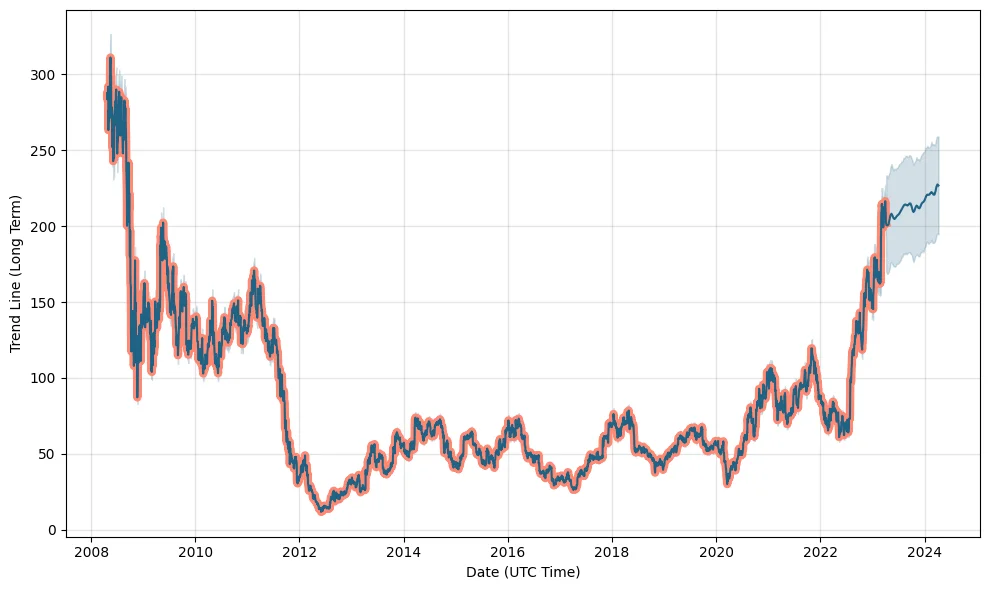

According to CityTelegraph’s analysts, the future of First Solar’s stock price is uncertain. Predictions vary, with some analysts projecting an increase in stock price to reach $224-$260 within the next year, while others anticipate a decline to around $200 by April 2024. Nevertheless, certain forecasts suggest a long-term stock price increase, with a predicted value of up to $226.211 by 2028.

The report indicates that the company’s robust financial performance may result in a considerable rise in net income, which could have a positive impact on the stock price in the future. Ultimately, the future of First Solar’s stock price will depend on numerous factors, including the company’s financial performance, market trends, and global economic conditions.

FSLR stock is a bad long-term (1-year) investment.

At City Telegraph, we predict future values with technical analysis for a wide selection of stocks like FSLR. First Solar stock can be a reasonable, low -risk 1-year investment option if you are looking for stocks with good returns. FSLR’s real-time quote equals 207.89 USD on 2023-04-13, but your current investment may be devalued.

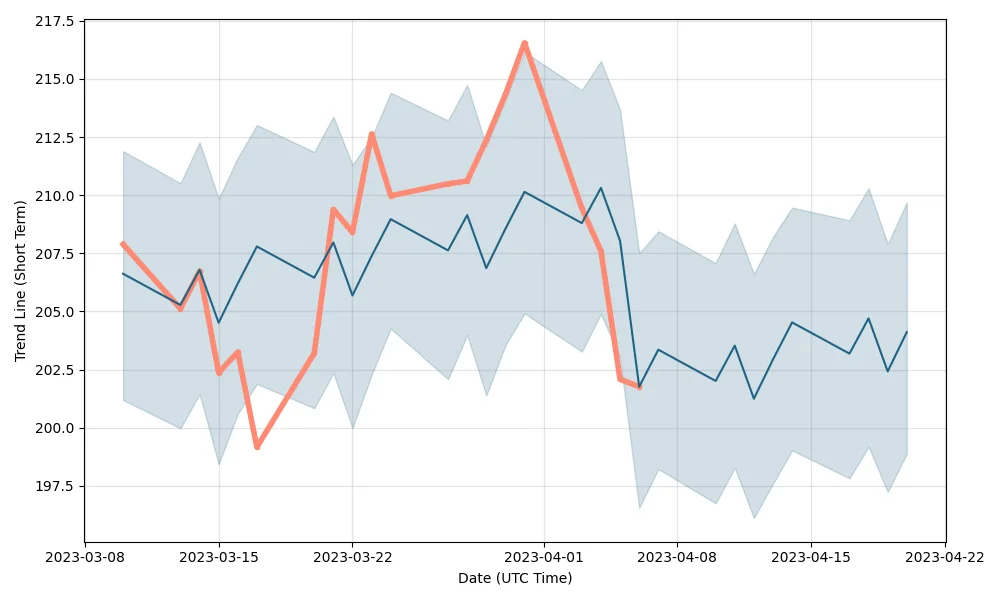

Meta Platforms Stock Chart and Share Price Forecast, Short-Term “FSLR” Stock Prediction for Next Days and Weeks

FSLR Forecast Chart, Long-Term Predictions for Next Months and Year: 2023, 2024

Technical Analysis of First Solar by City Telegraph using Moving Average (MA) with range 50 and 200.

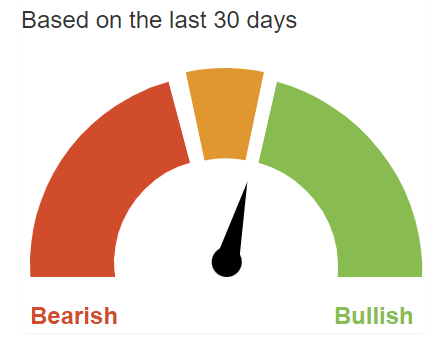

As per the above chart, it can be clearly seen that the MA (50) never crossed MA (200). This means the market has been bullish. thatswhy we can predict clearly that First Solar’s Stock price will Grow more. now at the time of writing, the FSLR Stock price is trading at 207.89$ (approx).

As the RSI (Relative Strength Index) the RSI is a little Over 50 (default range), which means the WMT Stock might experience a price drop or correction in the coming days. Overall the market is not bad for First Solar stock in 2023-2024.

TradingView.com provides a range of technical indicators and charting tools that can be used to analyze stock price trends and forecast future movements. Common indicators include moving averages, Bollinger Bands, and Relative Strength Index (RSI).

It’s important to note that while technical analysis can be helpful in predicting short-term stock price movements, it may not be as effective in forecasting long-term trends. Additionally, stock prices can be influenced by various factors, including market trends, company performance, and global economic conditions.

Read Also: First Solar, Inc. to Announce First Quarter 2023 Financial Results on April 27, 2023

Historical data:

Market Cap (Previous Close): 22.21 B

Price in USD (Previous Close): 207.930

Share Volume (Previous Close): 1.58 M

Price in USD (Last): 207.890

52 Week Change: 128.913

90-Day Moving Average: 187.785

Beta: 0.96884860447065

52week High: 219.55

52week Low: 59.6

50-Day Moving Average: 200.03

200-Day Moving Average: 164.69

Forecast data:

52 Week High: 227.823

52 Week Low: 200.241

45-Day Moving Average: 205.223

90-Day Moving Average: 206.073

Calculation For Trading:

Resistance Level (R3): 216.013

Resistance Level (R2): 214.397

Resistance Level (R1): 211.163

Pivot Point: 209.547

Support Level (S1): 206.313

Support Level (S2): 204.697

Support Level (S3): 201.463