Do you want to have a noteworthy checking account to grow? Here’s what we can learn from the ways of the richest men in the world.

The great rich of the Earth represent only a small percentage of humanity, it is a matter of a few families or individuals who have managed to enter the short list of millionaires and today they can afford to lead a lifestyle that most of us can only aspire to in dreams. Their fortune is partly due to the economic solidity of the inherited companies, from having found themselves operating on the market at the right time and place or having been able to seize an opportunity that others have ignored. Not everyone can achieve huge fortunes, but what we can do is copy some tricks and behaviors of the tycoons and the powerful to get as close as possible to the universe of millionaires or, at least, recover some ground and raise the fortunes of our account. current.

What do millionaires do to increase their wealth?

-

Be frugal

The concept of frugality refers to the idea of sobriety in the use of our money. We must avoid making unnecessary spending and squandering money without thinking about it. According to Sarah Stanley Fallaw , research director at the Affluent Market Institute and author of The Next Millionaire Next Door: Enduring Strategies for Building Wealth , overspending is what leads to living on the edge of your paycheck or even getting into debt. regardless of the limits of our earnings. So it is important to think twice before spending even a single euro on something that is not strictly needed like, for example, a cup of coffee at the bar instead of making it at home.

-

Leaving the comfort zone and knowing how to take calculated risks

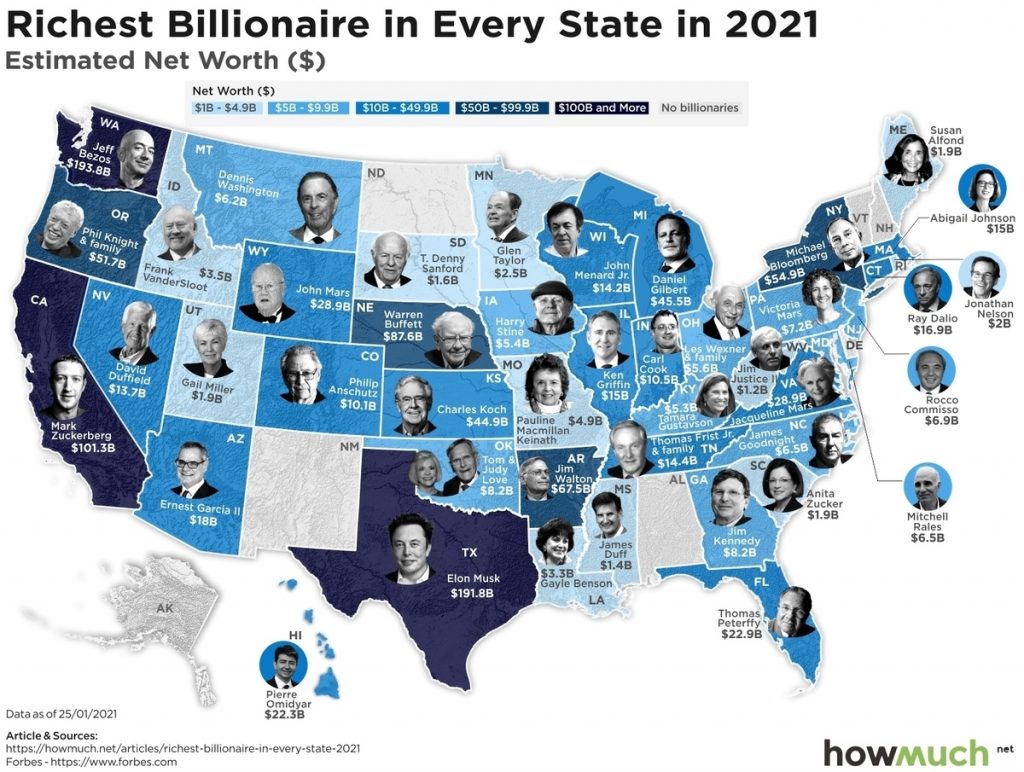

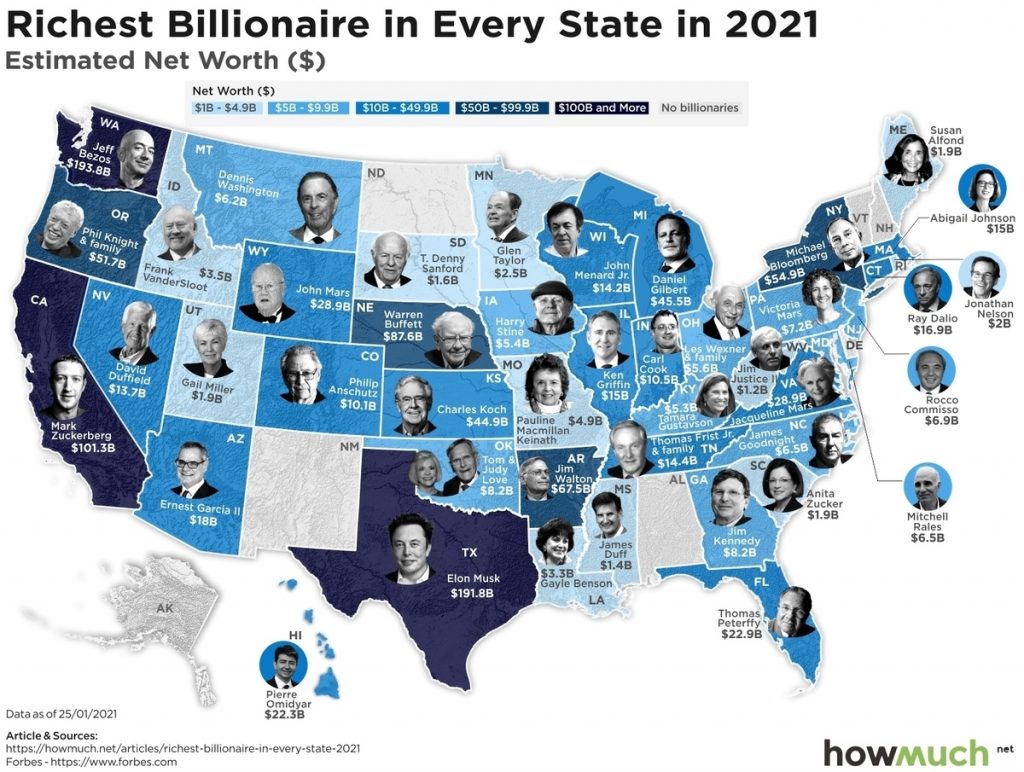

