Despite the increased volatility caused by the Bitcoin Spot ETF, the XRP price demonstrates a more limited range of movement compared to other cryptocurrencies. The weekly price pattern of Ripple’s coin plays a crucial role in determining the direction of the upcoming trend. Currently, the XRP price trend remains uncertain, leaving sideline traders in a holding pattern.

XRP maintains its influence above the psychological threshold of $0.50, indicating active buying interest at lower levels. This underscores the confidence and enthusiasm of investors, expressing a strong belief in an upward trajectory towards the $1 mark.

Furthermore, any positive developments in the decision regarding the Bitcoin Spot ETF could trigger a bullish trend, aligning with general market expectations of Ripple surpassing the $1 milestone. The prospect of a breakout raises pertinent questions such as “Is XRP a worthwhile investment?” or “Can the XRP price reach $1?”

If you’re contemplating investing in XRP cryptocurrency, we invite you to peruse our latest Ripple (XRP) price prediction. In this analysis, we delve into a detailed forecast for Ripple’s price from 2023 to 2030, aiming to provide insights into the likelihood of XRP reaching the $1 mark.

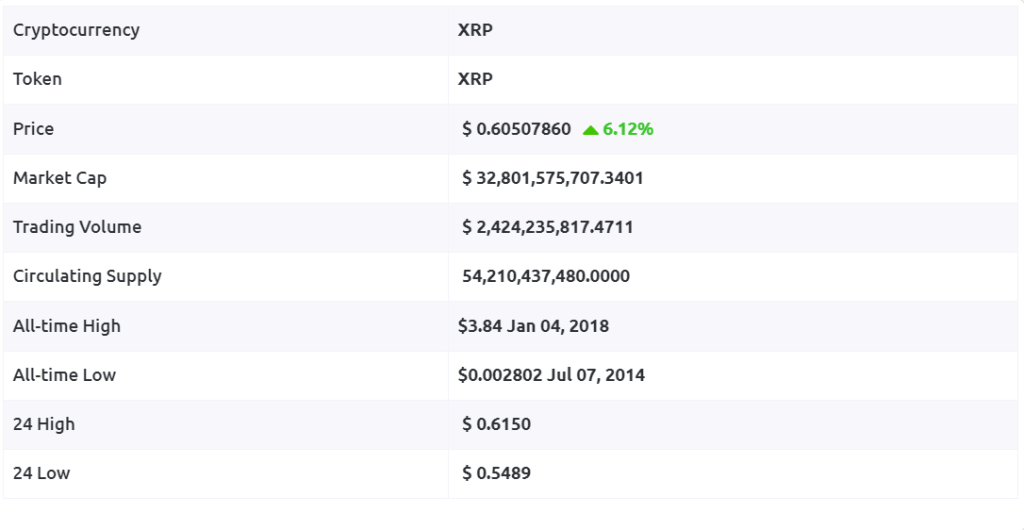

Overview

What’s New With Ripple?

- Ripple achieves a partial win against the U.S. Securities and Exchange Commission (SEC).

- The court ruling offers regulatory clarity for the cryptocurrency sector.

- Ripple argues that the SEC’s case lacks strength for an appeals court intervention in their ongoing legal battle.

- Ripple highlights differences in the cases, emphasizing that their evidence shows no promises or offers to purchasers in Programmatic Sales.

- The SEC has until September 8 to respond to the recent filing.

- XRP has emerged as the preferred cryptocurrency over Bitcoin and Ethereum in Japan.

- SEC drops charges against Ripple executives Brad Garlinghouse and Chris Larsen.

- The SEC vs. Ripple case potentially concludes on November 6th.

Ripple Price Prediction January 2024

After encountering resistance around the $0.75 mark, XRP undergoes a corrective phase, shaping a descending wedge pattern. Despite this correction, consistent support along the descending trendline suggests a potential robust comeback.

Moreover, the recent rebound from the trendline signifies bullish endeavors to maintain control above the $0.50 level. Consequently, the sudden resurgence from buyers and the prevailing optimism for a market recovery contribute positively to Altcoin’s prospects.

Presently, the XRP is valued at $0.5630, with a slight intraday decline of 0.67%, hinting at a potential substantial retreat towards the support trendline. However, the purchasing strength at the trendline suggests the imminent initiation of a bullish cycle, aiming to challenge the upper trendline.

Also Read: Solana Price Forecast: Can $SOL Reach $150 Amidst Spot BTC ETF Buzz?

Given the high likelihood of a renewed attempt at the $0.70 resistance, a bullish breakthrough of the trendline aligns with the broader market’s recovery. If a breakout rally unfolds beyond $0.70, buyers may propel the Ripple price toward the psychologically significant threshold of $1.

Conversely, in the event of increasing supply pressure, the altcoin could experience a descent towards a support level of around $0.55, nearing the 200-day Exponential Moving Average (EMA).

