In the world of technical analysis, the Hammer Candlestick pattern stands out as a powerful tool for traders seeking to understand and capitalize on market trends. This article blends insights from multiple sources to provide a comprehensive guide to the Hammer Candlestick, covering its definition, application, and limitations. Whether you are a seasoned investor or a newcomer to the world of trading, unlocking the secrets of the Hammer Candlestick can enhance your ability to make informed decisions.

Defining the Hammer Candlestick

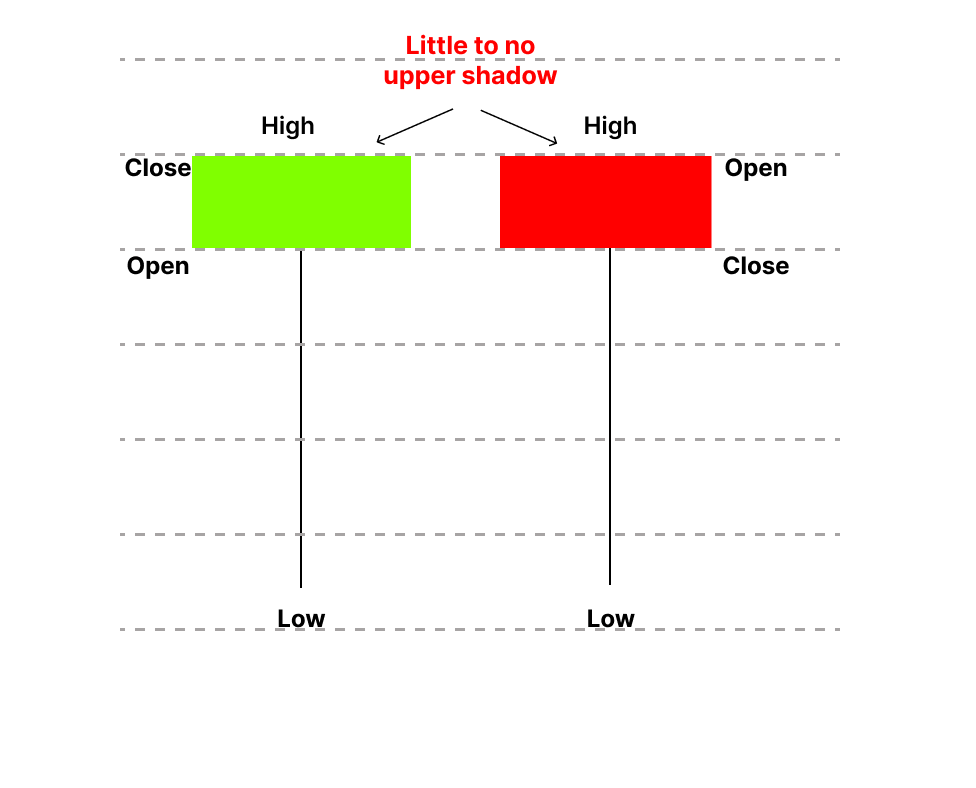

A Hammer Candlestick is a distinctive pattern in candlestick charting that materializes when a security experiences a significant decline from its opening but rebounds within the period to close near the opening price. Visually, it resembles a hammer, with the lower shadow being at least twice the size of the real body. The real body represents the gap between the opening and closing prices, while the shadow illustrates the high and low prices during the trading period.

Understanding the Nuances

Hammer Candlesticks often emerge after a prolonged downtrend, signaling that the market is in the process of finding a bottom. This pattern suggests a potential capitulation by sellers, with a subsequent price rise indicating a potential reversal in the price direction. However, it’s crucial to note that a Hammer Candlestick doesn’t guarantee an immediate price reversal; confirmation is essential.

Confirmation and Trading Strategies

Confirmation occurs when the candle following the Hammer closes above its closing price. The confirmation candle ideally exhibits robust buying activity. Traders commonly use additional analyses, such as price or trend analysis and technical indicators, to validate Hammer Candlestick patterns. It’s essential to place stop-loss orders strategically, considering factors like the low of the Hammer’s shadow.

Practical Application

Spotting a Hammer Candlestick on a price chart is just the beginning. Traders should wait for confirmation and consider the broader market context. The appearance of a Hammer in a downtrend indicates more bullish investors entering the market, potentially foreshadowing a reversal in the downward price movement. Practical considerations include setting up directional trades, identifying optimal entry and exit points, and managing risk through stop-loss orders.

Also Read: Best Indicators for Intraday Trading: A Comprehensive Guide

Differentiating the Hammer Candlestick

Distinguishing the Hammer Candlestick from other patterns is crucial for effective analysis. A key comparison is with the Doji, which has a smaller real body and signals indecision. The Hammer, with its long lower shadow and occurrence after a price decline, indicates a potential upside reversal, especially when confirmed by subsequent price action.

Inverted Hammer and Other Variations

An inverted hammer is a bullish reversal pattern that occurs during a downtrend. It resembles a Hammer but with a long upper wick. Traders can observe these variations on charts, providing additional insights into market dynamics. Understanding the differences between these patterns enhances a trader’s ability to interpret and act upon market signals.

Is a Hammer Candlestick Bullish?

Yes, the Hammer Candlestick is a bullish pattern, suggesting that a stock may have reached its bottom and is poised for a trend reversal. Sellers initially drive the price down, but buyers eventually outnumber them, leading to an upward price reversal. Confirmation is crucial, with the following candle closing above the Hammer’s previous closing price.

Limitations and Cautionary Notes

While the Hammer is a valuable tool, traders must be aware of its limitations. The absence of a price target and the potential for a distant stop loss highlight the importance of supplementary analyses. Monitoring the speed of retracement and considering the context of the pattern within the overall trend are vital precautions.

Conclusion

In conclusion, the Hammer Candlestick is a potent instrument in the trader’s toolkit, providing insights into market dynamics and potential trend reversals. Its bullish nature, when confirmed, opens opportunities for strategic trades. However, traders must approach its application with caution, considering its limitations and incorporating it into a broader analytical framework. By mastering the nuances of the Hammer Candlestick, traders can unlock valuable insights for successful trading endeavors.