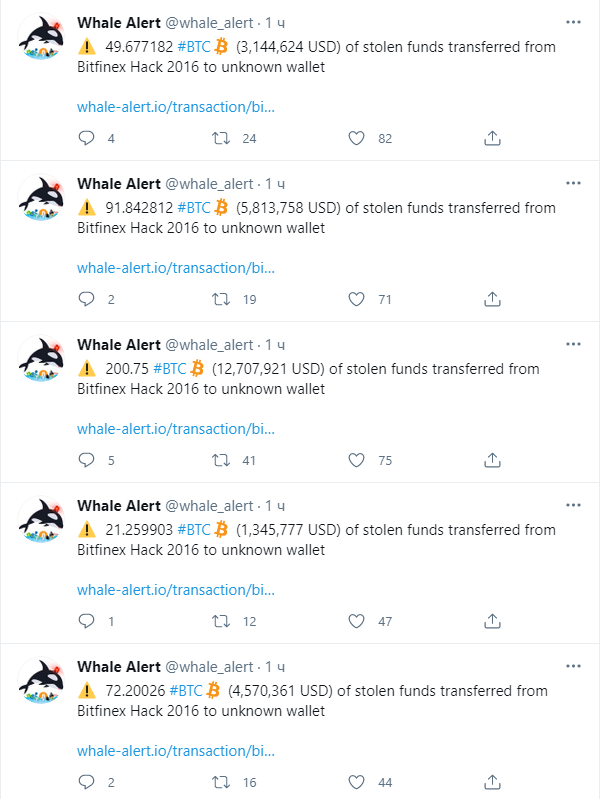

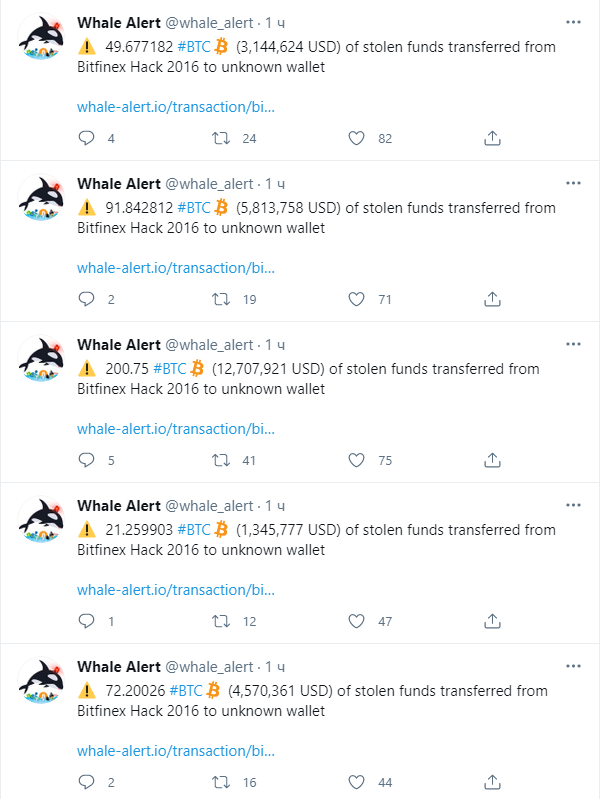

The tracking service Whale Alert, which monitors large transactions with the cryptocurrency, reported about 63 newly-made bitcoins, linked to the baseline.

In general, 10,057 BTC was shifted, approximately at $ 627 million. The size of transactions of the ship ranged from 50 BTC to 1241, 37 BTC, the first translation contained 300 BTC.

It is interesting that the stolen coins came into motion for example at the moment when the shares of the cryptocurrency exchange Coinbase started trading on the Nas shares.

Must Read:

- Check out Bitcoin, Ethereum, Ripple, Litecoin Weekly Technical Analysis April 12-16

- Why BNB can Reach 1000$ this Year in 2021

- Will Rarible (RARI) Coin will ever reach 70$ this year?

Recall that in August 2016, hackers stole from Bitfinex a colossal 120,000 BTC. Last year, the company offered a grant of $ 400 million for the return of stolen property.

Quantum founder: SEC threatens the future of cryptocurrencies

Soon there may be a judicial precedent that will allow the US authorities to liquidate any project related to digital assets, Mati Greenspan said.

Quantum Economics founder Mati Greenspan believes the actions of the US Securities and Exchange Commission (SEC) threaten the future of cryptocurrencies. So he commented on the accusations of the regulator against the platform for the distribution of content LBRY. At the end of March, the SEC accused the site of selling unregistered securities worth millions of US dollars under the guise of LBRY Credit tokens.

“If the court ruled against LBRY, it would call into question the future of all cryptocurrencies, including Bitcoin and Ethereum,” added the founder of Quantum Economics.

Mati Greenspan, in response to the SEC’s actions, published a newsletter titled “Don’t let them kill crypto”. In it, he argues that the LBRY litigation could have dramatic consequences. In his opinion, this situation could create a precedent that would classify digital currencies as securities.

“Judges are usually guided by previous decisions in similar cases, so a negative decision here can make it easier for them to liquidate any project that uses crypto tokens. DeFi, non-fungible tokens (NFTs), smart contracts, and just about anything other than possibly stablecoins will be on the hook, ”added Mati Greenspan.

LBRY is a content distribution platform where users themselves determine the fees and conditions on which they are willing to share their content using blockchain technology and the Bittorrent protocol.

Earlier, Don Fitzpatrick, the investment director of the legendary financier George Soros’ company Soros Fund Management, warned that the emergence of central bank digital currencies (CBDCs) would be a threat to bitcoin.

Central Bank of Turkey has frozen payments in cryptocurrencies

The Central Bank of Turkey has banned the use of cryptoactivities in the payments, claiming that they do not have significant risks because of the unstable consumption and

The bank also declared that the cryptoassets “do not support any mechanisms of regulation and supervision and are not supervised by the central regulating organ.” The official statement of the bank says about the release of the so-called “Provisions on prohibiting the use of cryptoassets in payments”.

Also Read:

- Playboy gets into the NFT business

- Damian Lillard is dropping “Dame Time” NFT collection

- Robot Sophia: The first work of this “crypto artist” is worth $ 688,000

This event was preceded by months of economic trauma, the culmination of which was the appointment of a prezid with a Regeneration of Erdogan of the new flower

Likewise, that Kavchioglu is not inclined to take up a cryptocurrency, since the following reasons for the ban are given in the official statement:

- the cryptocurrency is not subject to the action of any mechanisms of regulation and supervision from the side of the central regulatory authority;

- has a market value that can be quite variable;

- can be used in illegal actions because of its anonymous structure;

- uses wallets that can be hacked or used without the permission of their owners;

- Uses irrevocable transactions.

The Central Bank of Turkey has banned the use of cryptoassets for the purchase of goods and services through a week after that, as the Turkish information on the use of

Other countries have also banned the use of cryptocurrencies in payments: in Russia it happened this year, China came to such a solution back in 2017.

Pazumeetcya, Tvittep navodnon vozmuschonnymi coobscheniyami, a izvectny ctoponnik bitkoyna and kpiptoinvectop Entoni Pompliano napical chto bitkoyn (BTC) «pobezhdal nA cvobodnom pynke, poetomu ppavitelctva and tsentpalnye banki pytayutcya moshennichat”.

“This is of no value,” Pompliano said, “the acceptance in these countries does not wane.”

CEO Jeff Booth said that “there is no better signal that you need a bitcoin than trying the central banks to stop it.” He also expressed his confidence in the acceleration of acceptance.