At the time of writing, there are approximately 7,200 cryptocurrencies in the world. Almost every one of them promises to bring something that no other cryptocurrency project has done before. Many of you know that most cryptocurrency projects either don’t live up to their promises or are never anything special from the start.

Also Read: The expert told when the bearish cycle on the crypto market will end

Solana is a cryptocurrency that does not fall into this category. This is a cryptocurrency project with a radically different approach to the principles of the blockchain. His efforts are focused on an element that is so devilishly simple that you’ll wonder why you didn’t think of it sooner. This element is time. As it turns out, adding decentralized clocks to the blockchain makes it more efficient than anyone could have imagined.

Also Read: Bitcoin (BTC) Price Prediction and Forecast

A Brief History of Solana

The history of the Solana project begins with a sunny Californian beach with the same name. Solana Beach is located just a thirty-minute drive north of San Diego, where Anatoly Yakovenko , the founder and CEO of the Solana cryptocurrency project , who worked in the telecommunications industry, spent most of his life. That’s a bit of an understatement considering Anatoly was instrumental in developing the technology used in all smartphones since he gave Qualcomm 12 years.

Image from Sunset.com.

At first, Yakovenko was not very interested in Bitcoin, and Ethereum only slightly affected his interests. However, he had been mining Bitcoin for a while when he was developing a deep learning computer network. In his own words , during a “ caffeine-induced 4 a.m. nap ” in 2017, he realized that Bitcoin’s hash function (SHA256) could be used to create decentralized clocks based on the blockchain.

Tweet to @aeyakovenkoSolana creator Anatoly Yakovenko. Image from the Twitter page

Yakovenko suggested that timestamped transactions could exponentially increase the scalability of a cryptocurrency blockchain without compromising its security or decentralization. He knew it was possible because Google and Intel were implementing similar technologies into their databases, even though everything was done centrally. Solana ‘s revolutionary white paper was published quietly in November 2017.

What is Solana

Solana is a high-performance cryptocurrency blockchain that supports smart contracts and decentralized applications. It uses a Proof of Stake consensus mechanism with a low barrier to entry and timestamps in transactions for maximum efficiency.

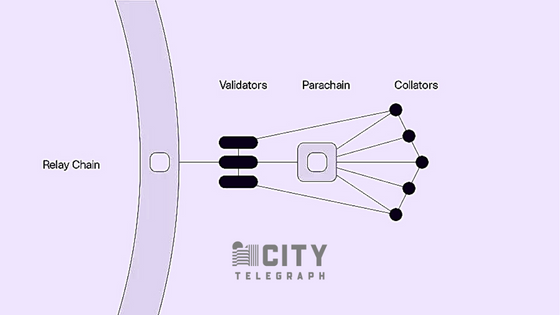

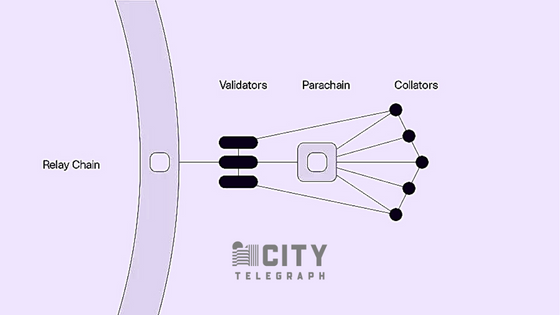

The Solana algorithm allows processing 50-65,000 transactions per second (TPS) with a theoretical limit of over 70,000 transactions per second (for comparison, Bitcoin has 7 TPS and Ethereum has 15 TPS). Unlike other similar projects such as Polkadot and Ethereum 2.0 (when it will be released), Solana is a single blockchain (layer 1) and does not delegate operations to auxiliary chains (layer 2).

Must Read: The number of Bitcoin millionaires has dropped by 80% in a year

“Parachains” Polkadot. Image from the Polkadot Wiki page.

The Solana team has developed its blockchain with long-term plans. These plans stemmed from the personal experience of company founder Anatoly Yakovenko, who while at Qualcomm watched telecommunications technology almost double its capabilities every year.

The Solana project is being developed by a company of the same name based in San Diego, California. The Solana team is made up of former employees of Qualcomm, Google, Apple, Microsoft and Dropbox. In addition to being based on database technologies similar to those used by Google and Microsoft, Solana’s architecture is also inspired by Filecoin , a decentralized cryptocurrency storage solution.

