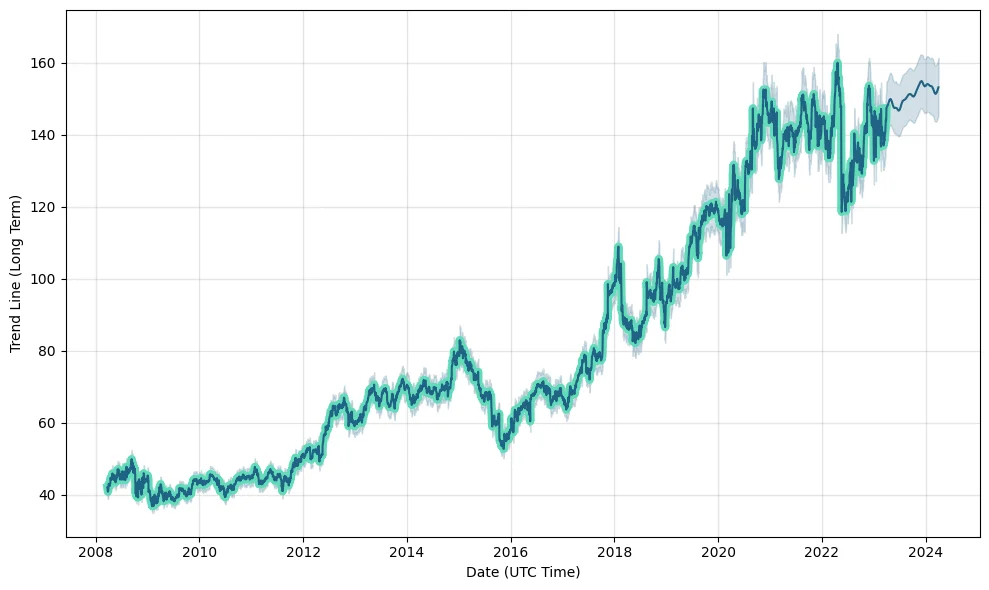

According to long-term projections, Walmart’s stock is predicted to reach $155 by the end of 2023 and $227 by 2024. The stock is then anticipated to climb to $347.30 in 2025, $643 in 2027, and $766 in 2028, with even more growth expected beyond that.

Walmart stock is a bad long-term (1-year) investment.

At City Telegraph, we predict future values with technical analysis for a wide selection of stocks like Walmart. Walmart stock can be a reasonable, low -risk 1-year investment option if you are looking for stocks with good returns. Walmart’s real-time quote equals 150.80 USD on 2023-04-08, but your current investment may be devalued.

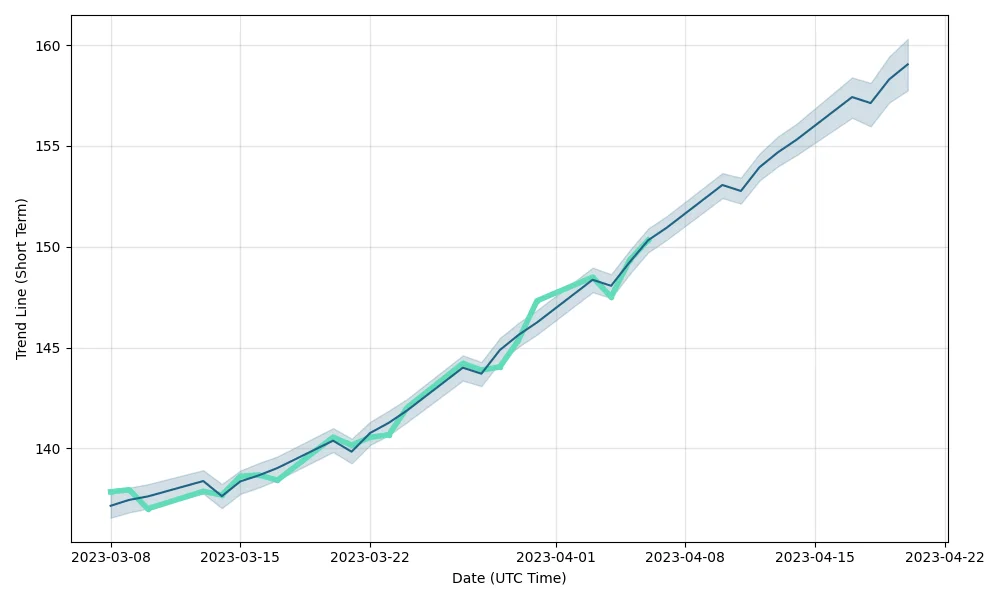

Meta Platforms Stock Chart and Share Price Forecast, Short-Term “Walmart” Stock Prediction for Next Days and Weeks

