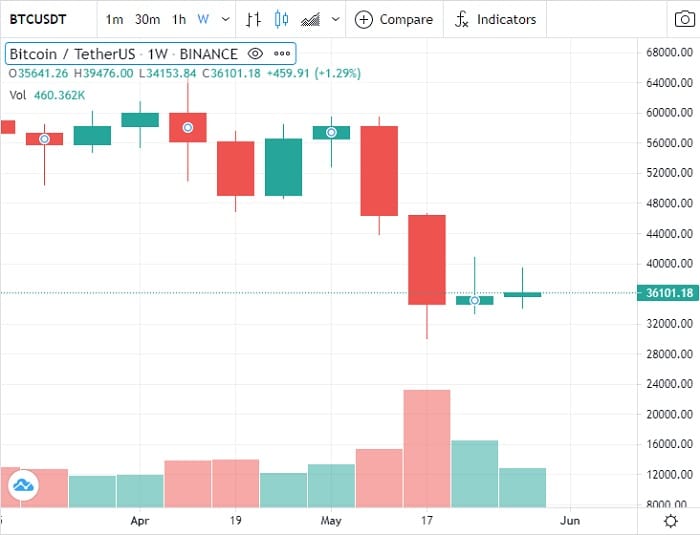

For the third week in a row, the price of bitcoin is below $ 40,000, after falling as much as 50% in about two weeks (from $ 59,000 to $ 30,000 at its lowest point).

Unlike last week, during the last few days bitcoin has not even momentarily touched the level of USD 40,000 and remains lateral, in a range between 35,000 and 39,000.

According to this week’s Market Report from Glassnode, the current state of the bitcoin market is best described as a “battlefield” between bulls and bears.

Specifically, long-term BTC holders are not selling at current prices, pointing to a new bullish move, while recent investors are selling their bitcoins at a loss, anticipating a prolonged downtrend, the researchers note.

To be sure, the current market structure is best described as a battleground between bulls (bulls) and bears (bears), with a clear trend forming among long-term and short-term investors.

Glassnode.

Lack of consensus among analysts

The field of analysts in the bitcoin market is also in full battle of positions: there is no clear consensus on the direction the market will take from where it is currently

The financial analyst Rekt Capital, for example, pointed out this Thursday that bitcoin is facing the appearance of a metric of bad omen, as its name suggests: the “cross of death.”

Stability after a bloody May

Although a recovery scenario is not fully supported, this first week of June has brought some calm to the bitcoin market, after a black May for the cryptocurrency.

The fall of the month of May exceeded that of March 2020, when the declaration of the coronavirus pandemic shook not only bitcoin and the rest of cryptocurrencies, but also traditional markets and economies around the world. With a drop of more than 35%, this May 2021 is one of the most negative months in the history of bitcoin.

In the middle of the negative month, traders significantly increased their activity on exchanges. Exchange platforms experienced a record month , with $ 2.31 trillion in transaction volume during the month of May.

Taproot approval progresses

The activation of one of the main and most anticipated technological improvements for Bitcoin is getting closer and closer. With the arrival of a new cycle of Bitcoin mining difficulty, most miner pools have been signaling in favor of activating Taproot.

With Taproot, the way Bitcoin transactions are transmitted would be updated which points to better privacy and efficiency. The proposal, which has wide support in the bitcoiner community, would be activated in November of this year.

This same week, Marathon’s MaraPool mining pool, one of the most representative companies in this industry in North America, stated that it was in favor of this improvement. In addition, he announced that they would stop censoring Bitcoin transactions, a measure that they had taken shortly before in compliance with OFAC provisions.

Continuing in the realm of Bitcoin mining, this week the difficulty of mining blocks was reduced by 16%, after a significant drop in accumulated processing power in previous days.