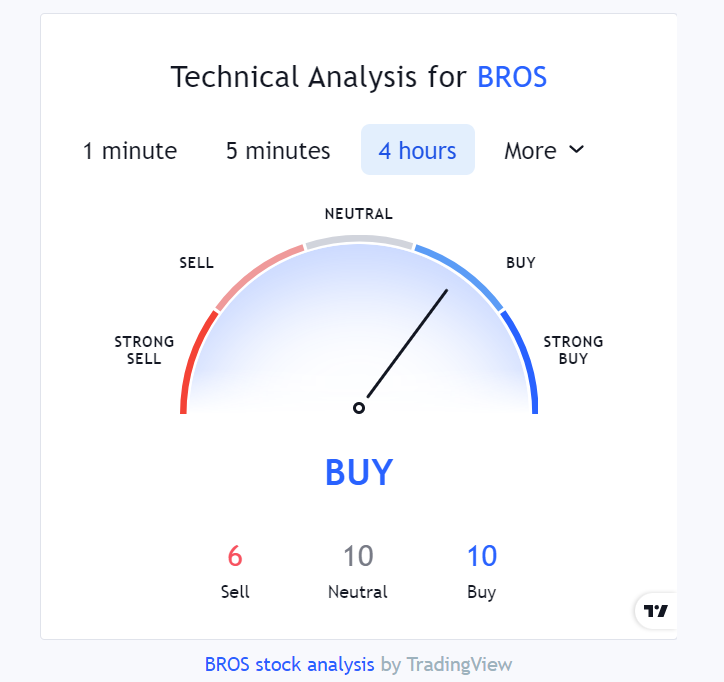

Dutch Bros stock Price Forecast by TradingView.com

Technical Indicators

TradingView.com provides a range of technical indicators and charting tools that can be used to analyze stock price trends and forecast future movements. Common indicators include moving averages, Bollinger Bands, and Relative Strength Index (RSI).

It’s important to note that while technical analysis can be helpful in predicting short-term stock price movements, it may not be as effective in forecasting long-term trends. Additionally, stock prices can be influenced by various factors, including market trends, company performance, and global economic conditions, among others.

According to the 12-month price forecasts provided by 10 analysts for Dutch Bros Inc, the median target is 37.50, with a high estimate of 53.00 and a low estimate of 32.00. The median estimate indicates a 16.42% increase from the previous price of 32.21.

Dutch Bros has been given a Buy consensus rating, based on an average rating score of 2.50, derived from 5 buy ratings, 5 hold ratings, and no sell ratings.

17 stock analysts have provided a 12-month price forecast for Dutch Bros stock, with an average prediction of $39.68, indicating a 25.29% increase. The highest target is $55.65, while the lowest is $32.32. On average, analysts have rated Dutch Bros stock as a Buy.