Table of Contents

- Determine What Type of Trader You Are

- Consider Getting Training

- Open an Account with a Brokerage Firm

- Learn the Language of Trading

- Develop and Backtest Your Strategy

- Paper Trade Your Strategy

- Set Aside Some capital

- Manage Your Risk

- Stay disciplined

Day trading is a popular way to make money in the stock market, but it can be intimidating for beginners. You may wonder how to start day trading if you’re just starting. This beginner’s guide will provide helpful tips on everything from day trading to the best strategies and tactics for success. Read on to learn more about how to start day trading.

Determine What Type of Trader You Are

Before starting day trading, you must determine what type of trader you are. Three main types of traders are long-term investors, swing traders, and day traders. Long-term investors tend to focus on stocks to hold them for a more extended period. Swing traders focus more on short-term price movements, while day traders focus on making multiple trades during the day. Beginners in 2023 should take some time to decide which type of trading best suits their personality, lifestyle, and goals. It’s also important to consider how much time and capital you can commit to day trading before starting.

Consider Getting Training

Investing in yourself is one of the best investments you can make, and getting training as a day trader is no exception. Many traders opt to take classes or receive mentorship from experienced traders. You can find many resources online or attend live seminars or classes.

For example, in 2023, the UK government launched an initiative for traders to learn about trading strategies and practice trading in a simulated environment. This program provides valuable resources and insight into trading and how to develop a plan. Additionally, many brokers also offer their trading courses and provide educational materials.

No matter what type of learning method you choose, make sure it is from a credible source with plenty of knowledge in the trading world. Understand what trading is like before putting your money on the line. With the right resources and guidance, you’ll be ready to start day trading!

Open an Account with a Brokerage Firm

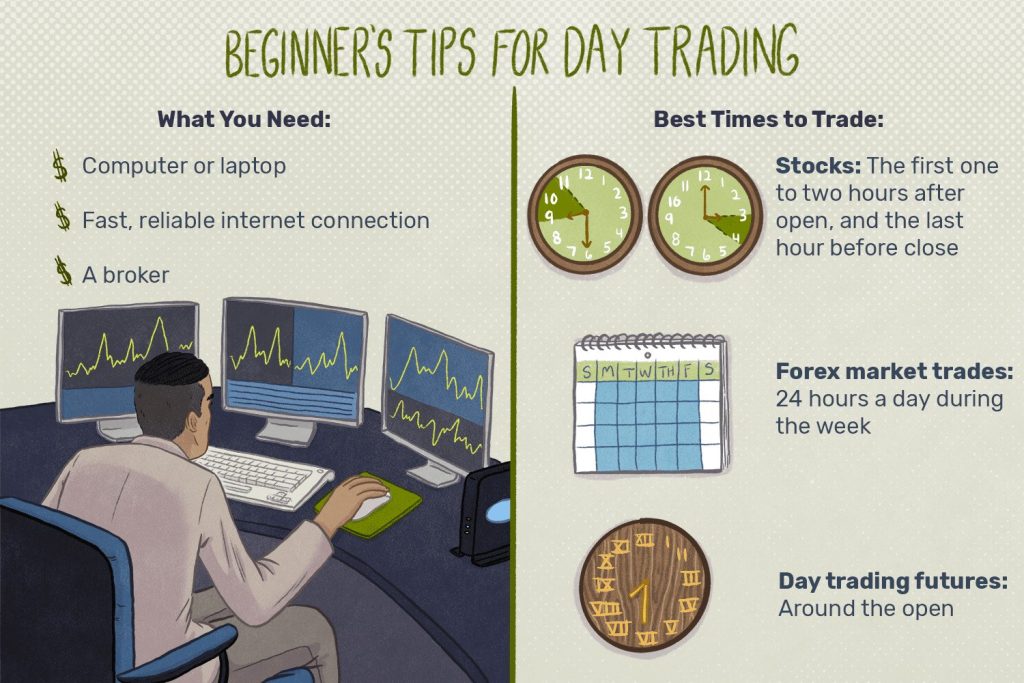

One of the most critical steps in day trading is to open an account with a brokerage firm. This is where you will be placing your trades and having access to real-time financial market data. As of 2023, many brokers offer services specifically tailored for day traders.

When selecting a brokerage firm, consider factors such as fees, account minimums, platforms, and available resources. Some brokerages provide users with a demo account, allowing them to familiarize themselves with the venue before they begin trading. Also, pay attention to their customer service policies. You want to be sure you can contact them with any questions or concerns.

It’s essential to read the fine print and understand the terms and conditions before opening an account with a brokerage firm. Make sure you understand the fees associated with trading, the regulations, and the risks associated with day trading.

