Experienced tech investors are actively seeking avenues to invest in the promising potential of artificial intelligence (AI), especially since the notable advancement achieved in November through the launch of Microsoft-backed OpenAI’s ChatGPT bot. However, they approach the investment landscape with caution, mindful of potential market bubbles.

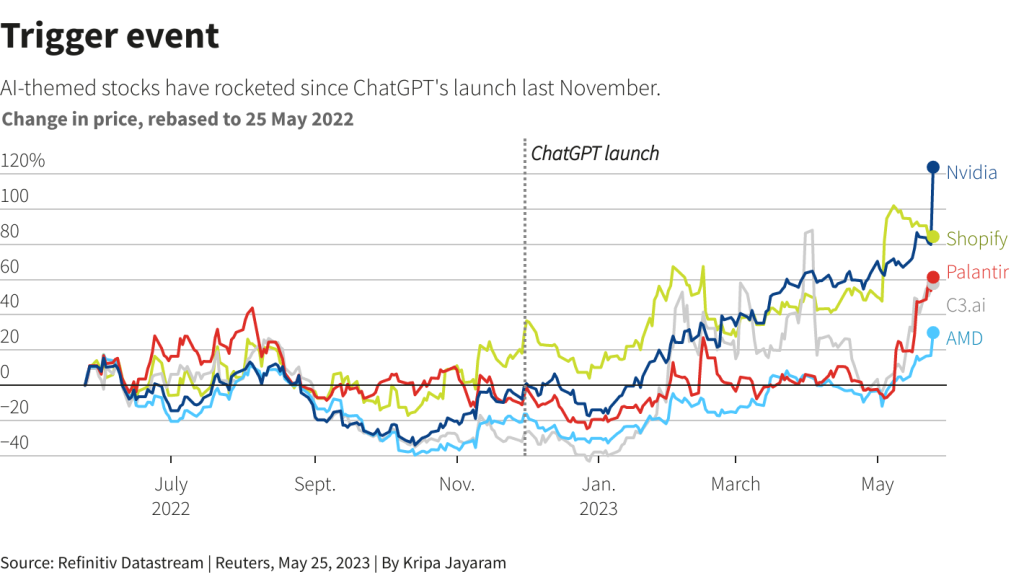

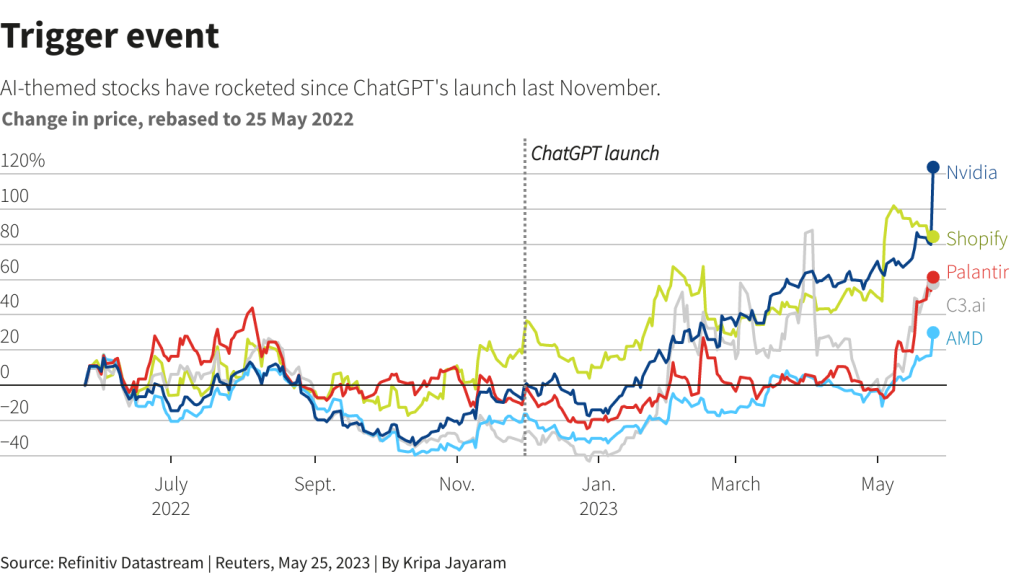

Shares in Nvidia, a leading provider of computer chips used in training AI systems, have nearly doubled since the release of ChatGPT. The company’s market value currently stands at around $940 billion, surpassing that of Europe’s Nestle by more than double. Nvidia witnessed a significant surge of approximately 25% in its stock on Thursday alone, driven by strong sales forecasts.

Another example is C3.AI, an AI software company that operates under the stock ticker AI. Despite its current loss-making status, its shares have risen by 149% this year. Palantir Technologies, which has developed its own AI platform, has seen a 91% increase in its stock value year-to-date.

Investors are particularly attracted to generative AI, the technology employed by ChatGPT, which learns from extensive datasets to generate text, images, and computer code. Businesses are actively exploring the application of generative AI to enhance video editing, recruitment processes, and even legal work.

