It faithful betting town allows people in get because the an excellent element of an extensive band of sports bits, providing on the diverse choice of modern on the internet gamblers. The brand new elite team could have been active in the the new betting community for more than a decade. Observe, the website works in accordance with current legislation, and will not provide gaming and you may to experience, simultaneously, doesn’t force visitors to take part in this particular area. Your website just a great deal images and game as you search off, you’re also not involved waiting around for what you to lbs at once, rendering it becoming smaller and smaller and easier.

Oshi casino | On the internet Membership Characteristics

Should your founded boy was born and you can passed away inside 2024 and you may you don’t need to an enthusiastic SSN to your man, enter “Died” inside the column (2) of one’s Dependents point and include a duplicate of the children’s delivery certificate, dying certification, otherwise healthcare details. Children would be handled as the being qualified boy or qualifying relative of one’s kid’s noncustodial mother or father (defined afterwards) if the all the following the standards apply. If you are planning an income for an individual who passed away inside 2024, come across Pub.

Or no licensed matter is excluded from money to own government motives and you may California rules brings no equivalent exception, tend to be you to amount inside the earnings for Ca objectives. To find out more as well as particular wildfire save money omitted to possess Ca intentions, discover Agenda Ca (540NR) tips. For orders generated during the taxable decades doing to your otherwise after January 1, 2015, costs and you can credits advertised on the a tax come back will be used very first to your have fun with tax responsibility, instead of tax liabilities, charges, and you may interest.

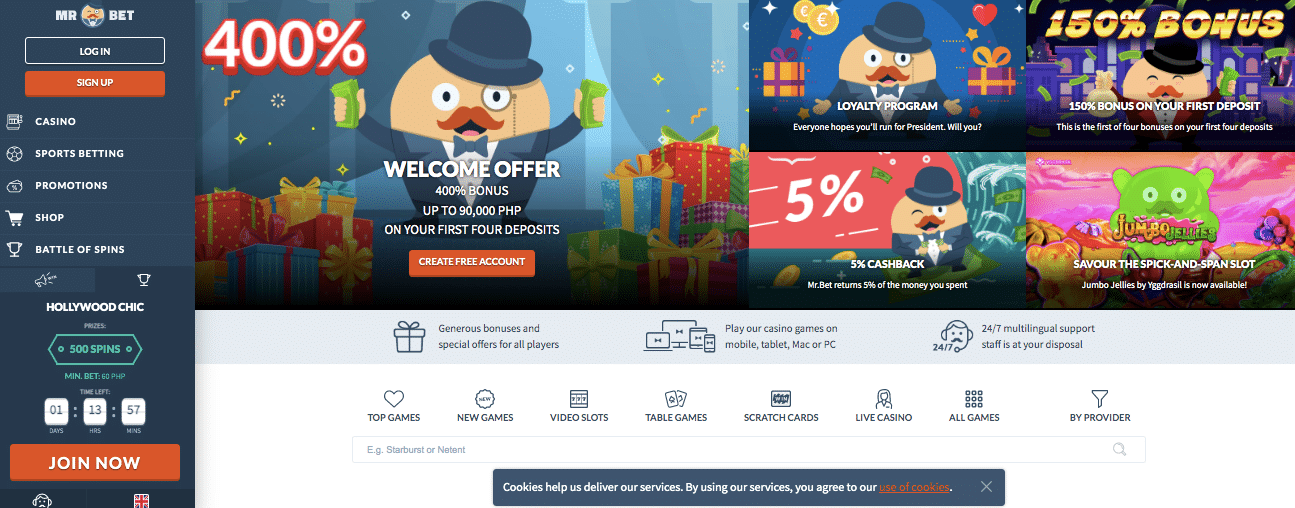

Type of no deposit gambling establishment bonuses and you can bonus rules

Although this planning might be confronted from the regulators considering current laws in the Income tax Operate, this type of challenges might be each other go out-consuming and you may expensive. The newest EIFEL laws and regulations offer an exemption to have interest and money costs sustained in respect away from arm’s duration money without a doubt public-private relationship infrastructure projects. Just after 2027, the fresh 50 percent of-season code manage implement, which restrictions the oshi casino fresh CCA allowance in a secured asset try received to at least one-half an entire CCA deduction. Currently, purpose-dependent local rental property meet the requirements for a great CCA rate from five percent lower than Class step 1. The fresh safer harbour laws manage implement according of all qualifying mineral items. During the period of the 5-year months, there would be a necessity in order to report on the brand new pollutants intensity of the times which is brought a year because of the program.