Also Read: Xiaomi 13 presentation canceled due to the death of the ex-president of China

How Solana Works

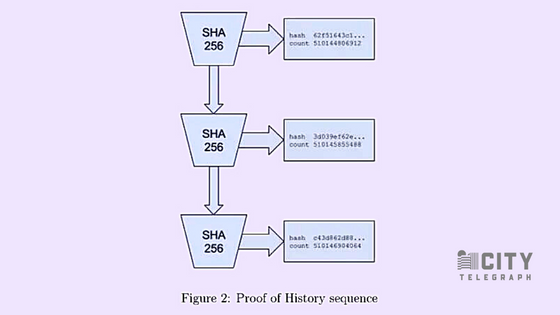

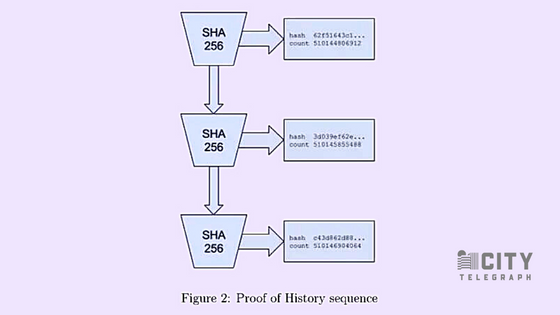

Note: Solana is incredibly complex. Let’s start with a term you might have heard if you’ve paid attention to the project before: Proof of History (PoH). PoH is not a consensus mechanism. Rather, it is a component of the Proof of Stake consensus mechanism.

PoH involves adding timestamps to transactions when they are added to a Solana block. A new Solana block is generated every 400ms (for comparison, in Ethereum it is 15 seconds, and in Bitcoin 10 minutes). Without going into too much detail, the decentralized clock that is used as a reference for timestamps is a SHA256 hash function. The name SHA256 may sound familiar because this system is used in Bitcoin’s Proof of Work consensus mechanism.

Duplicate SHA256 output.

However, instead of working on computing hash functions to create a new block, Solana uses the repeated SHA256 output as reference timestamps. This creates a kind of “ clock ticking ” in 400ms increments (instead of one second like a normal clock).

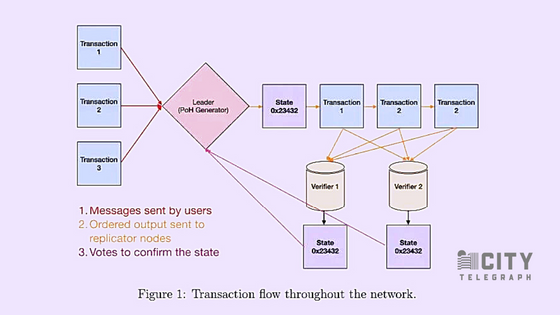

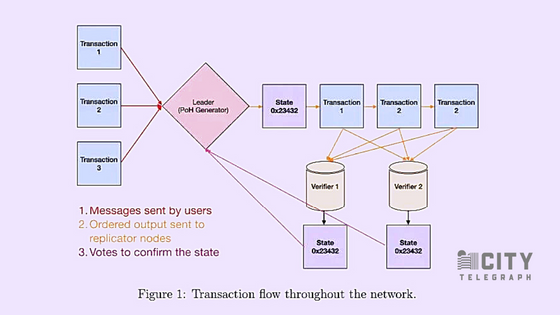

Now let’s dispel some misconceptions about Solana. Many sources call the Solana Delegated Proof of Stake (DPoS) consensus mechanism. The definition is not entirely accurate, and the Solana team has talked about this many times . The fact is that there are various roles in the Solana blockchain (leaders, validators, archivers, and so on).

Cryptocurrencies like DPoS essentially delegate to these selected network members, but Solana doesn’t do that. Simply put, all nodes in the Solana network participate in all network roles.

For example, “ Leaders ” are engaged in the production of new blocks and change every 4 blocks (1.6 seconds). When a node takes the leadership position, it tries to squeeze as many transactions as possible into the four blocks it produced, and exposes these transaction blocks to special groups of nodes called Solana clusters. These nodes validate transactions using digital timestamps as a reference, and then quickly propagate the records to other nodes on the network.

Unlike other PoS cryptocurrencies, there is no minimum staking required to become a node owner on the Solana blockchain . Naturally, the amount of block reward you receive is proportional to the amount of SOL tokens you have locked.

Although the choice of leader is pseudo-random, the number of SOLs you wager also affects the likelihood that you will become a leader and be able to create blocks. Unscrupulous nodes have their stakes confiscated, with the confiscated funds added to block generation rewards.

Image from the Medium page.

Solana is based on eight basic functions. We have already mentioned one of them (Proof of History). Of the remaining seven, only two deserve attention for this article. They are called Sealevel and Gulf Stream.

The Sealevel feature allows you to quickly identify all non-overlapping transactions and process them simultaneously. Gulf Stream allows you to pre-determine several future Leaders so that they can start accumulating transactions before they start producing blocks.

If you didn’t get it right away, let’s look at a simple example to help you understand how Solana works.

Imagine a small company with 180 employees (that’s roughly the number of nodes/validators Solana currently has). Despite the fact that this company has different departments (for example, accounting, shipping and receiving, customer service), each employee is able to do the work of any other department. In addition, from time to time, each employee is pseudo-randomly selected to the position of boss (leader) for 1.6 hours, during which time he must sign incoming documents from various departments.

Although the selection of an employee as boss is partly random, each employee has a small window on the computer screen showing the next 10 people who will temporarily act as boss. This allows them to hand over their documents to the selected employee before he becomes the boss, so that the work gets done faster (Gulf Stream).

When the boss signs some documents, they are timestamped and sent back to the appropriate department for double verification (as the Solana node clusters are called), and if approved, they are added to the company’s database. All departments can do their paperwork at the same time, as they do not overlap (Sealevel).

Each employee has a role to play in keeping these documents, in checking them, and in controlling the behavior of the boss so that he really does his job, and does not mess around. Basically, this is how Solana works.

A technical overview of the Solana architecture.

The key advantage of the Solana network is that it distributes different tasks between different nodes of the network as needed to optimize speed, and all transactions are timestamped to ensure they are correct.

That is, one cluster of nodes (Solana Cluster) can be responsible for hosting a DeFi platform such as Uniswap , while another cluster is responsible for processing microtransactions created in the Decentraland virtual world. This makes the Solana network decentralized, scalable and secure without compromise.

Cryptocurrency SOL

SOL is the internal cryptocurrency of the Solana blockchain. It is used to pay fees on the Solana network, after which it is burned. You can also use SOL in staking to become the owner of a blockchain node.

In the future, SOL will be used to vote on changes to Solana. At the time of writing, it is not clear whether SOL is inflationary or deflationary due to documentation inconsistencies, although it is most likely deflationary.

Solana token ICO

Solana has had five funding rounds in total , with the most recent being a public ICO. Over the course of these five rounds, Solana has raised over $25 million in funding and even issued buyback guarantees at a price of just under 20 cents to those who signed up and staked their tokens within the first three months after the ICO.

Solana Staking Price Guarantee. Image from the Binance website.

The first closed funding round took place in March 2018, and just under 80 million SOL was sold for $3.17 million ($0.040 per SOL). The second round of closed funding took place in June 2018, and this time just over 63 million SOL were sold for $12.63 million ($0.20 per SOL).

The third round was held in July 2019, with just over 25 million SOL sold for $2.13 million ($0.22 per SOL). And the last round took place in February of this year – just over 9 million SOLs were sold for $2.29 million ($0.25 per SOL).

First four rounds of Solana funding. Image from ICOdrops website.

The Solana ICO took place in March 2020 on the CoinList platform. It sold 8 million SOLs for $1.76 million ($0.22 per SOL). This is just 1.6% of the total supply of Solana tokens.

The SOL cryptocurrency has a total supply of 500 million. Of this, 36.2% (approximately 160 million SOL) was sold to private investors in the four closed sales rounds mentioned above, and 12.8% (approximately 65 million SOL) was allocated to the Solana team.

Distribution of SOL tokens. Image from the Binance website.

10.4% (approximately 52 million SOL) was allocated to the Solana Foundation, a non-profit organization dedicated to educating people and spreading blockchain technologies. The remaining 39% (approximately 195 million SOL) is reserved for the Solana community (as rewards for validator nodes).

It is important to note that the Solana token release schedule is quite aggressive. Team funds will be slowly released over two years until January 7, 2021, but all other SOL tokens will immediately be in circulation.

