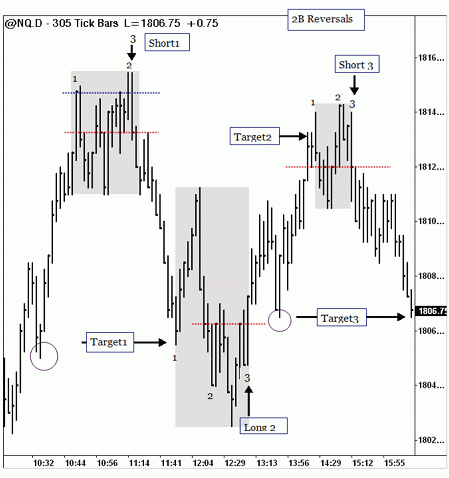

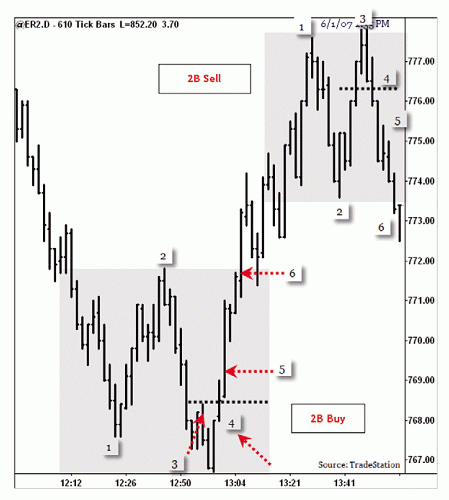

Trading on the 2B pattern (“Spring”) allows you to determine the possibility of a downtrend or uptrend change when the price does not form new lower lows or highs.

This pattern is used when the price in the market has formed another high or low, after which a correction occurs. After a rollback, the price will try to test the already formed high or low of the price. Failed testing is a potential signal that indicates a reversal of the previous trend. This moment signals the beginning of a corrective movement.

Formation of tops 2B occurs according to the following rules:

The price moves in an uptrend, forming a new maximum, for example, for 20 bars, after which a price correction occurs, consisting of 6 – 9 bars. Then the price will try to break through a new maximum, after which it will close above it. This bar is commonly called a “breakout bar”. If the close above the top of the bar does not occur and the price closes below the minimum, a 2B pattern will form. Stop loss is set at the maximum, and take profit, at least at the nearby minimum.

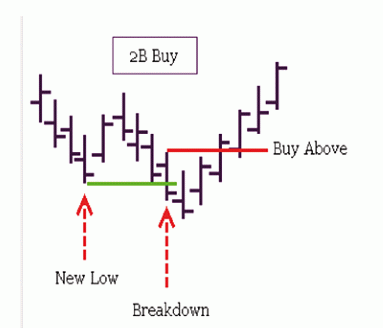

The formation of 2B lows occurs according to the following rules:

A new low is forming in the market. Then a rollback occurs, consisting of 5-8 bars. The price will then try to update the minimum and the bar will close below the new minimum. This is the breakout bar. If the price reverses and the next bar closes your broken low, a 2B pattern will form.

Opening a long position:

1) A new low should form.

2) A price pullback should occur.

3) A bar should form and close below the low of bar 1.

4) We mark the high level of bar 3, and then wait for the bar above 4 to close.

At a high of 4, go long.

We fix the profit at the nearest local maximum.

When opening a short position, the conditions are opposite.