WMT Forecast Chart, Long-Term Predictions for Next Months and Year: 2023, 2024

Technical Analysis of WMT by City Telegraph using Moving Average (MA) with range 50 and 200.

As per the above chart, it can be clearly seen that on 02 Mar 2023, the MA (50) crossed down MA (200). This means the market has been bearish. This is a Death cross, and since then date, i.e., 8 April 2023, the Walmart Stock Price has Decreased but now Walmart’s stock price is Recovering. The price at the Death Cross, i.e., on the date 02 Mar 2023, was 142 (approx) (As per Nasdaq), and now at the time of writing, the WMT Stock price is trading at 150$ (approx).

As the RSI (Relative Strength Index) the RSI is a little over 70 (default range), which means the WMT Stock might experience a price drop or correction in the coming days. Overall the market is not bad for Walmart stock in 2023-2024.

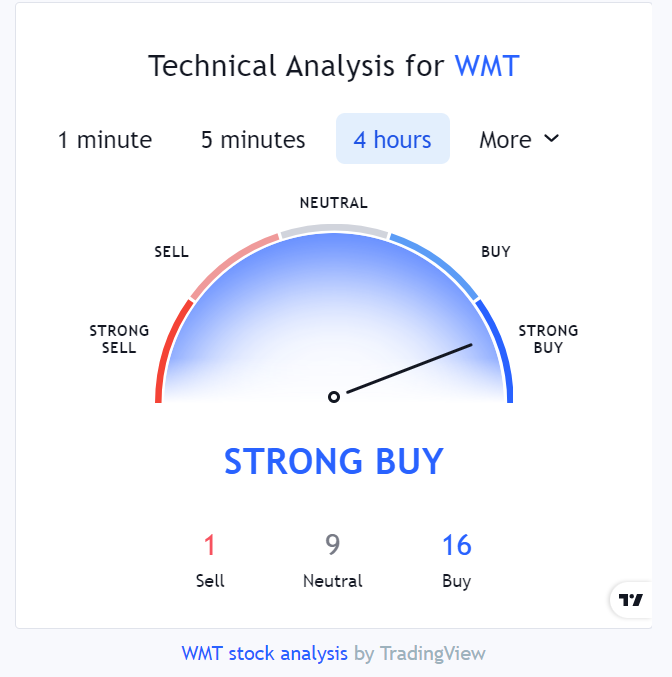

TradingView.com provides a range of technical indicators and charting tools that can be used to analyze stock price trends and forecast future movements. Common indicators include moving averages, Bollinger Bands, and Relative Strength Index (RSI).

It’s important to note that while technical analysis can be helpful in predicting short-term stock price movements, it may not be as effective in forecasting long-term trends. Additionally, stock prices can be influenced by various factors, including market trends, company performance, and global economic conditions.

Also Read: Walmart’s Plan to Build a Nationwide EV Charging Network

Historical data:

Market Cap (Previous Close): 406.51 B

Share Volume (Previous Close): 5.96 M

Price in USD (Last): 150.800

52 Week Change: -6.655

90-Day Moving Average: 142.412

Beta: 0.49527587675071

52week High: 159.23

52week Low: 115.85

50-Day Moving Average: 141.48

200-Day Moving Average: 140.87

Forecast data:

52 Week High: 155.044

52 Week Low: 146.591

45-Day Moving Average: 148.878

90-Day Moving Average: 148.027

Pivot, Resistance Levels, and Support Levels

For Stop Loss and Trading Targets

Calculation For Trading:

Resistance Level (R3): 152.600

Resistance Level (R2): 151.730

Resistance Level (R1): 151.265

Pivot Point: 150.395

Support Level (S1): 149.930

Support Level (S2): 149.060

Support Level (S3): 148.595