Welcome to the dynamic world of option trading, where opportunities and risks dance hand in hand. In this comprehensive guide, we will unravel the intricacies of hedging option trading strategy—a powerful tool designed to navigate uncertainties and protect your investments. Whether you are a seasoned trader or a newcomer, understanding how to hedge in the options market is crucial for managing risks effectively. So, let’s dive into the meaning of hedging, explore various strategies, and learn how to implement them in your trading journey.

Understanding Hedging in Options Trading

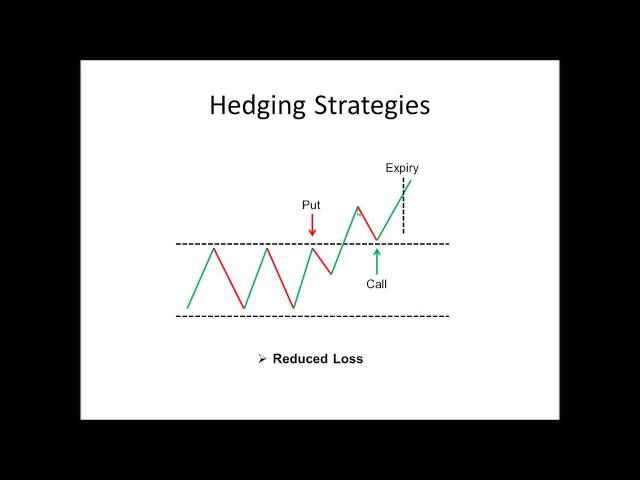

In the realm of options trading, a hedge is a strategic maneuver aimed at reducing or managing the risk of adverse price movements in an underlying asset. The primary objective is to limit potential losses while acknowledging that it may also cap potential gains. Picture this: your stock portfolio is like a beautifully nurtured garden, and market volatility is the unpredictable weather. Hedging acts as a protective fence, shielding your investments from potential losses during adverse market conditions.

Types of Hedging Strategies

1. Protective Put Strategy:

- This common hedging strategy involves buying a put option on the underlying asset.

- Example: If you hold 400 shares of Infosys and anticipate a potential drop in its price, you can buy Infosys Put options to minimize losses.

2. Bull Call Strategy (Option Buy Position):

- When you are bullish on an asset (e.g., Nifty), you buy a Call Option.

- To hedge against potential losses, you simultaneously sell a Call Option with a higher strike price (e.g., Bull Call Spread).

3. Hedging Option Sell Position:

- If you’ve sold a Call Option on Nifty with a specific strike price, you can hedge by buying a Call Option with a higher strike price.

- This limits potential losses if Nifty moves above your initially sold strike price.

Options Trading Hedging Strategies: A Closer Look

Types of Options Explained

1. Call Options:

- Confer the right to buy an underlying asset.

- Used when anticipating a market price increase.

2. Put Options:

- Allow the sale of a stock at a predetermined price within a specific timeframe.

- Deployed to protect against potential downside risks.

Also Read: Scalping Trading Strategy: Meaning and How to Use It for Profits

Steps to Start Hedging with Options

- Learn Options Trading:

- Acquire a solid understanding of options trading, including terminology and market dynamics.

- Account Setup:

- Create a trading account with a reliable broker that supports options trading.

- Market Selection:

- Choose your preferred options market, considering factors like expiration dates and strike prices.

- Strike Price and Position Size:

- Select an appropriate strike price and determine the position size based on your risk management strategy.

- Deal Execution and Monitoring:

- Execute your options hedge and actively monitor market conditions.

- Adjust or close the hedge based on your assessment of market movements.

How Does Hedging Protect Investors?

Consider a scenario where you’ve purchased a Tata Motors stock and foresee a potential short-term price fall. By buying a put option (protective put), you limit your maximum loss to the option premium paid. If the stock price falls, the put option’s value increases, offsetting losses in the underlying stock.

Pros and Cons

Pros of Hedging

- Downside Protection: Shields investors from heavy losses, minimizing the impact of unfavorable market movements.

- Promotes Liquidity: Encourages liquidity by allowing investors to explore different asset classes.

- Versatile for Long-Term Investors: Options serve as effective hedging instruments for both short-term and long-term traders and investors.

Cons of Hedging

- Cost Involvement: Hedging comes with a cost, potentially impacting profits if the original trade performs well.

- Risk-Reward Trade-off: Reducing risk may lead to reduced profits, highlighting the trade-off between risk and reward.

- Complexity for Short-Term Traders: Short-term traders may find hedging to be a complex strategy.

- Capital Requirement: Trading in options or futures often demands high capital investment.