Historical index for the Uniswap price prediction: B+ “Should I invest in Uniswap CryptoCurrency?” “Should I buy UNI today?” According to our Forecast System, UNI is an awesome long-term (1-year) investment*. Uniswap predictions are updated every 3 minutes with latest prices by smart technical analysis

At Citytelegraph.com we predict future values with technical analysis for wide selection of digital coins like Uniswap. If you are looking for virtual currencies with good return, UNI can be a profitable investment option. Uniswap price equal to 18.674 USD at 2021-02-07. If you buy Uniswap for 100 dollars today, you will get a total of 5.355 UNI. Based on our forecasts, a long-term increase is expected, the price prognosis for 2026-01-31 is 100.134 US Dollars. With a 5-year investment, the revenue is expected to be around +436.22%. Your current $100 investment may be up to $536.22 in 2026.

Will UNI reach 30$ Mark?

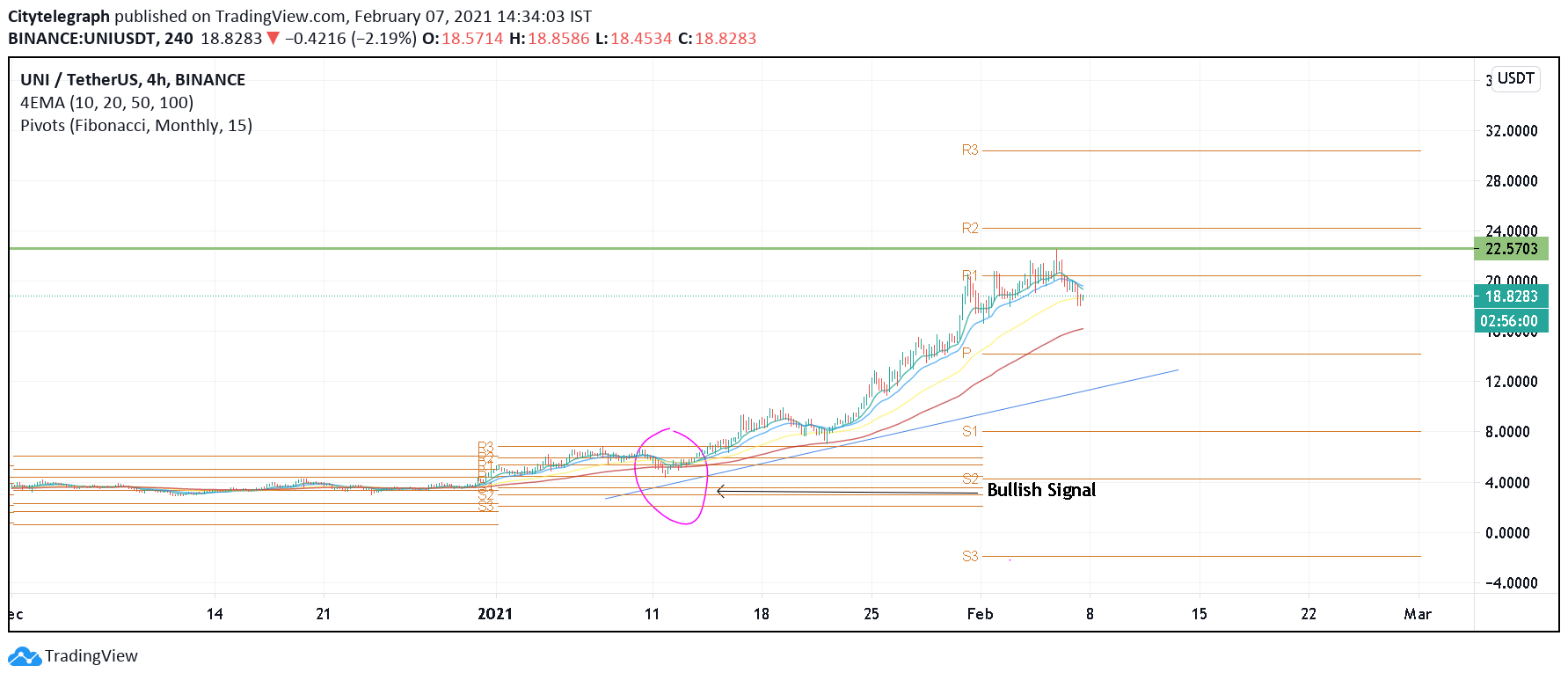

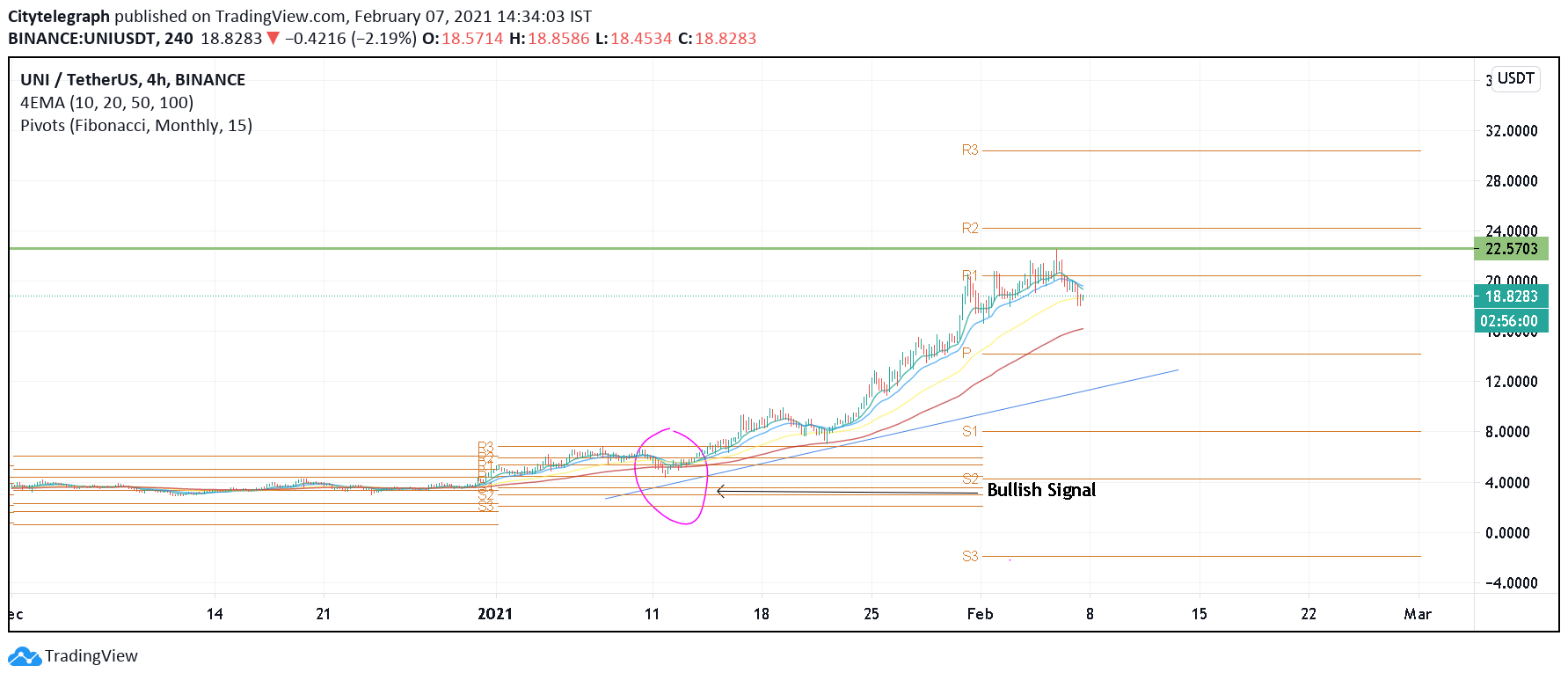

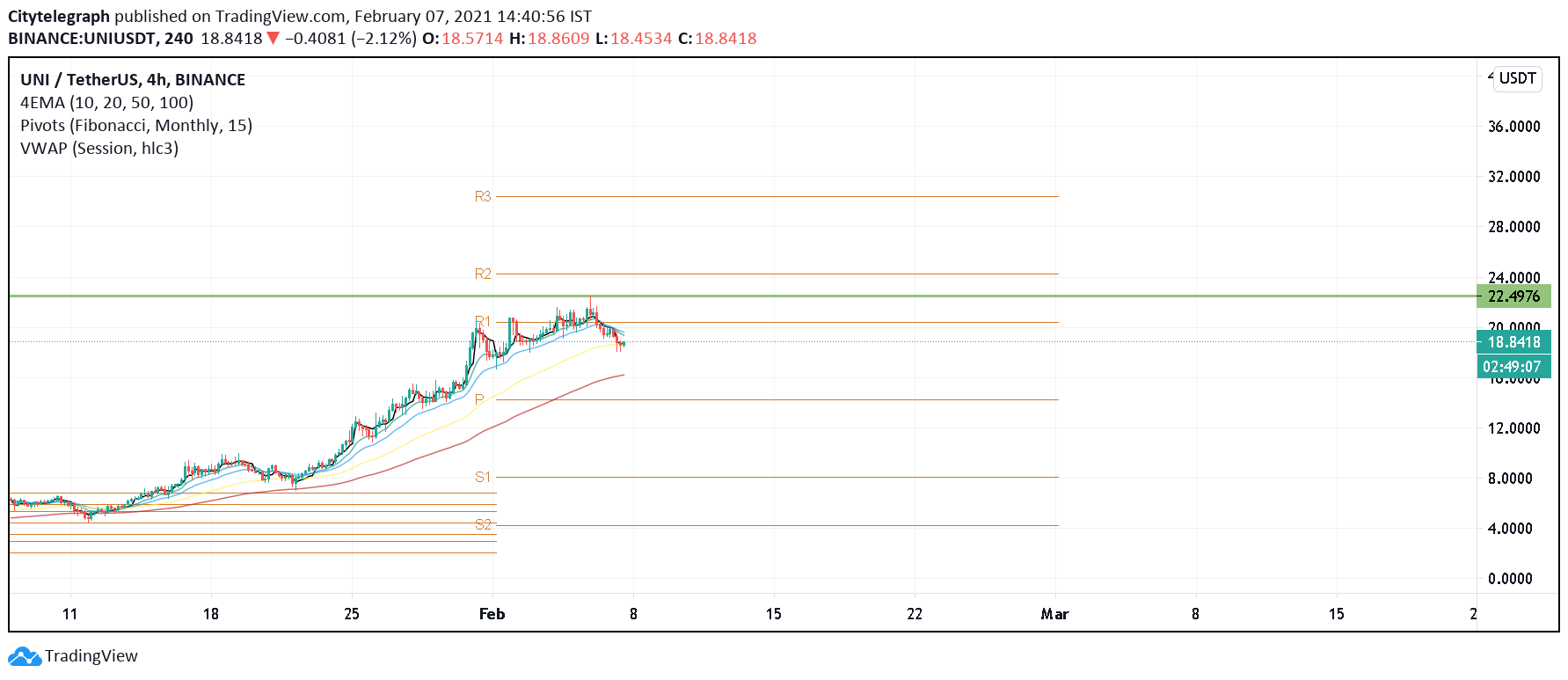

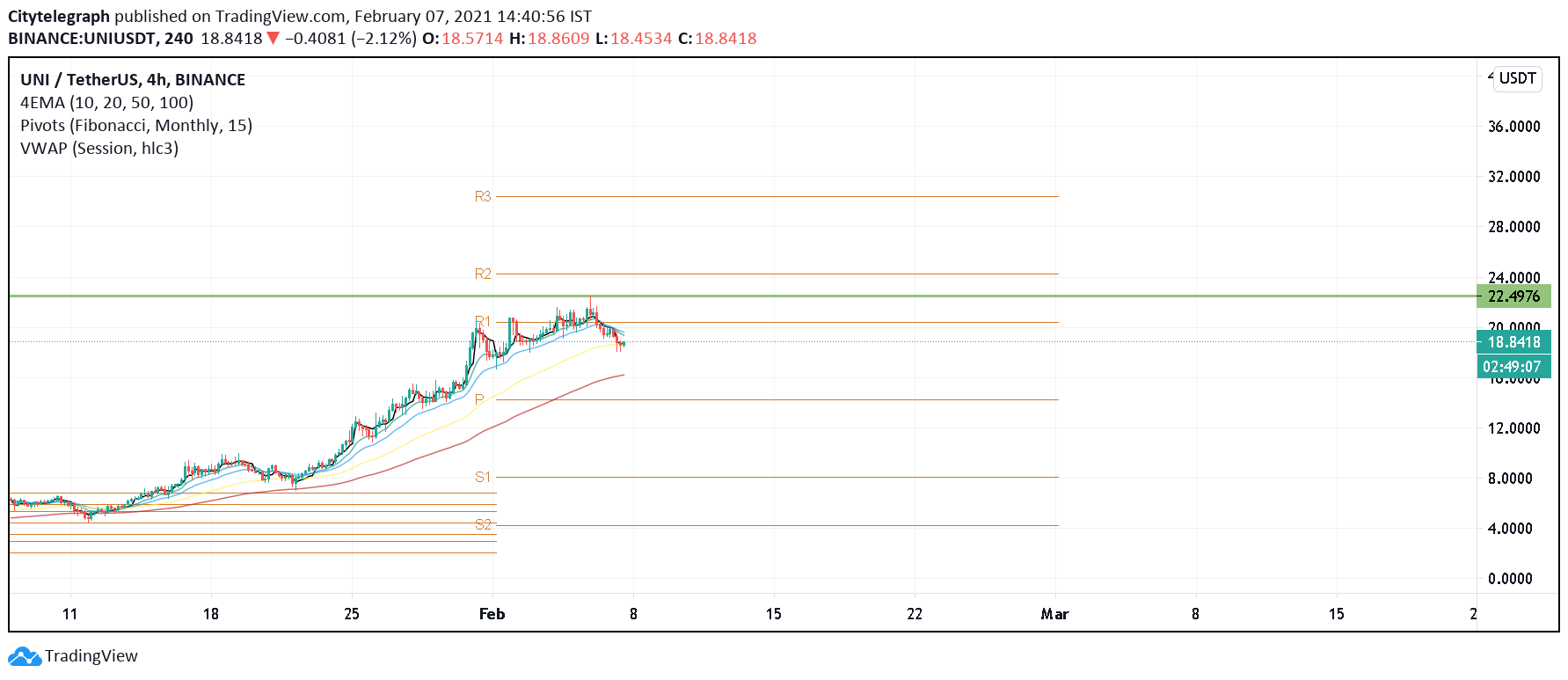

If you closely have a look at the 4 hour chart with 4EMA. The 4EMA (10,20,50,100) is still in bullish sentiment since the price was at $5.

As the UNI Coin (UNISWAP) remains in bullish sentiment, the Pivot Point (Fibonacci’s Monthly S/R technical indicator), there is a strong resistance at $20.

Two days back, i.e. on 5th Feb UNI broke it $20 resistance and tried to climb up for next ATH i.e. $24 but failed to do so & made a new all time high at $22.

Since the whole UNI coin is Bullish, there are more chances that it will retest its current ATH i.e. $20 and this time it might break $24 resistance and climb to for $30 to stablish a new ATH.

UNI Price Comparison with other Governance Tokens

A comparative study with other governance tokens is also not reliable because of the newly found yield farming craze which might grow or subside in the future. Moreover, while the general concept of yield farming requires staking of tokens or using a platform, their value is backed differently across each platform.

Note that the decentralized applications (DApps) like MakerDAO, Compound or Aave aren’t new, but the boom in the governance tokens are.

Let’s take the example of COMP tokens, these are governance tokens which are distributed to the lenders and borrowers on the platforms. The distribution rewards both lenders and borrowers divided 50-50 among them.

ownership > governance

— Kyle Davies (@kyled116) September 24, 2020

Essentially, the governance tokens play no role in the functioning on the platform. The direct earnings from the platform are passed on to the liquidity providers and other participants on the network. The governance token rewards are additional rewards that sometimes come by burning a part of those earnings or could be completely separate from it.

