What is the future for decentralized finance? – During its first year of existence, the DeFi ecosystem was restricted to Ethereum . However, in the face of growing congestion on the network, many blockchains and second-layer solutions have sprung up in the hope of providing a more economical alternative to Ethereum.

Blockchains EVM compatible

The DeFi ecosystem was born at the beginning of 2020 , with the sudden emergence of many decentralized financial protocols. Among them, we can cite the birth of many MAs such as Uniswap or Balancer , as well as the proliferation of so-called lending protocols , such as Aave or Compound .

However, as the DeFi ecosystem evolved , Ethereum faced a significant congestion issue causing transaction fees to rise.

Faced with these constantly increasing costs, several other so-called compatible EVM blockchains have emerged . As a reminder, these blockchains offer an environment similar to that of Ethereum, allowing developers of decentralized applications to migrate them without having to modify them .

Among these blockchains, we can cite the Polygon commit chain as well as the Binance Smart Chain . In the space of a few months, these latter have seen their activity explode to reach several thousand daily transactions.

Subsequently, the long-awaited second layer solutions were deployed on Ethereum. Although they have not yet reached the level of compatible EVM blockchains, these solutions are attracting new users every day .

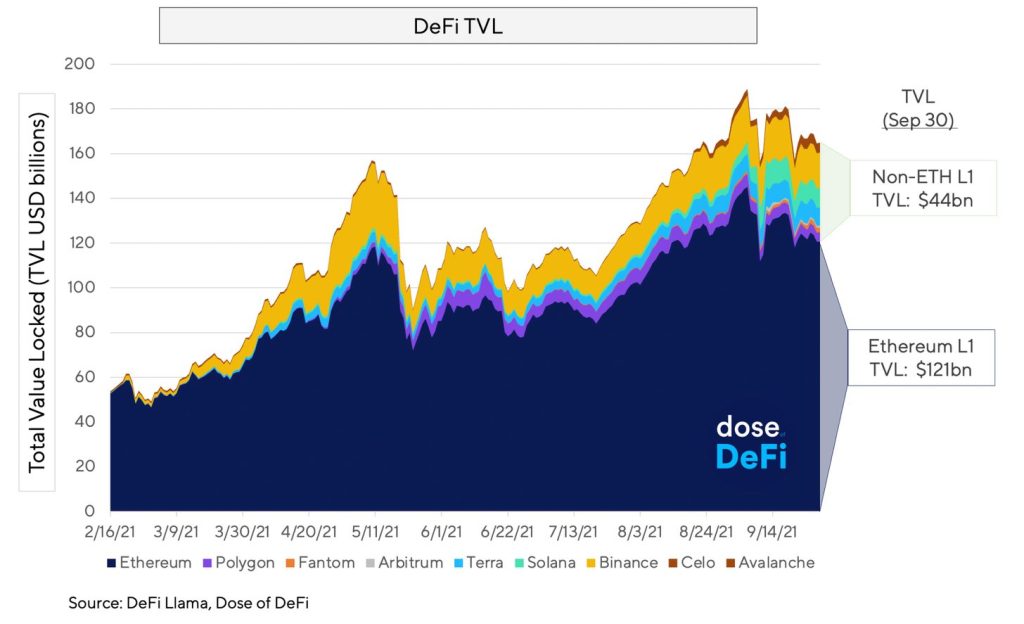

In total, the DeFi ecosystem outside of Ethereum now represents $ 44 billion , spread over several hundred protocols hosted on ten different channels .

Ethereum remains the queen chain

The Ethereum blockchain remains, despite everything, queen of DeFi , despite the almost constant rise in fees and significant congestion.

Thus, the DeFi ecosystem on Ethereum currently represents more than 121 billion dollars , which is three times more than the rest of the DeFi ecosystem excluding Ethereum .

Ethereum powers DeFi at large

This supremacy of Ethereum over the DeFi ecosystem is not surprising. More interesting still, it is the Ethereum network which feeds a good part of DeFi evolving on other blockchains.

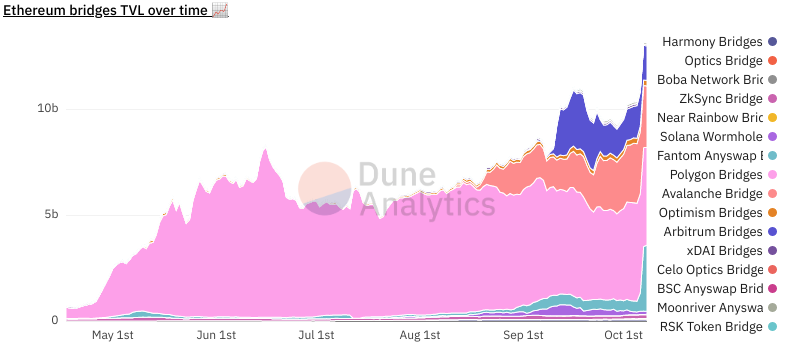

Indeed, according to data compiled by Elias Simos , about a third of the funds were deposited in the DeFi ecosystem outside of Ethereum were deposited from Ethereum via various bridges.

Thus, 13.28 billion dollars were deposited from Ethereum to other blockchains.

In practice, it is the bridges connecting Ethereum to Polygon, Fantom and Avalanche that have transferred the most funds. Together, these protocols represent 80% of the funds that have migrated from Ethereum to other chains via bridges.

Certainly, most of these blockchains are presented as “Ethereum Killer” . However, at present, none of them come close to the king of smart contracts . It would even seem that they are highly dependent on it to attract liquidity.

Despite its evolution, the DeFi ecosystem remains plagued by a persistent evil: hacks. Thus, many protocols are the target of hackers, all blockchains combined. Recently, the Cream Finance protocol was the target of an attack resulting in the loss of $ 25 million in cryptocurrency .