The Trend Lines strategy is one of the multi-currency trading strategies that is based on plotting trend lines, where the price itself is an indicator that reflects the situation in the market. This trading strategy is similar in some respects to the 3-touch strategy, so it is very easy to use and gives good results.

This strategy uses two time frames – H1 and M5. First of all, the H1 chart is analyzed, and deals are made on M5.

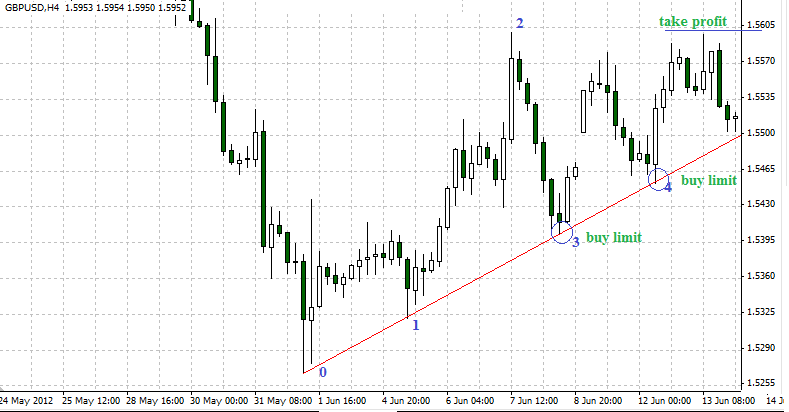

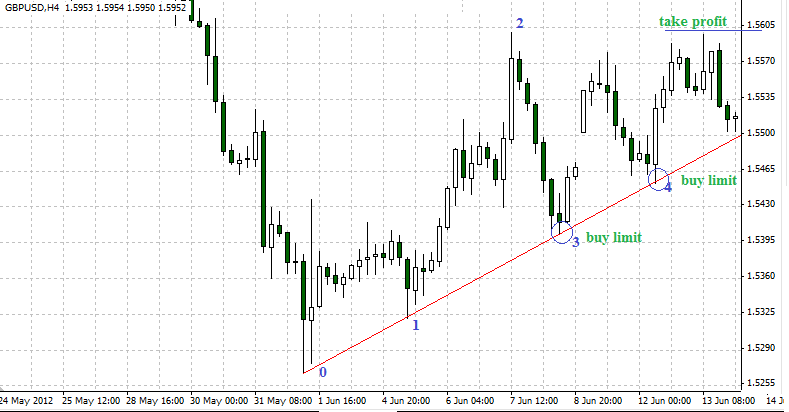

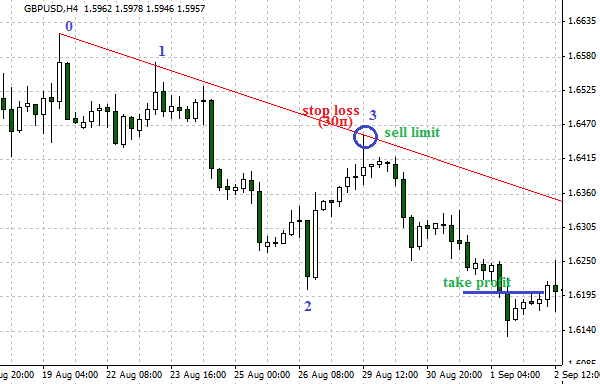

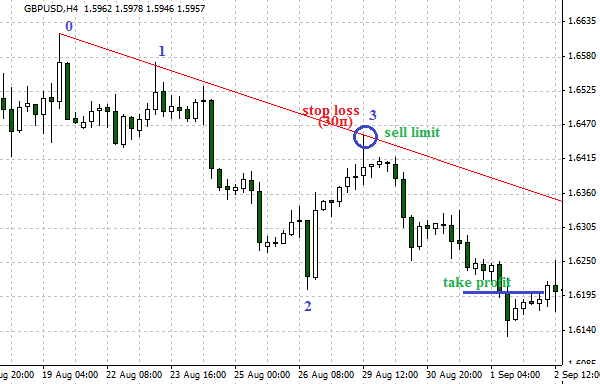

1) It is necessary to determine 2 consecutive points on the H1 time frame, designating them for example as “0 and 1”, through them it is necessary to draw a trend line.

2) Then, after finding the points “0” and “1”, you must go to the interval “M5”.

3) After the formation of the minimum point 1, we expect the formation of a new maximum, which we denote as 2.

4) After the maximum has formed, you should wait for the price correction to the trend line, where a purchase will be made using a pending order at point 3. For buy deals, the order should be placed above the trend line by about 4-7 points.

5) Place a stop loss below point “1”. You can also place it at the level below the trend line at the level of 20-30 points.

6) Place take profit at the level of point 2. If you wish, you can close only part of the position, and move the stop loss to breakeven.

When using this strategy, you need to remember one important condition that the stop loss level should be at least two to three times less than the take profit size.

If this condition is not met, then the deal is not concluded!