Once you choose a broker, you must fund your account. You may be able to use a bank transfer, debit card, or credit card to do so. Once your account has been funded, you can place trades and begin day trading.

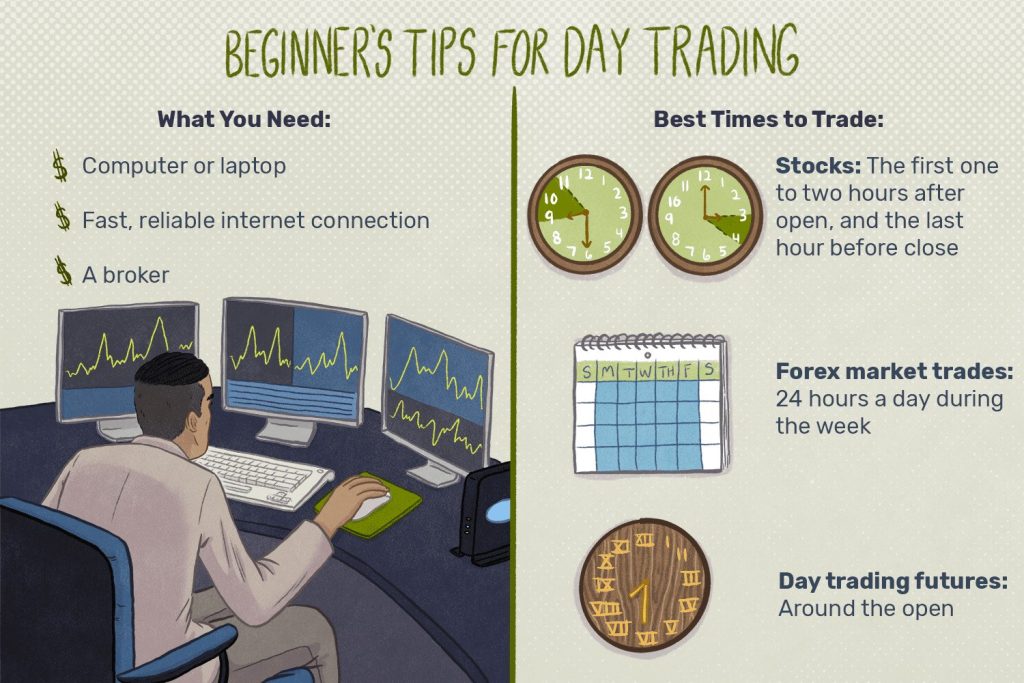

Day trading can be intimidating, but with some knowledge and preparation, anyone can become a successful day trader. Before you start trading for real money, it’s important to understand the trading language. Knowing all the terminology can help you make informed decisions about your trades and develop an effective strategy.

First, familiarize yourself with the different orders you can use when placing a trade. Market orders are executed at the best price available at that time. Limit orders are used to buy or sell at a specific price. Stop orders can be used to buy above the current market price or to sell below it. Stop-limit orders are also available, triggering a limit order once a specific fee is reached.

Next, understand the basics of the different asset classes in which you may be trading. These include stocks, options, futures, forex, and cryptocurrencies. Each of these markets has its own characteristics and terminology that you need to know. For example, stocks are bought and sold in increments of shares, while options have expiration dates and strike prices.

Finally, learn how to read charts and technical indicators. Charts visually represent a stock’s past performance, while technical indicators are mathematical calculations used to analyze past price action. Both can be used to identify potential trading opportunities.

Learning the language of trading is essential for any beginner day trader. Once you understand the basics, you can start researching strategies and putting together your own trading plan.

Develop and Backtest Your Strategy

Before you begin to invest your money in day trading, it is essential to create and backtest a strategy. Developing a trading strategy involves researching the markets, using technical analysis, understanding the different trading instruments, learning how to use charts and data, and considering various market conditions.

Backtesting your strategy involves testing your system on past data so you can determine how effective it would have been. This consists in running simulated trades using historical data to see how profitable or unprofitable your strategy would have been. Testing the strategy against different market conditions and time frames is essential.

The goal of backtesting is to assess the viability of the strategy. If it shows promise in terms of profit potential and risk management, you can move on to paper trading your strategy and eventually live trading. If the backtest results are not promising, you will need to tweak the strategy or develop a new one.

It’s important to understand that backtesting is not foolproof and should be used in conjunction with other types of analysis. Also, it is essential to note that even if a strategy works in backtesting, it is not guaranteed to work in live trading. So, when developing a day trading strategy, it’s best to do your research and due diligence before diving in.

Paper Trade Your Strategy

Paper trading is a great way to practice your trading strategy without putting any real money at risk. This practice allows you to gain experience in a live market environment and track your progress as you go. Paper trading can help you understand your strategy and give you the confidence to make decisions in the live market when you are ready.