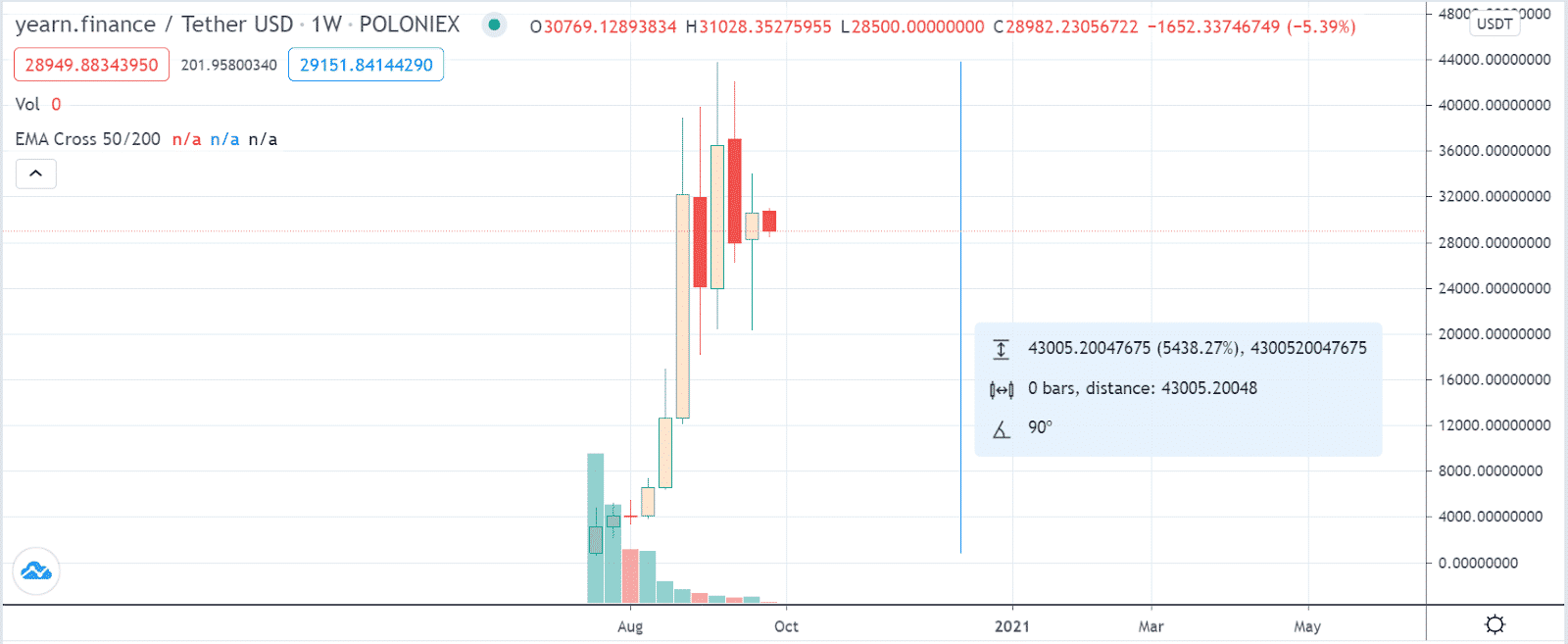

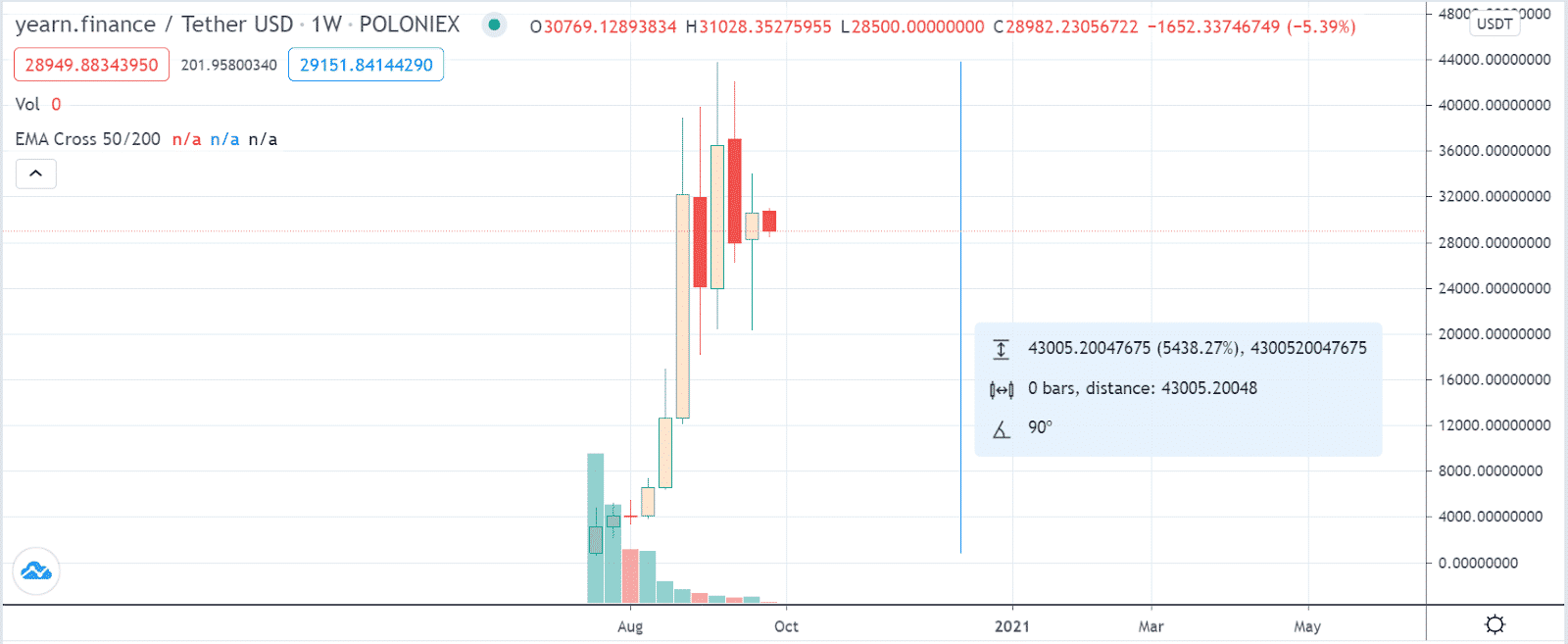

Lastly, the governance tokens themselves have grown astronomically in the last couple of months. The support and resistances are not established on long-term charts (weekly and monthly).

YFI, the governance token for yEarn Finance peaked with a 5500% rise since August. Others like Aave (LEND), SNX, MKR also rose ecstatically over the last few months. Hence, defining the DeFi boom.

During such a bull market or price discovery phase, anything is possible because there is a high risk: reward ratio.

From old ATH to a New ATH and growing further: UNI Price Prediction 2021

Trading Above the VWAP with Monthly Pivot Point Standards (Fibonacci Monthly): Makes UNI more bullish for Monthly trading

UNI Price Prediction for 2021

It’s been only three weeks since the UNI token launch. Hence, estimating the price of the token one year in the future relies completely on fundamental value with certain probabilities.

The possible scenarios in the future for Uniswap are:

- Uniswap continues to keep up with the volume on centralized exchange and stands to as much as $500 million in a year. These earnings from fees will be earned by the liquidity providers and then governance of the exchange will be more valuable.

- Expansion of DeFi space outside of Ethereum or general fading out of the exchange leads to loss of liquidity, and the governance token holds very little value in the future.

- UNI token and the platform evolves over time into serving the market in a different way. Currently, the team is focused on building the Uniswap platforms and is doing it via grants and public goods.