Consultancy firm PwC predicts that AI-related productivity enhancements and investments could generate approximately $15.7 trillion in global economic output by 2030, nearly equivalent to China’s gross domestic product.

For investors, the key question is whether to embrace AI investment opportunities promptly or exercise caution due to mounting regulatory concerns surrounding its potentially disruptive impact.

Niall O’Sullivan, Chief Investment Officer of Multi-Asset for EMEA at Neuberger Berman, acknowledges that winners will emerge within the AI landscape but cautions that this may not be true for the entire market.

Considerations for AI Investments:

- Early Stages: AI technology is still in its nascent phase, leading to uncertainties about which companies will succeed.

- Market Competition: The AI industry is highly competitive, making it challenging for any single company to dominate the market.

- Potential Risks: Concerns persist regarding the negative impacts of AI, such as job displacement and privacy violations.

Potential Rewards of AI Investments:

- Industry Revolution: AI has the potential to revolutionize numerous sectors, paving the way for new markets and opportunities.

- Current Adoption: Businesses and consumers are already leveraging AI-powered products and services, indicating a growing trend.

- Market Growth: The AI market is expected to expand rapidly in the coming years, presenting new investment prospects.

When considering an investment in AI, thorough research and comprehension of the associated risks and potential rewards are crucial. Diversifying your portfolio across multiple AI-related companies is advisable, rather than relying solely on one or two investments.

Investing in AI: Navigating Opportunities and Risks

Investors with experience are adopting a different approach by supporting established technology companies that have already demonstrated their potential and stand to benefit from the long-term AI trend, instead of backing speculative startups or highly valued AI-focused businesses that carry higher risks of failure.

Alison Porter, a tech fund manager at Janus Henderson, emphasizes the transformative nature of AI, comparing it to previous technological advancements such as the internet, mobile internet, and mainframe computers. She holds positions in Nvidia, with Microsoft as the largest holding in their funds.

Nevertheless, Porter acknowledges that the use cases for AI are still in their early stages and evolving. With that in mind, she favors prominent tech giants like Microsoft (MSFT.O) and Alphabet (GOOGL.O), citing the robust balance sheets that enable them to invest in various technological advancements, including their recent focus on AI.

Navigating the AI Hype Cycle

The technology hype cycle has raised concerns among investors due to skyrocketing valuations. This cycle, popularized by consultancy Gartner, typically begins with a trigger event, such as the launch of ChatGPT, followed by inflated expectations and eventual disillusionment. Even if technology reaches mass adoption, many early-stage innovators may stumble along the way.

Mark Hawtin, investment director at GAM Investments, highlights the ongoing debate about AI’s position within this hype cycle, where the hype surrounding the technology is highly visible. He emphasizes the importance of exploring alternative avenues to gain exposure to the AI theme without solely relying on investments in highly valued entities.

Backing Proven Companies and Experts

Industry experts are recommending investors focus on established companies that can provide infrastructure support for future trends in generative AI, even as the specific implications of these trends remain uncertain.

Alison Porter, tech fund manager at Janus Henderson, suggests looking for companies that could benefit from providing essential infrastructure in the AI space. These companies are expected to play a crucial role in supporting the development and implementation of new AI technologies.

Similarly, Mark Hawtin from GAM Investments emphasizes the importance of identifying companies that offer the necessary tools and resources for enabling AI advancements. He specifically mentions Seagate Technology and Marvell Technology, which provide data storage and chip solutions, respectively.

Jon Guinness, tech portfolio manager at Fidelity International, includes management consultancy Accenture in his portfolio. Recognizing the complexity of integrating AI into businesses, he believes that seeking the expertise of industry professionals is essential.

These investment strategies reflect the recognition that the growth and success of AI depend on not only the development of innovative technologies but also the infrastructure and expertise needed to harness their potential.

Caution Amidst Tech Dominance

While recognizing the potential of AI in supporting the valuations of dominant tech stocks, investors like Trevor Greetham from Royal London Investment Management remain cautious about investing specifically in AI-themed stocks. Greetham draws parallels to the dotcom crash of the early 2000s, emphasizing the risks associated with blindly betting on AI-focused companies.

Fidelity’s Jon Guinness also maintains a focus on big tech, with Amazon being one of the holdings in his funds. He highlights Amazon’s efforts to make AI more accessible and cost-effective for businesses through services like Bedrock, enabling companies to customize generative AI models without extensive development costs.

Alison Porter of Janus Henderson stresses the long-term nature of AI’s benefits. While acknowledging the enthusiasm for investing in AI, she emphasizes the importance of careful consideration and avoiding blind investments at any price.

These insights highlight the need for investors to approach AI with caution, recognizing the potential pitfalls and the importance of thoroughly evaluating investment opportunities in this rapidly evolving landscape.