- Citigroup Inc. stock can be a bad, high-risk 1-year investment option.

- Citi at $50 by the end of 2023 and $46 by 2024.

- On 27 Mar 2023, was 48$ (approx) (As per Nasdaq), and now at the time of writing, Citi’s Stock price is trading at 46$ (approx).

Long-term projections have Citi at $50 by the end of 2023 and $46 by 2024. Citi stock will hit $43 in 2025, and $36 in 2027, with further gains, expected after that.

Citigroup Inc. stock is a bad long-term (1-year) investment.

At City Telegraph, we predict future values with technical analysis for a wide selection of stocks like Citigroup Inc. If you are looking for stocks with good returns, Citigroup Inc. stock can be a bad, high-risk 1-year investment option. Citigroup Inc.’s real-time quote equals 46.09 USD on 2023-04-05, but your current investment may be devalued.

Citi Groups Stock Chart and Share Price Forecast, Short-Term “CITI” Stock Prediction for Next Days and Weeks

Technical Analysis of Citi Group Inc by City Telegraph using Moving Average (MA) with range 50 and 200.

As per the above chart, it can be clearly seen that on 27 March 2023, the MA (50) crossed over MA (200). This means the market has been bullish since the beginning of 2023. This is a Death cross and since then date, i.e., 5 April 2023, the Citi group.inc Stock Price has Increased by 8.09% for the 5 days. Then we can clearly see that Citi Group’s Stock got a Downfall of around 4%. The price at the death cross, i.e., on the date 27 Mar 2023, was 48$ (approx) (As per Nasdaq), and now at the time of writing, Citi’s Stock price is trading at 46$ (approx).

As the RSI (Relative Strength Index) the RSI is a little over 50 (default range), this means Citi’s Stock might experience a price drop or correction in the coming days. Overall the market is bad for Citi Group inc stock in 2023-2024.

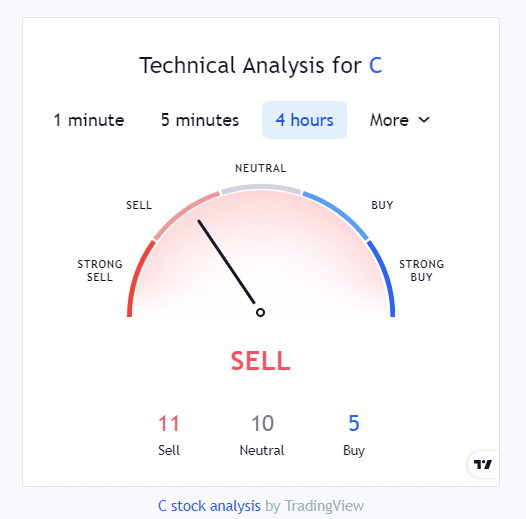

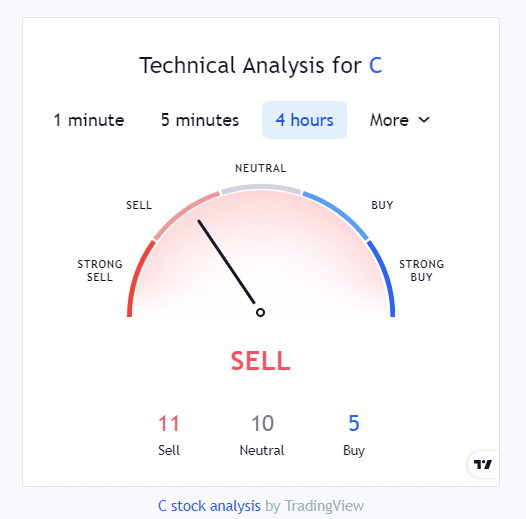

Citi Group Inc. stock Price Forecast by TradingView.com

TradingView.com provides a range of technical indicators and charting tools that can be used to analyze stock price trends and forecast future movements. Common indicators include moving averages, Bollinger Bands, and Relative Strength Index (RSI).

It’s important to note that while technical analysis can be helpful in predicting short-term stock price movements, it may not be as effective in forecasting long-term trends. Additionally, stock prices can be influenced by various factors, including market trends, company performance, and global economic conditions, among others.

Also Read: Veteran Merrill Lynch executive Andy Sieg joins Citi as head of Global Wealth