Elon Musk and Jeff Bezos have one thing in common: the choice to explore new paths, do something different and take risks even when it seems crazy to others. It is not a question of taking a chance at random and without thinking about it: to take a risk you must first analyze the pros and cons, determine what the consequences of an action are and whether it is really worth doing it after having prepared a backup plan in the event. things don’t work out.

Also Read:

- Google expands News Showcase: new partners and first evaluation.

- Robot Sophia: The first work of this “crypto artist” is worth $ 688,000

-

Having multiple sources of income

Bezos owns Amazon, Jet Blue, the Washington Post and many other companies that can increase his wealth, Musk has Tesla, SpaceX and Boring Company, which gives us an important lesson: if we really want to increase our wealth, we need to understand which ones. other income options we may have besides fixed employment. It doesn’t have to be a big thing, but it all adds up when it comes to earning more.

-

Invest

The people who had the nose to invest in Netflix, before it became the current streaming giant, are now millionaires. Investing is a good way to secure our future and make money grow effortlessly. A personal wealth management to be adopted with the help of an expert who can guide us and help us understand which companies are really valid.

-

Don’t live beyond your means

In this case, the advice does not refer only to small expenses, but to the lifestyle and where the millionaires live. Most of them own several houses, yet none of them are located in a city or area where the price is higher than they can afford. Living in the right place can help us spend less and not unbalance the balance of income compared to expenditure.

-

Save

Whether it is a small or large amount, saving is the most important thing for the future, especially if we intend to retire at some point in our life. A luxury that millionaires never fully indulge in. With the savings it is also possible to set up a social security fund useful for dealing with emergencies and unexpected expenses.