China’s crackdown on Micron Technology, a U.S. chipmaker, has placed South Korean companies, Samsung Electronics and SK Hynix, in a difficult situation. They must choose between expanding their market share in China, the largest economy in Asia, and potentially angering Washington, or refraining from doing so and risking the ire of Beijing.

Samsung Electronics and SK Hynix are the world’s top two memory chip manufacturers, with Micron ranking third. While all three companies conduct significant business in China, only the two South Korean companies have extensive production facilities in the country.

In an announcement on Sunday, Beijing declared that Micron had failed a security review, resulting in a ban on operators of critical infrastructure from purchasing products from the company.

While Micron has faced scrutiny from Chinese regulators for months, Samsung and SK Hynix find themselves caught in the middle of the conflict between the two superpowers. Last month, the United States requested that Seoul urge its chipmakers not to fill any market gaps that might arise from a potential Chinese ban on Micron.

Despite the political tensions, some analysts perceive Micron’s challenges as a significant business opportunity for Samsung and SK Hynix.

“They have the potential to capture the market share that Micron loses in China. This is advantageous for them, as they are not in a disadvantageous position,” stated Lee Seung-woo, a senior analyst at Eugene Investment & Securities, in an interview with Nikkei Asia. “While the exact extent is uncertain, it is undoubtedly beneficial for them.”

According to Mark Li, an analyst at Sanford C. Bernstein, the worst-case scenario for Micron would result in an approximately 11% revenue loss due to the ban. However, Li believes this outcome is highly unlikely, with a more probable impact on revenue in the “low single-digit percentage” range.

Li acknowledges that China is likely to approach South Korean companies for memory chip supplies. However, he expresses uncertainty about whether these companies would be willing to comply.

“Given that China’s domestic memory suppliers are not technologically or capacity competitive, China would need to turn to Samsung, SK Hynix, Kioxia, Western Digital, or other foreign suppliers as alternatives to Micron,” Li stated. “However, these companies are all from countries that are allies of the United States and rely on equipment exported from U.S. suppliers. We believe the chances of these foreign memory chipmakers ignoring U.S. pressure and fully capitalizing on the ban on Micron to gain market share in China are low.”

China’s Foreign Ministry expressed opposition to any attempts to prevent South Korean chipmakers from selling to China and reiterated its stance against export controls. They stated that export restrictions “seriously violate the principles of market economy and international economic and trade rules, and undermine the stability of the global production and supply chain. We firmly oppose this practice,” as stated by Foreign Ministry spokesperson Mao Ning.

It is also important to consider the overall state of the memory chip market.

“We estimate the ban on Micron’s products in China will have a limited impact on the global memory chip industry, including on Chinese clients because the overall market is still struggling with oversupply amid the slowing global economy,” said Brady Wang, a semiconductor analyst with Counterpoint Research.

“If the ban goes on longer — for two, three years, or more — South Korean players would benefit from the vacancy of Micron in the Chinese market. But at the moment, no one knows how long the restriction will last,” Wang said.

On Monday, shares of SK Hynix rose by 0.9% to 98,200 won, while Samsung Electronics saw a slight increase of 0.2% to 68,500 won.

Both Samsung and SK Hynix declined to comment on the situation for this article. The South Korean government stated that it was “not aware” of China’s ban on Micron.

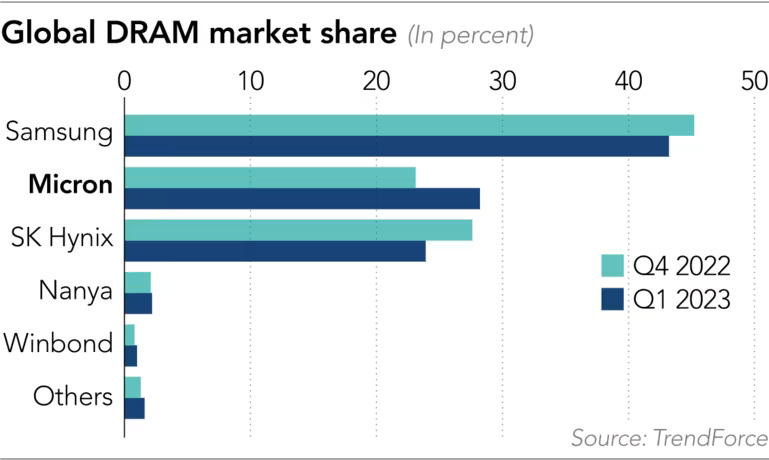

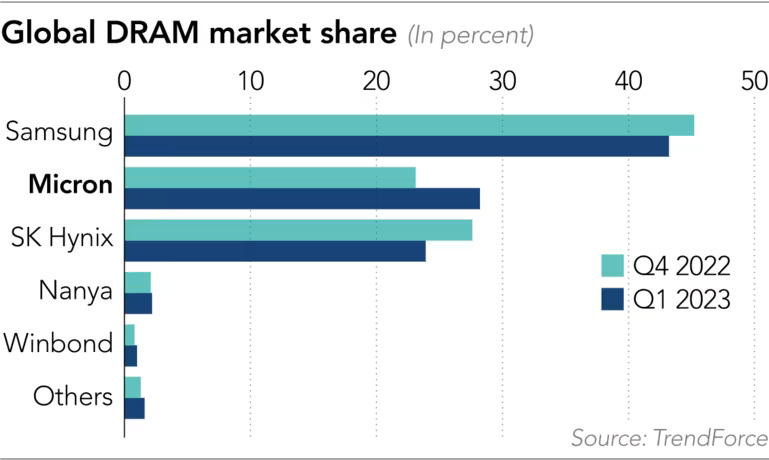

Data from research agency TrendForce shows that Samsung and SK Hynix dominate global sales of dynamic random-access memory (DRAM) chips, with market shares of 40.7% and 28.8% respectively in the final quarter of 2022. Micron held a market share of 26.4%. DRAM chips are used in various devices such as TVs and smartphones, but they are considered commodity products and are subject to price fluctuations.

Samsung has a NAND flash chip facility in Xi’an, China, and a back-end plant in Suzhou. SK Hynix has a DRAM chip facility in Wuxi and a NAND flash factory in Dalian. Both companies have obtained export waivers from the U.S. government, allowing them to continue supplying production equipment to their Chinese facilities.

Micron stated in a statement to Nikkei Asia that they have received the notice of conclusion from the Cyberspace Administration of China regarding its review of Micron products sold in China. They are evaluating the conclusion and assessing their next steps, and they look forward to continuing discussions with Chinese authorities.

China initiated its investigation into Micron in March after the U.S., along with Japan and the Netherlands, signed an agreement to restrict their exports of chip production tools to China.

Although most of Micron’s production occurs outside China, the company does have a component and module assembly and test facility in Xi’an. In its annual report, Micron stated that its China and Hong Kong-based clients accounted for approximately 16% of its total revenue in 2022, down from 18% in 2021 and 19% in 2020.

Micron has expressed concerns about growing risks from the technology conflict between the U.S. and China, including increased competition from Chinese NAND memory chip companies such as Yangtze Memory Technologies and Changxin Memory Technologies. Micron even warned in its filing that it could face restrictions in accessing the Chinese market.