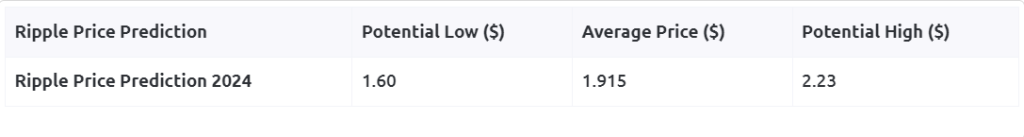

Ripple Price Prediction 2024

In the unfolding of 2024, XRP’s price trajectory deviates from the anticipated breakout rally, opting for a bearish course confined within its weekly triangle pattern. This deviation is characterized by notable volatility, challenging the conventional trends associated with triangle formations and causing abrupt fluctuations in Ripple’s price.

At present, a prevailing bearish momentum is evident as the price descends towards the support trendline following resistance. Nevertheless, existing predictions for Ripple’s price suggest the possibility of a bullish breakout from the weekly triangle pattern, with an optimistic target set at $1.

Examining the weekly chart, it becomes evident that the recent decline in XRP’s price is putting the strength of bullish forces to the test, particularly at the crucial support level of $0.50. Should the buyers effectively counteract the current selling pressure, there is a strong possibility of Ripple experiencing a notable recovery, thereby heightening the chances of a breakout.

Also Read: Ripple Price Prediction: Will XRP Reach 2$ in 2024 – Technical Analysis

A pivotal juncture in this scenario would be the breach of the $1 mark; surpassing this level could significantly enhance the likelihood of the price reaching the potential high of $2.23. Conversely, if the bearish trend persists and the price falls below $1.60, it might signal an extended breakdown phase.

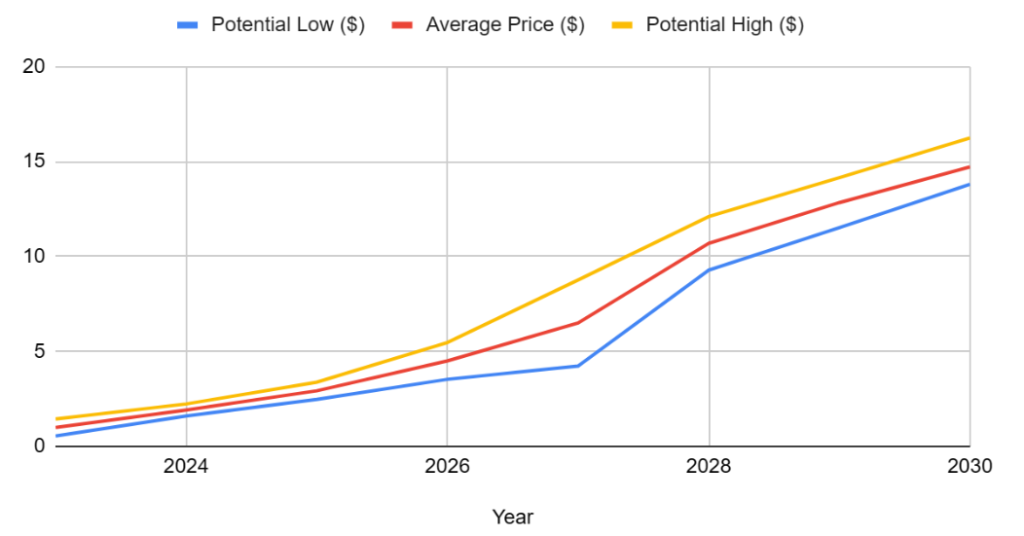

XRP Price Prediction 2023 – 2030

Market Analysis

We expect the XRP coin price to reach the potential high of $2.23 in 2024.

In the optimistic outlook for 2024, the anticipated trajectory suggests that the price of XRP coin could ascend to a promising $2.23, reflecting positive market sentiment and potential growth factors within the cryptocurrency landscape. Investors and enthusiasts are closely monitoring developments that could contribute to this bullish projection, fostering anticipation and excitement within the XRP community.

FAQs

XRP maintains a price above $0.50, indicating active buying interest. The current trend is uncertain, with the potential for a bullish breakout towards $1.

Positive developments in the Bitcoin Spot ETF decision could trigger a bullish trend for XRP, aligning with expectations of reaching $1.

Ripple achieved a partial win against the SEC, providing regulatory clarity. The article notes Ripple’s argument against the SEC’s case and mentions a deadline for the SEC’s response.

A descending wedge pattern after resistance at $0.75, consistent support along the trendline, and bullish endeavors contribute to XRP’s potential comeback.

For more content like this do follow us on Instagram, Facebook and X

Disclaimer:

The information herein is purely for general informational purposes, not constituting financial, investment, or professional advice. Reliant on publicly available information and personal interpretations, its accuracy, completeness, or relevance isn’t assured. Readers are strongly urged to perform individual research before financial decisions, given the risks involved. Past performance doesn’t predict future results, and personalized advice from a qualified financial professional is recommended.

The author and platform disclaim responsibility for losses resulting from reliance on this content. Financial markets fluctuate, and investments can rise or fall. Opinions expressed are solely the author’s and may not reflect the platform’s views. Trading carries inherent risks; users should exercise caution, assess risk tolerance, and seek professional advice. This article doesn’t endorse specific actions regarding financial instruments.

Accessing and reading this article implies agreement with this disclaimer. The author and platform aren’t liable for direct or indirect consequences of using or relying on the provided financial information.