Volatility is back! The week started with a bang this Monday, September 6 with a Bitcoin (BTC) which pierced the 52,000 dollars like butter until it even touched the 53,000 dollars the following day. Subsequently, the last 24 hours have been less tender for the market, after several consecutive weeks of rise and a new local top reached, the cryptocurrency suffers an impressive fall of nearly 20% on Tuesday, September 7, 2021. Return and explanations on this phenomenon, what can we expect next?

A vertiginous drop from 53,000 dollars

After almost 2 months of continuous rise, and against all expectations, Bitcoin (BTC) undergoes its first major correction, the largest since June by losing more than $ 10,000, drastically plummeting the price of the cryptocurrency and leading it to its lowest level since early August.

Everything was going for the best on the bulls side in recent weeks, the virtual currency continued to explode its resistance without difficulty , until reaching 52,920 dollars on Binance at the high of the daily candle of Tuesday, September 7, 2021. A value that rivaled with early-May levels.

But that was without taking into account the effect of “buy the rumor, sell the news” (the fact of buying at the first echoes of the rumor and selling when the news came out) since this Tuesday was the first day of adoption of Bitcoin (BTC) as the official currency of El Salvador, a news that was closely followed and expected by all market players for several months.

The effects were not long in coming, suffering a sharp rejection from $ 52,920, the price of the cryptocurrency quickly fell into the area around the critical support of $ 43,000 falling to $ 42,843 at the low of the daytime.

With this plunge of nearly 20% in the space of a day, sellers manage to make Bitcoin (BTC) regress to a level that has not been visited since August 9. (More Analysis: Stellar Strategies: What Large investment funds bought while the market was growing wildly : Market Analysis)

Following this significant downward movement, volatility spilled over and price rebounded sharply from the low point, with buyers managing to swallow the decline until closing the day at $ 46,863.

This flash-crash validates the divergence that can be observed on the chart below with a volume visibly declining for several weeks despite the soaring price of virtual currency. A sign that heralded a likely fall to come as the bullish momentum waned.

A potential support area to restart the machine

Despite the fall, some technical elements still remain in favor of the bulls. We can thus notice that the rebound caused by the reaction to the support of the 43,000 dollar zone brought Bitcoin (BTC) just above its capital support represented by the 200-day moving average.

We observe on the graph that only the wick protrudes and that the body of the candle rests on this important floor, thus giving hope for a maintenance by the buying force from this zone.

In addition, we can also note the bullish divergence that we find against the RSI, it is another technical element which corroborates this possibility of continuation to the rise from this support.

All is not therefore lost and the bulls still have their say in what will happen next. As long as we manage to maintain this zone, the continuation of the bullish movement started in recent weeks is more than possible.

Excesses on the levers involved

How to explain this sudden fall in the market? El Salvador may well be the catalyst causing the effect of “sell the news” initiated by the whales, behind such a crash often hides an accumulation of elements that pile up to collapse.

And it does appear to be the case here. The culprit is clear: Leverage effects, at least their massive abuse by traders.

Thus, over the last 24 hours, no less than 376,449 liquidations have taken place, many traders having placed themselves in over-indebted positions.

According to Bybt data , there is a total of $ 3.7 billion liquidated on the day for exchanges offering derivatives markets, with the record for the largest liquidation attributed to Huobi with 43.7 million liquidated on a single order. .

Respect for the historic bearish tradition of September

Completely unexpected fall? Maybe not that much if you consider the lessons of the past about the queen cryptocurrency.

Bitcoin (BTC) tends to follow increasingly obvious patterns. These patterns that can now be observed with enough history on the price of the cryptocurrency allow us to draw certain conclusions.

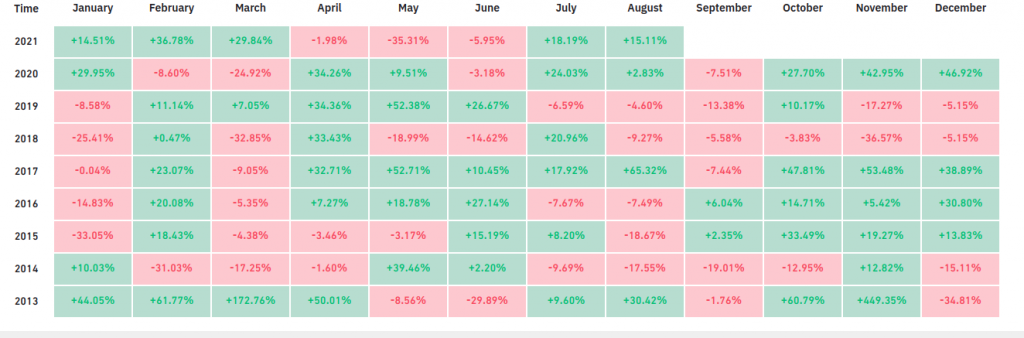

We can thus observe that this month of September is no exception to the rule in 2021 by being considered a traditionally bearish month in the history of Bitcoin (BTC).

It is therefore not a total surprise to see the fall occur precisely this month, it is even something that we could anticipate .

This table reminds us that the month of September has never been significantly to the advantage of bulls, historically Bitcoin (BTC) has never seen an increase of more than 6% in September.

Diving does El Salvador’s business

We cannot talk about this considerable drop without making the obvious link with all the news around El Salvador and the officialization of Bitcoin (BTC) as the currency of this Central American country, an event that has without zero doubt played a major role in the volatility of the last 24 hours.

Despite the adoption by El Salvador which was supposed to be the most encouraging news for the future of cryptocurrency, the price did not react in the most optimistic sense.

But that was not enough to disconcert Nayib Bukele , the president of El Salvador who took advantage of this drop to do his small purchases and accumulate Bitcoin (BTC), up to 550 who are now in El Salvador’s possession according to his statements.

Buying the dip 😉

— Nayib Bukele 🇸🇻 (@nayibbukele) September 7, 2021

150 new coins added.#BitcoinDay #BTC🇸🇻

Historic launch for Bitcoin (BTC) in El Salvador and shattering consequences for the cryptocurrency market which sees its bullish progression of several weeks reduced to nothing in the space of a few hours. The crypto thus finds itself revisiting the critical low of 43,000 dollars before a rebound in extremis propelling the price just above its symbolic support of the 200-day moving average. Opportunistic operation of the bears taking advantage of the context or real end of the festivities for the bulls? The next 48 hours may give us the answer.