We explain how investing in companies that follow environmental, social and good governance principles has become the new normal of finance.

The price of ESG companies has grown dramatically in recent years and there are incentives already approved for them to continue to rise in the future.

“Greed is good . ” That is the phrase with which the banker Gordon Gekko preached the benefits of capitalism during the Teldar Paper shareholders’ meeting. “Greed is fine. Greed works. Greed clarifies, opens paths and captures the essence of the evolutionary spirit “, evangelized Gekko, played by Michael Douglas in the film Wall Street (1987), before the captive gaze of all shareholders and of his young apprentice: the character of Charlie Sheen .

“And greed – you can underline my words – will not only save Teldar Paper , but that other corporation that does not work: the United States”, he concludes before a room that breaks into applause to praise the best known monologue of all the career of Michael Douglas.

That speech could be very well received on Wall Street in the 1980s. But today, 40 years later, it is out of date because greed is no longer the only thing that moves financial markets. Seeking the highest returns remains the priority of asset managers, yet sustainable investment criteria are the ‘new normal’ in the world of finance.

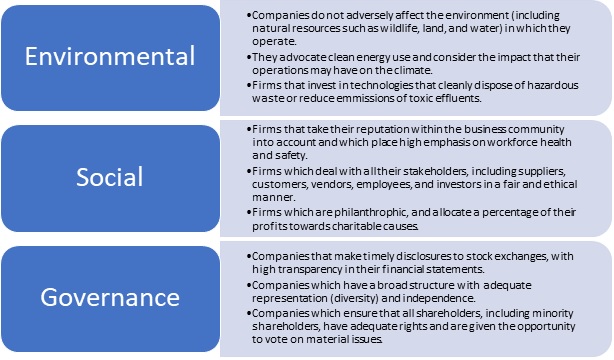

How to invest in sustainable companies: what are ESG investments

At the beginning of 2020, there was about 17.1 trillion dollars in the United States for ESG investments , an acronym that exclusively includes companies that use environmental, social and good governance principles . The figure is 42% higher than the 14 trillion at the beginning of 2018 , according to a report published in 2020 by US SIF , an organization that supports sustainable investment in the United States.

It is estimated that around the world there are about 40 billion dollars of companies that have carried out ESG investments , a trend that does not go unnoticed in Spain. The Spainsif organization estimates that in 2019 in Spain there were some 285,454 million euros invested in assets with ESG criteria , 36% more than the 210,644 million registered in 2018.

And the 285,454 million in 2019 is seven times the 35,710 million that were invested in ESG in Spain in 2009 , data that shows the appetite of investors to be part of companies that strive to have a positive social impact. Those millions invested in ESG contradict that famous New York Times article written in 1970 by economist Milton Friedman, who claimed that the only social responsibility of business is only to increase profits.

Which ESG investments are profitable

Investments that take into account sustainable principles are starting to return higher returns than those that do not follow them. The concept of sustainable investment is quite broad and includes companies in different industries.

And, of all the sectors they cover, the actions of companies related to renewable energies , the development of the green economy, or the electric vehicle are the ones that have registered the best performance.

Tesla securities have appreciated 1,100% in the last two years , going from $ 53 to $ 690 from August 2019 to the present. But Elon Musk‘s company is not alone in this sector. In the same period, NIO shares have risen 642% , while those of LI Auto have appreciated 59%, those of XPen 62% and those of Lordstown Motors 25% since they went public between 2019 and 2020.

The first three are Chinese manufacturers of electric vehicles, while Lordstown develops a type of electric pick-up truck. The S&P 500 index, meanwhile, has appreciated 40% in the last two years.

That of renewable energy is another sector with ESG criteria spanning a time of prosperity . In Spain, companies such as EDP Renováveis or Solaria have appreciated 130% and 250% respectively in the last two years. For its part, Iberdrola has risen 42%.

Among many other companies outside of Spain, the Danish Ørsted (+ 97%) , the Canadian Canadian Solar (+ 147%) , the American Brookfield Renewable Partners (+ 159%) and the Danish Vestas ( + 159%) have registered a good performance ( + 106%) . Renewables have been in development for years and are increasingly meeting the energy needs of a planet that will consume less fossil fuels more and more efficiently

Investing in sustainable companies, the ‘new normal’ of finance

The pandemic has been a push for ESG investments to stop being niche and play a key role in the asset management industry. The expansion of the new coronavirus (COVID-19) has provided an extra stimulus for investors to turn their attention to long-term projects , that is, those that will be essential in the future and will allow companies to recover quickly from any situation .

Developing sustainable projects is already the ‘new normal’ in the business world. And to that end, Western governments are preparing gigantic funds to only support projects that follow ESG criteria .

In the case of the European Union, the Commission has created a fund of 750,000 million euros, called Next Generation EU , with which only ideas that allow building a more “ecological, digital and resilient” Europe will be financed, according to the Commission. European on web. Companies have to present innovative projects that follow ESG criteria to access these resources.

You may also like:

- Binance Coin (BNB) Arbitrage, Price Prediction and Technical Analysis Prediction 2021-2022

- WhatsApp: how to hide the “writing” notification in the app

- How to Find Vertical Asymptotes in the Forex Markets

An example is Ferrovial’s proposal to build 20 ‘vertiports’ for flying taxis in Spain. A ‘vertiport’ is a prototype airport for vertical take-off aircraft that could be located within cities, as is the case with helipads in skyscrapers. The aircraft would use electrical energy generated with renewable systems.

Meanwhile, the new president of the United States, Joe Biden , said during the election campaign that he would invest 2 trillion dollars (1.7 million euros) to develop a plan to help reduce greenhouse gas emissions . There is money, desire and companies and governments seem committed to supporting ESG initiatives. There is no other: the investment will be sustainable or it will not be.