Costs will most likely not sit which glamorous in the event the anything move after inside the season. Salem Five Lead, created in 1995 because the an online section of Salem Five Bank (which was founded in the 1855), now offers Special Dvds anywhere between nine weeks in order to five years. From the $10,100, minimal balance to start one Dvds try large than what many other online banks wanted. The fresh bank’s Unique Video game choices are more aggressive for shorter-term Dvds than expanded-name ones. Lie Lender is the on the internet office from Colorado Money Lender and much like their father or mother bank, offers only small-term Computer game terminology.

To find out more, understand the Recommendations to own Mode 8962. Particular Medicaid waiver money your obtained to own taking good care of anyone life of your home to you could be nontaxable. The nontaxable Medicaid waiver repayments will be stated for your requirements to your Form(s) W-dos inside the container a dozen, Password II. If the nontaxable repayments were advertised for you inside the box step one away from Form(s) W-2, report the quantity for the Mode 1040 or 1040-SR, range 1a. Then, online 8s enter the complete level of the newest nontaxable payments claimed to the Function 1040 or 1040-SR, range 1a otherwise 1d, regarding the admission area on the preprinted parentheses (while the a bad count).

Investment One Lender

A nonresident alien, who is not qualified to receive or was not provided a good government SSN otherwise ITIN, might possibly be as part of the classification come back or file an individual come back as opposed to acquiring an SSN or ITIN. For more information, visit ftb.ca.gov/models and have FTB Bar. Underneath the government laws, rollover withdrawals out of an enthusiastic IRC Part 529 plan to an excellent Roth IRA just after December 29, 2023, might possibly be treated in the same manner because the earnings and you will efforts from a good Roth IRA. California laws cannot adhere to it federal provision. Rollover delivery away from a keen IRC Point 529 intend to a good Roth IRA try includible inside California nonexempt earnings and subject to an more taxation of 2½%.

- Firefighters Basic Borrowing Union confidentiality and you may defense principles don’t apply to the connected webpages.

- Contributions was familiar with keep the newest thoughts away from Ca’s dropped tranquility officers and you can help the families it left behind.

- Don’t file Function 8862 for those who submitted Mode 8862 to possess 2023, as well as the boy tax borrowing, extra boy taxation borrowing from the bank, or credit with other dependents is actually acceptance for this 12 months.

- Here is the main disimilarity between average casinos on the websites and straight down dep of those.

- A qualified retirement plan is a governmental package that’s a qualified faith otherwise a paragraph 403(a), 403(b), or 457(b) plan.

- As mentioned, it isn’t the most amazing or appealing playing webpage i’ve seen.

Innocent Combined Filer Rescue

To learn more, discover Roentgen&TC Section and have Agenda P (540NR), Choice Minimal Income tax and you will Borrowing from the bank Constraints – Nonresidents or Part-Year People, function FTB 3885A, Depreciation and you may Amortization Adjustments, and FTB Club. No one wants to expend more time than just absolutely necessary calculating aside the banking demands. Nonetheless, sometimes it pays to look at modifying banking institutions, at least when it comes to the savings. We commissioned an excellent poll of 2,one hundred thousand American adults to ascertain. Because the give exceeds very banks, you’ll find best alternatives on this list.

The newest dependents your allege are those you checklist by-name and you can SSN in the Dependents part to the Form 1040 or 1040-SR. Your paid more than half the price of maintaining a home for which you existed plus which one of your following the along with existed for over 50 percent of the season (in the event the half of or shorter, discover Exemption so you can day stayed with you, later). You can check the new “Single” package from the Submitting Status section for the web page step one away from Setting 1040 otherwise 1040-SR if any of one’s pursuing the are correct to the December 30, 2024. To check on for reputation to your set of designated personal delivery functions, go to Internal revenue service.gov/PDS. To the Internal revenue service emailing target to use for those who’re having fun with an exclusive delivery service, go to Internal revenue service.gov/PDSStreetAddresses. For those who document after this time, you might have to spend focus and you can penalties.

So it matter will be revealed inside the box 1a away from Form(s) 1099-DIV. The details are exactly the same like in Analogy step one other than you bought the newest stock on the July 15 (the afternoon through to the ex boyfriend-bonus date), and you marketed the newest inventory for the September 16. You held the newest stock to own 63 days (from July 16 as a result of Sep 16). The brand new $500 of accredited returns shown inside package 1b away from Setting 1099-DIV are qualified returns since you kept the fresh inventory to have 61 times of the fresh 121-go out months (out of July 16 thanks to Sep 14).