SOL price analysis

The Solana cryptocurrency debuted on the market in April 2020 at a price of approximately $1 per SOL. Shortly thereafter, SOL began trading on Binance however this did not affect the price as the token dropped to around 60 cents and remained there until early July.

Solana price history. Image from CoinMarketCap website.

At the end of July, there was news that the popular cryptocurrency derivatives exchange FTX was going to introduce the Serum decentralized platform on the Solana blockchain. This caused Solana’s price to skyrocket to almost $5 over the next month.

Although the price has settled around $3 since then, the SOL remains in a visible uptrend. It is not yet clear how long this will last given the influx of tokens into the market in January 2021. With a current turnover of only 40 million SOL, a sudden increase in supply could have a negative impact on Solana’s price.

Where to buy Solana (SOL) tokens

If you want to buy SOL cryptocurrency, there is only one option: Binance . The volume of trading on other exchanges is quite low, and the reputation of most of them is not very good (we will not name names).

Solana’s daily trading volume is also fairly low given the project’s market cap, and is slowly declining. This can lead to serious volatility, so trade with caution!

Cryptocurrency wallets for SOL

Unfortunately, there are not many cryptocurrency wallets available for Solana at the moment. When it comes to software wallets, the choice is limited to Binance’s Trust Wallet. The only hardware wallet that currently supports the SOL cryptocurrency is the Ledger .

Quite interesting is the Solana web wallet called SolFlare , which is a non-custodial type and developed by the community.

Solana Roadmap

The Solana project does not currently have a well-defined roadmap. The latest roadmap shows that the team has not achieved any of their intended goals. And there are reasons for that. Anatoly Yakovenko noted in March of this year that in the development of Solana, the team faced almost every problem imaginable. Therefore, Solana’s main blockchain is still in beta

Despite some problems in development, the Solana team managed to conclude a number of serious partnership agreements. Their collaboration with FTX’s Serum DEX is especially important, in part because the FTX team studied dozens of alternative blockchains over the course of a year before choosing Solana.

The second major partner is Chainlink, with which Solana is developing a super-fast oracle. This oracle will be cheaper to use and will be able to update the price data for each Solana block (every 400ms). Most recently, the Solana team agreed to another major partnership with Tether to bring USDT into their ecosystem

In a recent interview , Yakovenko highlighted Solana’s goals. Most of them are related to the ability to work effectively with hundreds of millions of users and hundreds of thousands of decentralized applications.

On a more technical level, the Solana team wants to reduce the block generation time to just 80ms. In addition, the developers hope to enable 1ms cryptocurrency trades on decentralized exchanges based on the Solana blockchain. For comparison, the smallest timeframe on the Binance exchange is 1 minute.

No specific stages for the further development of the project are indicated. Although there has been a discussion on the Internet about the introduction of community governance with the participation of all SOL token holders, a detailed plan for this governance model and a forecast of the implementation timeline have not yet been published.

Our opinion about Solana

The creator of Solana in an interview mentioned something that everyone should think about: what will happen when decentralized exchanges become more efficient than centralized ones? Of course, the answer is that centralized cryptocurrency exchanges will switch to using a decentralized blockchain that provides this higher efficiency. The Solana team is determined to make their project this blockchain, and they have every chance to succeed.

Solana token emission schedule. Image from the Binance website.

The only obvious problem with Solana is the issuance schedule for SOL tokens. The visual representation of this issue can be safely called one of the scariest images in cryptocurrency. The number of tokens in circulation will increase from approximately 15% to 95% of the total supply in one week! It is very hard to believe that this will not have a negative impact on the price (at least in the short term).

It is also questionable whether Solana will be able to overtake competitors such as Ethereum 2.0 and Polkadot. While the project prides itself on not using layer 2 auxiliary blockchains, the point is that the average user of a decentralized application won’t care how the underlying infrastructure works as long as it works well. This narrow-mindedness can ruin a project if not handled with care.

The Solana Team Image from Coindesk.

Overall, Solana is a very promising project, and heavyweights like FTX CEO Sam Bankman-Fried truly believe in its promise. First, the project team is very strong and far-sighted. Second, even though Solana is still in beta , it boasts a very slick interface with over 3.5 billion confirmed transactions.

Third, the company had a rather modest start and is not backed by hundreds of millions of dollars from venture capital investors looking to make a quick profit. Taken together, these facts point to one thing: the result.