The process of paper trading involves setting up a virtual trading account, researching and creating a strategy, and executing trades in the virtual version with virtual money. This process mimics real-life trading and allows traders to become comfortable with the platform and their strategy before entering the live market.

Before starting with paper trading, creating a trading plan suited to your individual goals, objectives, and risk tolerance is essential. Developing a trading plan will help you stay focused and organized while executing trades and managing risk. Your plan should include details about entry points, exit points, position size, and risk management techniques. Once your trading plan is in place, you can set up your virtual trading account.

Once you have set up your virtual trading account, you can begin paper trading using real-time data. As you trade, keep track of your performance, including wins and losses. This will help you identify areas of improvement and better understand how your strategy performs in different market conditions.

Although paper trading has its benefits, there are also some drawbacks. Since you are not investing real money, you may be less disciplined with your trades or take on more risk than with real money. Paper trading does not allow emotions like fear or greed to affect the decision-making process, so it is important to remember that it is not a substitute for real-world trading experience.

Paper trading can be an excellent tool for novice traders to learn the ropes without risking real money. It is essential to be disciplined and adhere to your trading plan while paper trading so that you can use the experience to build confidence and eventually transition into live trading.

Set Aside Some capital.

When it comes to day trading, capital is essential. To succeed, you need to have enough money in your trading account to cover all your trades. You must have no fixed amount of capital in your account; however, you should have at least $2,000 to $3,000 available to start day trading.

Before you begin trading, ensure you have enough capital to cover all your trades. Consider what kind of position size you plan to take and how much risk you’re comfortable with. This will help you determine how much capital you should set aside for trading.

It’s also important to remember that when trading, you should never risk more than you can afford to lose. This means you shouldn’t use the money you need for bills or other expenses. Make sure you have enough cash flow to cover your trading costs, such as commissions and fees before you begin trading.

Finally, remember that day trading is a risky venture. Setting aside some capital you can afford to lose if something goes wrong is essential. This way, if you suffer a loss, it won’t be devastating and you can keep trading until you profit.

Manage Your Risk

Risk management is an essential part of day trading. Understanding the risks involved and developing a risk management strategy that works for you is essential. Some basic techniques to manage your risk include:

1. Set a Maximum Loss Limit: Before entering any trade, it is essential to set a maximum loss limit. This should be an amount you are comfortable with losing and won’t affect your trading capital significantly.

2. Monitor Your Trade Risk: Keeping track of the potential risks associated with each trade is important. Consider factors such as market volatility, position size, and the time frame when assessing the risk of each trade.

3. Use Stop-Loss Orders: A stop-loss order is an order to buy or sell a security once it reaches a certain price. This can be used to limit losses if a trade goes against you.

4. Use Risk/Reward Ratios: Risk/reward ratios refer to the ratio of potential losses to gains from a particular trade. A good rule of thumb is a minimum reward-to-risk ratio of 1:2 or greater.

5. Utilize Hedging Strategies: Hedging is an investing strategy used to reduce the risk of loss. This can be done by taking an offsetting position in another security that will help to mitigate the potential losses associated with the original work.

By following these simple strategies, you can effectively manage the risks associated with day trading and protect your capital. By having a risk management strategy in place, you can ensure that you are taking the necessary steps to maximize your chances of success in day trading.

Stay disciplined

One of the most important rules for successful day trading is to remain disciplined. Staying disciplined means adhering to your trading plan, no matter the market conditions. You should always keep in mind why you are trading and what your goals are. Having a clear strategy will help you stay focused and maintain discipline even when the markets are volatile.

Practicing good risk management and knowing when to cut losses is essential. Don’t let your emotions influence your trading decisions. Instead, stick to your trading plan and focus on your long-term goals.

Another critical aspect of staying disciplined is having patience. You should not expect to make huge profits overnight. Day trading requires patience and practice. It takes time to develop a winning strategy, so don’t be discouraged if you don’t see immediate results.

Finally, staying up to date with market news and trends is essential. Knowing what is happening in the markets will give you an edge over other traders and can help you make informed decisions. Check the news regularly and take advantage of educational resources available online to stay on top of the markets.

Summary

This is a beginner’s guide to starting day trading. The guide explains that before starting, you must determine what type of trader you are and consider getting training from credible sources. Additionally, opening an account with a brokerage firm that suits your needs and understanding the fees and regulations associated with day trading is critical. Understanding the language of trading is also vital, as it can help make informed decisions. Developing and backtesting a strategy is necessary before investing money in day trading. Finally, paper trading is a great way to practice your strategy without risking real money.

Also Read: