Pattern 5-0 is a simple pattern strategy that allows you to predict

reversals or, at least, a trend retracement with a fairly high accuracy .

Signs of a Bullish 5-0 Pattern

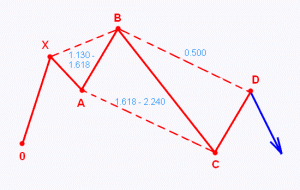

1. There was a bearish trend on the markets, directed from point O to point X;

2. There was a price correction on the XA segment;

3. After the correction, the price continues to decline (segment AB) to Fibo levels with a value of 113% -161.8%

4. Then the price performs a strong corrective movement to Fibo levels with a value of 161.8% -224%

5. Then there is a short downward movement, approximately 50% of the BC segment.

6.The final trend reversal occurred at point D

For the “Bearish 5-0 pattern” similar conditions, but for the bullish trend.

Position opening:

1. Determine the presence of a 5-0 pattern on the chart.

2. Having received point C, place a pending BuyLimit order (for a bullish signal pattern) or a SellLimit order (for a bearish signal pattern) at the level of point D, which is formed as a result of drawing a parallel channel at points ABC. Point D is usually at the 50% Fib level of the BC segment.

3. Stop-loss is set at the next Fibo level for 50% in case of a 38.2% or 23.6% rollback. The amount of the last indent depends on the time interval. The larger the spacing, the more indentation we provide.