Moreover, Uniswap also bears the technical risk that comes with any smart contract-based project, i.e. contracts can be exploited.

Currently, the incentive for mining UNI tokens is acting in favour of increasing the liquidity. However, due to the high fees for Ethereum GAS, the cost of a swapping transaction is more than $3. This repels the low volume retail traders on the platform; hence, reducing the volume of transactions which is the medium for earning.

UNI Price Prediction for 2022

The future of decentralized finance lies not only in the hands of developers and users but also regulators. The debate on the application of securities law has taken a new turn with DeFi governance tokens.

Ethereum, the platform on which it is designed also plays a critical role in the future of the project.

Ethereum gas prices fluctuate daily in line with demand. If many folks are trying to use Ethereum all at once, then gas prices will be higher. If activity is low, then gas prices will be lower. The implementation of layer-2 and ETH 2.0 is still away in the future, hence, until then, the hindrance to retail adoption is still there. UNI token could attract the users to the platform, but their success is intertwined which is causing confusion among traders.

While the gains have been bountiful for some, there have been numerous instances of rug pulling an early sell-off as well. Hence, regulation might be necessary for the organic growth of the space as well.

Must Read:

- ETH Price Prediction: steady rise towards $2,000, rally for $3,000

- OMG Network Price Prediction: Ready to go for a Jump 10$ OMG to USD

- Polkadot (DOT) price prediction: 21Shares Launching First Polkadot ETP & DOT may fall down to $1.5

- Stellar lumens (XLM) Price Prediction: Live XLM/USD, Grayscale® Stellar Lumens Trust